Plantation Neutral

Sector Outlook

- Oversupply concern lingers

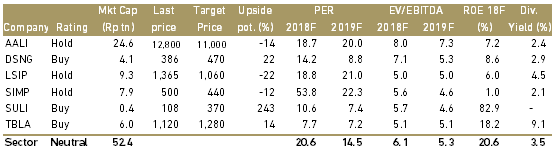

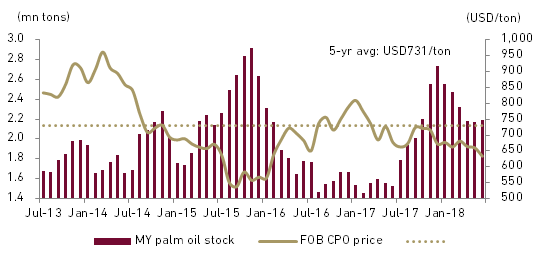

We believe threat from abundant supply of vegetable oil especially palm oil will continue next year as Malaysia palm oil stocks is seen rising 43.4% YoY, to average 2.49 mn tons in Aug 18, surging to six month high. We see that it is also the largest monthly pace increase since Nov 17 as production rise reaching just 7.9% MoM to 1.62 mn tons of CPO, offset the slower rise in exports seen at 1.10 mn tons of palm oil or -8.1% MoM.

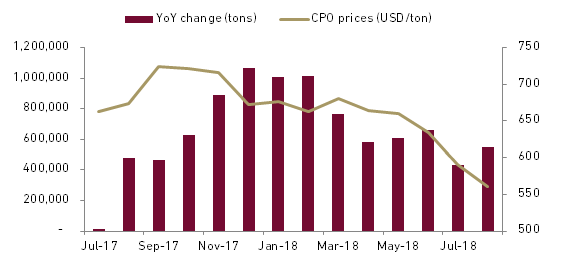

Exhibit 85: Malaysia palm oil stocks YoY change vs. average CPO prices

Source : MPOB, Ciptadana Estimates

Excess supply against lacklustre demand been the running theme since the beginning of 2018, mirrored by dwindling CPO prices, by 12% YTD after shaving off RM300 or USD73 since Jan 18 or down by 17% from same time last year.

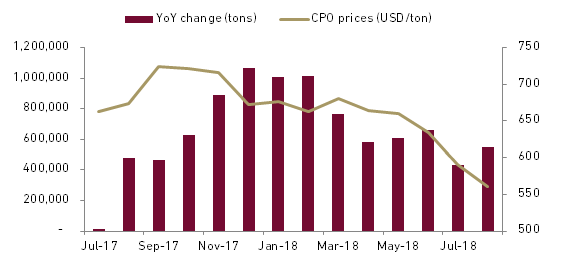

CPO prices remain under pressure

We see further downward pressure to CPO prices in the oncoming year. As of Jul 18, Indonesia palm oil stocks stand at 4.90 mn tons while Malaysian seen surpassing the 2.2 mn tons level hence it is likely we will see origin market stocks soaring to over 7 mn tons. We expect CPO price to flat at average RM2,400/ton (equal to USD600/ton) in 2019.

Exhibit 86: Malaysia palm oil statistics

Source : MPOB, Oil World, Ciptadana Estimates

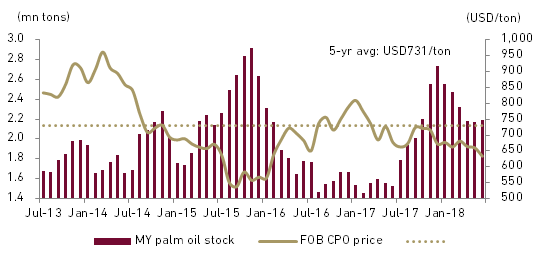

- Soybean: higher production, lower trade, and increased stocks

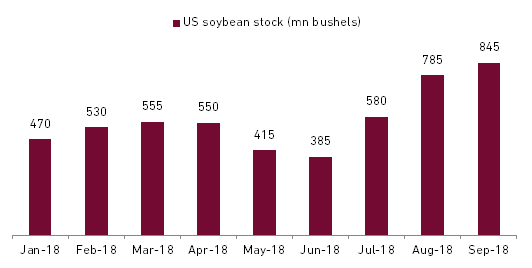

As expected, US soybean yield was increased another notch to 52.8 bushels per acre (bpa.) from the previous month of 51.6 bpa which was higher than market guess of 52.5 bpa, thus increasing production size to 4.69 bn bushels or 100 mn bushels more from Aug 18. Average market expectation was 4.65 bn bushels.

The lingering trade tension with China, the world number one soybean buyer reflected in US soybean export demand which was left unchanged at 2.06 bn bushels in Sep 18 from the previous month, which is 3.27% lower than estimated value of 2.13 bn bushels. In Sep 18, China soybean import was trimmed to 94 mn tons, from 95 mn tons in Aug 18.

- Rising production hits soybean oil price

Rising production against reduced trade troubled by tariffs war between US and China have driven domestic US soybean stocks higher, dampening soy complex prices, with soybean oil hit the hardest. Soybean oil prices are down 17% YTD to USD27.72 cents/pound on CBOT Futures, while soybeans is down 13% to USD8.29/bushels, and soy meal inched up 0.70% to USD315.7/short torn during the same time.

Exhibit 87 : US soybean ending stock

Source : USDA, Bloomberg

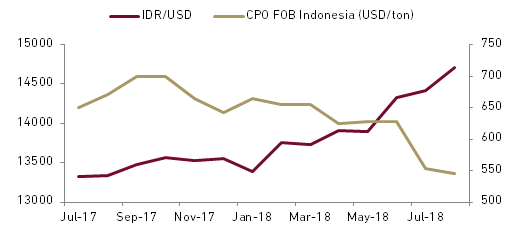

- Depreciating IDR increases Indonesian CPO competitiveness

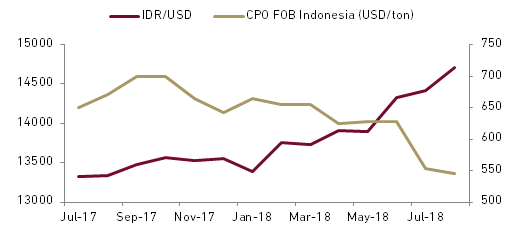

Fall in IDR is pushing the CPO prices lower on FOB basis, even as Malaysia reduces CPO export tax to zero in Sep 18. IDR been on a sell –off mode since the start of 2018 and accelerated in Aug 18 as rising energy prices, mounting trade tension and hike in US interest rate fuel demand for USD while emerging market currency face the rout.

While Malaysia zero export tax starting on 1 Sep 18 reduced the CPO discount enjoyed by Indonesia to below USD20 from the usual USD30-40 on FOB basis. However a continued decline in IDR may push the Malaysian premium back to above USD30, making it less competitive.

Both of Malaysia and Indonesia are faced woth rising stock levels amid slowdown in exports to key destination markets of India and China.

Exhibit 88 : Depreciating IDR and falling in CPO FOB prices

Source : Bloomberg

- New market arises from B20 mandatory

The mandatory use of 20% palm oil blending to biodiesel (B20) that extended into segments instead of PSO (non-subsidized) vehicles will create new markets for CPO. The B20 mandatory provision has came into force officially on 1 Sep 18, and Indonesian Palm Oil Association (GAPKI) projected that the domestic palm oil consumption will increase up to 1.25 mn tons/month.

As of Jul 18, the average of palm oil domestic consumption stands at 1.03 mn tons/month. However, judging from Indonesian closing stocks that has been at alarming level of 4.18 mn tons/month this year (up by 130% YoY), we believe the additional demand less likely give significant impact towards the already dwindled CPO prices.

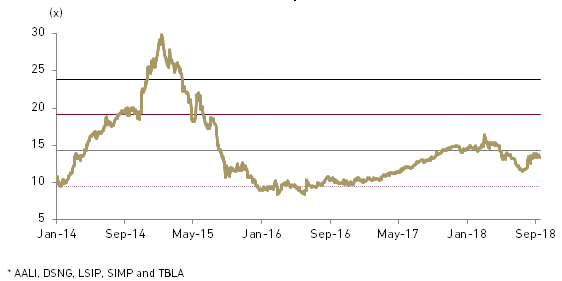

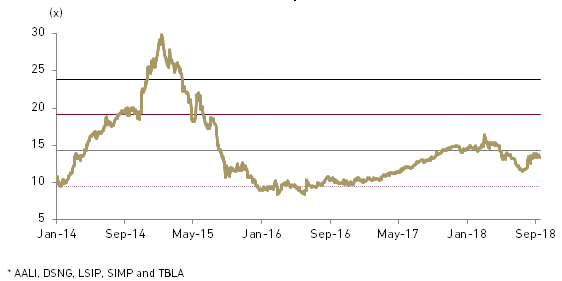

- Most of the stocks have already priced in

We believe that currently most of the stock of the CPO based companies under our universe have already priced in and do not offer significant upside. Looking into their blended PE band in Exhibit 5, at present the price is trading less than 5% discount to the five year mean blended PE of 14.3x.

Exhibit 89 : Plantation sector* forward PER band

Source : Bloomberg, Ciptadana Estimates

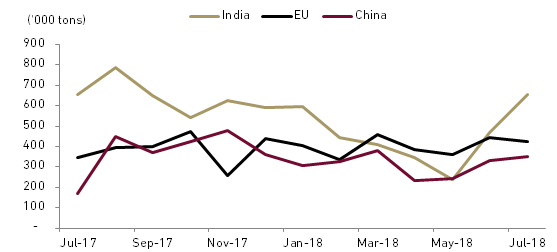

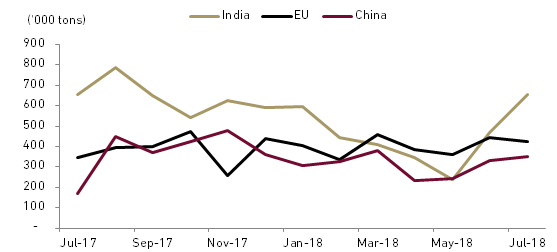

- Markets for Indonesian palm oil exports

Around 3.16 mn tons of Indonesian palm oil exports went to India during Jan-Jul 18 or representing 19% of total palm oil exports. Though continue to decline (25% within Jan-Jul 17), India remains the largest market for Indonesian palm oil hence Indonesia is susceptible to changes on India palm oil import duties.

EU has been using palm oil primarily for biodiesel mix and demand from the region has been relatively flat as palm oil infamously recognized as environmentally unfriendly product. Fortunately increase on China demand help unburden the negative impacts of the aforementioned condition. Other than the three top importers, markets for Indonesian palm oil include Middle East countries and Africa with the number projected to grow annually.

Exhibit 90 : Indonesia’s palm oil export destination

Source : GAPKI

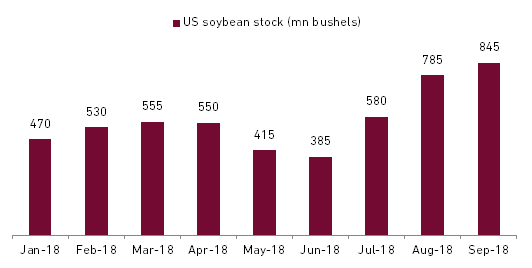

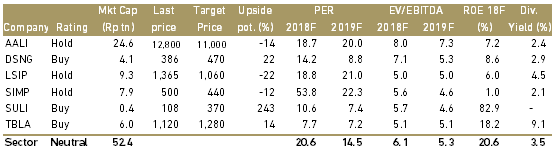

Though we maintain Neutral view on plantation sector, we isolate TBLA and DSNG amongst the rest as our top picks. We believe TBLA will be benefited from the latest B20 expansion while we also like DSNG as it boasts the highest FFB yield compare to its peers hence promising production growth in time of limited organic expansion.

Exhibit 91 : Plantation stock rating and valuation