Oil and gas Overweight

Sector Outlook

- Expecting higher oil prices on supply concern

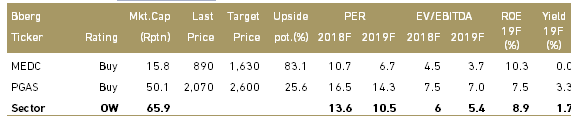

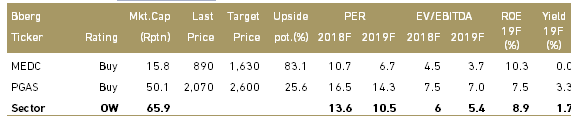

Due mainly to expected shortages in oil supply going forward, we have higher oil price forecasts for 2019 and 2020. The lack of oil supply will be the result of several developments. We expect that global demand for oil will continue to grow at a moderate pace in the coming years. Oil inventories are under pressure and the current reserve production capacity will not be sufficient to meet the rise in global demand. Finally, the 2020 IMO regulations will force marine fuels to lower sulfur content from 3.5% to 0.5%, leading to a sharp increase in demand for diesel. As a result, we see average Brent crude price increasing from USD70/bbl in 2018F to USD76/bbl in 2019 while WTI crude price to increase to USD67/bbl in 2018F to USD72/bbl in 2019F. We believe these assumptions are conservative given that Brent and WTI crude prices has averaged to USD72 and USD66 in 9M18, respectively.

Exhibit 46: WTI and Brent crude oil prices

Source: Bloomberg

- Supply under attack on several fronts

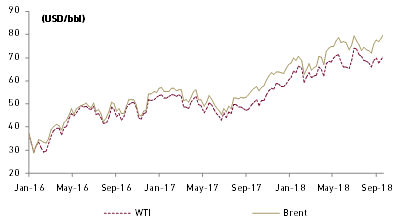

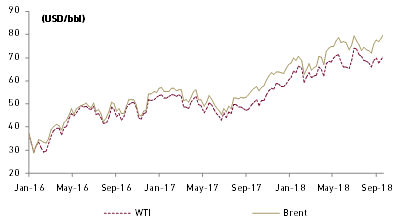

OPEC has faced some difficulties balancing the market due to unexpected supply disruptions within the OPEC, especially for Venezuela and Libya. The IEA highlighted Venezuela's continuing decline, attack on the headquarters of Libya's NOC, and a sharp reduction in Iranian output ahead of the reinstatement of US sanctions on November 4. In Venezuela crude oil production is on a sliding path and this does not seem to improve for the better in the near term. It estimated Iran's crude production had fallen by 150,000 b/d to a 25-month low of 3.3mn b/d in August. We believe, in the near term, it is unlikely that the situation will improve.

Exhibit 47: Iran, Lybia and Venezuela oil production trend

Source: Bloomberg

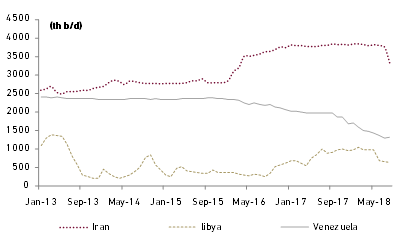

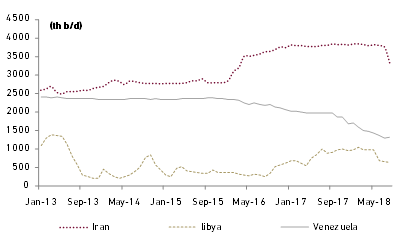

- Declining reserve capacity might further disrupt production

Based on Bloomberg data , OPEC reserve capacity has declined by 45% to 2.3 mn b/d in August from 4.3 mn b/d at end of 2017.This reserve capacity contains a certain amount of oil reserves which can be brought online within a certain period of time in case of potential production disruptions in order to prevent shortages. Less reserve capacity means less room to maneuver. As a result, the price swings due to new production disruptions can be even bigger in the future. The fact that the market is slowly but surely focusing again on reserve capacity is something we see as a signal that the years of oversupply are behind us.

Exhibit 48: OPEC reserve capacity

Source: Bloomberg

- Booming U.S. oil exports could hit a bottleneck

U.S. crude exports have boomed since the decades-old ban was lifted less than two years ago, with shipments recently hitting a record of 2 mn barrels a day. But shippers and traders fear the rising trend is not sustainable, and if limits are hit, it could pressure the price of U.S. oil. The current capacity to transport crude from the production basins to the US coasts in order to export this crude is running almost at maximum capacity.

U.S. oil export infrastructure will probably need further investment in coming years. Bottlenecks would hit not only storage and loading capacity, but also factors such as pipeline connectivity and shipping traffic. There are plans to expand this infrastructure but this takes time. As a result, the export capacity will hardly increase in 2019 and thus increased US crude production will only lead to higher inventories. US shale oil will therefore hardly contribute to prevent a shortage on the global oil markets.

- Demand might slightly increase

The IEA indicated in its latest Oil Market Report that global demand for oil will remain stable around 1.4 mb/d in both 2018 and 2019. Global demand increased by 1.5 mb/d during the first half of this year. A slight slowdown is expected for the second half of the year. OPEC is even slightly more optimistic in its expectations for global demand. OPEC expects demand to increase by 1.65 mb/d in 2018 and 1.45 mb/d in 2019. If global demand indeed grows by roughly 1.4/1.5 mb/d in 2019 shortages may be seen if oil producers fail to increase supply at a similar pace. The global macro outlook, weakness in emerging market currencies, impact of the last rally in oil prices, impact of sanctions on Iran and rising trade uncertainties are all potential risks to oil demand-growth.

- Gas distribution outlook depends on volume

The government of Indonesia capped natural gas trader profit margins at 7% in rules released early this year by the Ministry of Energy and Mineral Resources. Internal rate of return (IRR) for conventional gas infrastructure management capped at 11% per year, companies operating in areas without other infrastructure can propose IRR of up to 12%. Downstream natural gas prices for industry and power stations will be determined by the energy minister based on a formula taking into account wellhead prices, infrastructure management costs and commercial fees. Therefore, we believe revenue for pipeline gas distribution company will more depend on volume growth going forward. We also believe regulatory clarity for pipeline tariffs should move the gas distributor towards becoming a pure utility business, reduce the overhang of lower margins and keep margins stable. However we might see gas producer come under pressure from industries and the government to reduce gas prices, amid efforts to keep manufacturing and power generation costs down.

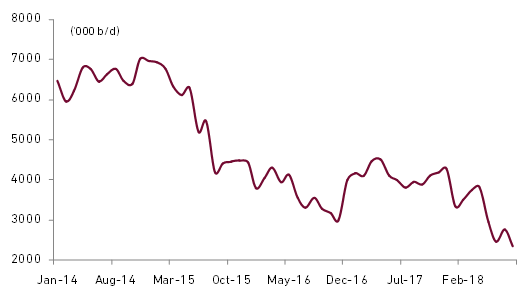

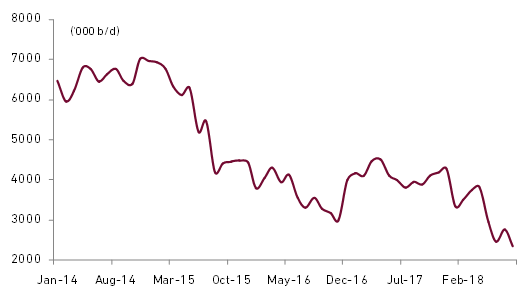

- Our stock picks and stock ratings

Medco is our top pick in oil & gas space as around 66% oil Medco’s oil and gas revenue are linked to oil price movements and the remaining 34% of revenue are based on fixed-price take-or-pay contracts with annual price adjustment. MEDC has also shown solid cash cost reductions. MEDC has seen its cash cost fall by 53% since 2013 to USD8.1/bbl due to economies of scale and cost control.

Despite the reduced investment and activity, SKK Migas estimated that Indonesia total oil production would touch 828,000 bopd, higher than the 825,000 bopd projected in the state budget. Additional production from Banyu Urip

Despite the reduced investment and activity, SKK Migas estimated that Indonesia

Exhibit 49: Oil and gas sector rating and valuation