Coal Overweight

Sector Outlook

- Strong thermal coal demand remains

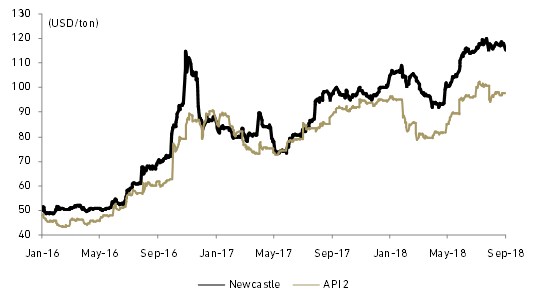

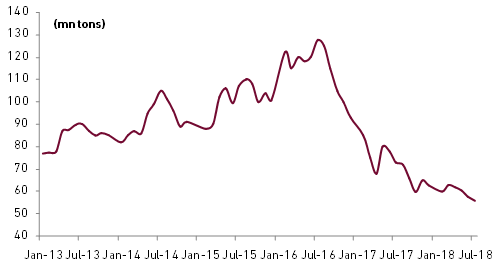

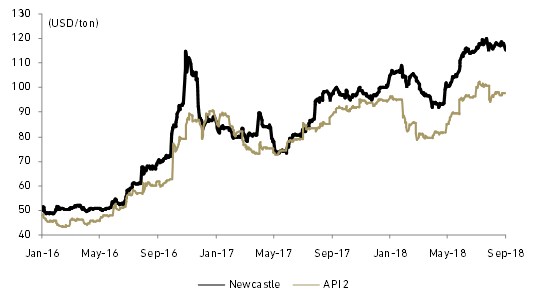

A hotter-than-usual summer in China and restocking of coal by utilities in Japan dominated the demand picture for 2H18, while heavy rains in Indonesia restricted global supply. We expect average prices to remain supported over 3Q18 (USD107/ton) before a slight pullback in the 4Q18 (USD103/ton) , stemming from a better fundamental outlook as demand stabilizes and supply improves, although low stocks of thermal coal in China will prevent a collapse in prices. Strong thermal coal in Asia is also indicated by sharp divergence in benchmark prices of European API 2 coal and the equivalent Pacific Basin Newcastle, which we believe to continue next year. The API 2 was traded at average discount of USD5/ton to the equivalent Newcastle in 2016-2017, but this spread has widened to an average of USD17 since start of 2018 (peaking at almost USD24 in March-18).

- Coal price to edge slightly lower in 2019

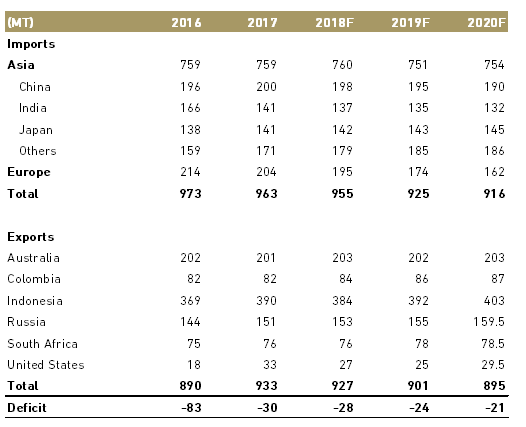

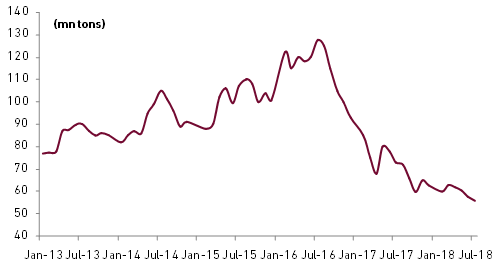

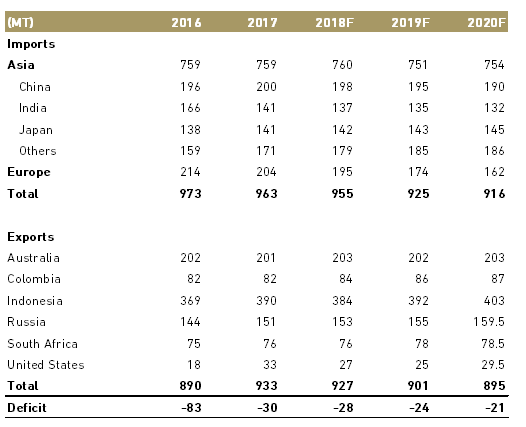

We expect thermal coal prices next year could average around 6% less than in 2018 amid the prospect of slackening Chinese and Indian import demand and higher supply from Indonesia. We estimated Asia-Pacific benchmark Newcastle prices to average USD 98/ton in 2019, slightly down from USD104/ton this year. In China, a string of import restrictions and rising domestic coal production despite cuts on outdated capacity should limit demand. Likewise, rising coal production in India will likely put a lid on the country’s imports. We expects coal prices to edge lower next year again as the Asian market deficit is likely to narrow from 28 mn tons in 2018 to 24 mn tons by 2019. However, we see upside risk to our forecasts from recent Glencore a deal with Japanese utilities at a price of USD110/ton, for the 2018-2019 financial years.

Exhibit 64: Global thermal coal imports and exports

Source: EIA, Australian coal statistic and CEIC

Exhibit 65: China coal inventory

Source: Bloomberg

Exhibit 66: European (API 2 coal prices) and the Pacific Basin Newcastle

Source: Bloomberg and QCP

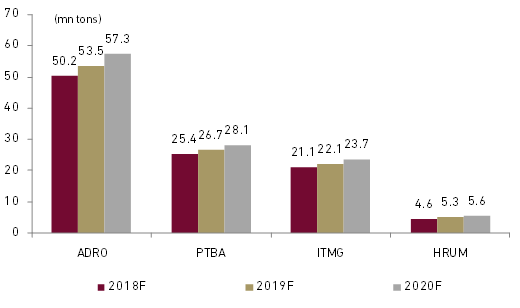

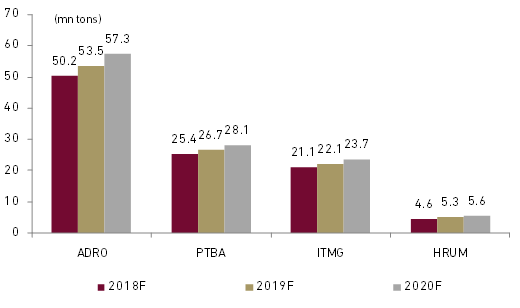

- Coal companies to grow output

Coal companies under our coverage (ADRO, PTBA, ITMG and HRUM) have stated that they would have higher coal output next year. We forecast they will increase their production by 5.7% to 129 mn ton on aggregate in 2019F and 6.4% to 137.2 mn tons in 2020F. Heavy equipment supply is expected to increase on a gradual basis, despite the current scarcity and high demand environment. Data from industry report revealed that domestic thermal coal production volume growth is expected to grow by 2% to 490 mn tons in 2019 driven by production 81% of which will be exported. At a coal price of USD98/t, Indonesian coal companies are able to sell at around USD62–78/ton depending on the coal grade, and enjoy USD26–33/ton cash margin, which would lead them to continue to grow their volume.

Exhibit 67: Listed coal companies production volume

Source: Ciptadana Sekuritas

- Transfer quota help meet DMO regulation

Through the domestic market obligation (DMO) the Indonesian government forces local coal miners to supply part of their coal production to the domestic market, specifically to coal-fired power plants as there is a real need for an increase in the nation's electricity supply. With DMO policy, all coal miners in Indonesia have to sell 25% of its full year production to domestic market. ESDM Ministry introduced coal quota transfer, in which high CV coal miners can buy low CV miners’ quota to fulfill the domestic portion obligation. Government plans to impose sanctions on coal miners who fail to comply with the DMO requirement (25%), in the form of a cap on production capacity for 2019 and a reduction in export quota until the DMO is fulfilled. Quota transfer schemes gives PTBA the opportunity to sell the remaining domestic coal sales volume at floating HBA prices once it has completed 25% allocation to the state-owned PLN where they expect to sell it at USD18-20/ton.

- Our stocks pick and rating

We have BUY call on PTBA, ITMG, ADRO and HRUM with TP of Rp5,200, Rp33,100, Rp2,400 and Rp3,400, respectively. Considering the potential upside, valuations, earnings growth and sensitivity to coal price, our pecking order of Indonesian coal stock are: PTBA, ADRO, ITMG and HRUM. PTBA plans to sell more high-CV coal to export market. Despite DMO regulation has lower its ASP but it will be offset by of additional income from DMO transfer quota coupled with higher coal production volume. We also like ADRO for its being the largest coal producer and expected improved production volume in 2H18 and onward supported by favorable weather and increased delivery rate of new mining equipment.

Exhibit 68: Coal stocks rating and valuation