Equity Strategy

Politic and policies

- Political landscape to heat up ahead of 2019 national elections

The presidential election in Indonesia next year will see a rematch between President Joko Widodo (Jokowi) and retired general Prabowo Subianto. President Jokowi chosen Ma'ruf Amin, the head of Indonesian Ulema Council (MUI) as his running mate in next year's presidential race. Jokowi describes Amin as a wise religious figure and get support from all nine parties in his coalition, holding 60% of parliamentary vote. Meanwhile, Prabowo, chosen as his running mate Sandiaga Uno, a wealthy businessman who had been serving as deputy governor of Jakarta. In the 2014 presidential election, Jokowi and running mate Jusuf Kalla secured 53.1% of the vote, compared with 46.9% by Prabowo and Hatta Rajasa.

We believe by picking Ma’ruf, Jokowi attempts to win the hearts of Muslim voters and to pre-empt political attacks questioning his credentials as a Muslim leader. Jokowi has also learned from the fall of Jakarta’s former governor Basuki Tjahaja Purnama (Ahok). After the demonstrations by the Islamic community to influence the Jakarta governor election, Jokowi has had massive concerns about the expression of Muslim opinion in politics. The choice of Ma’ruf is to appeal to the traditional Muslim voters, who are represented by NU, and in general, Muslim voters in Indonesia are moderate. Most polls suggested Jokowi who are backed by nine political parties controlling 60% of the seats at Parliament would be favorite to defeat Prabowo at next year’s poll. Jokowi’s coalition parties are PDIP (109 seats), Golkar (91 seats), PKB (47 seats), PPP (39 seats), NasDem (35 seats), Hanura (16 seats). Meanwhile Prabowo’s coalition parties consist of Gerindra (73 seats), Democratic Party (61 seats), PKS (40 seats), PAN (40 seats).

In the latest Indonesian Survey Circle (LSI) poll, taken after the vice presidential nominations were announced on August 9, Jokowi still has a 52.2%-29.5% lead over Prabowo, though 18.8% are undecided. However we view that the result of 2019 election is still less predictable. Recall that in 2014 presidential race the gap can narrow fast. The results of the 2014 legislative election also revealed that more than 38% of all eligible voters in Indonesia can be classified as swing voters. We view that Prabowo camp may be wise not to hinge their campaign on attacking Widodo’s negatives, and should shift campaign on economic issues. The economic problems range from the sharp weakening of rupiah, the lower-than-expected GDP growth and higher government debt position. This leaves Jokowi with plenty of homework to do.

- Policy shift from reformist to populist, focused on winning

With national elections around the corner, Jokowi seems to be backtracking on his reform agenda with a string of populist measures. Jokowi plans to keep electricity tariffs and fuel prices unchanged over the next two years by hiking energy subsidies in draft state budget 2019. The government has imposed price controls too on staple goods such as fuel, power, rice and sugar which are the moves that will surely be welcomed by voters but may threaten investment climate.

The government has also allocated Rp381 tn for social welfare spending in the 2019 draft state budget. This implies annual increase of 32%, which is significant increase compared to a CAGR of 4.8% from Rp249.4 tn in 2015 to Rp287.7 in 2018’s projection. However, on the positive note , as government will more use a card-base system to prevent leakage and The Family Hope Program (PKH) will receive higher allocation. The PKH budget would be doubled to Rp34.4 tn from previously Rp17 tn in 2018. PKH program was expected to decrease the poverty rate at 8.5 to 9.3%. The government will also raise salary of civil servant by 5% on average in 2019 (no raise for this year).

Market recap

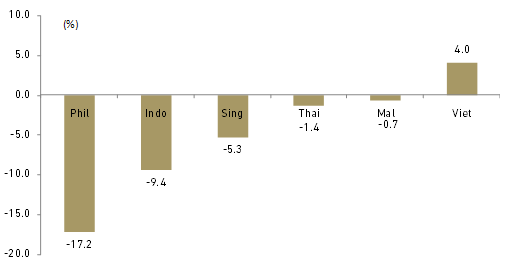

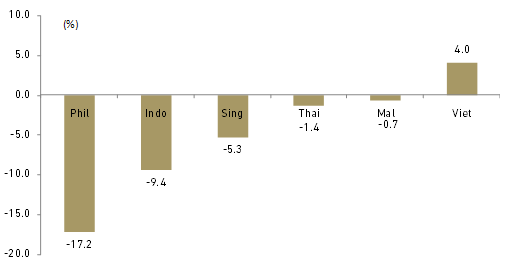

Selling pressure continues on the Indonesian bourses causing the benchmark JCI to drop by 9.43% Ytd to 5,757 (4 Oct).This market sell-off was due mainly to concerns about global sentiment, particularly the US Federal Reserve’s interest rates hikes and global trade war fear, which continues to put pressure on the rupiah. Rupiah fell to above Rp15,000 (10.7%) . The Indonesian rupiah is the currencies with twin deficits (current account deficit and fiscal deficit), in addition to the Philippine peso (weakened by 8.0% Ytd), which made investors more worried on hawkish Fed sentiment. The Indonesian stock market was the second underperformer market in South-East (SE) Asia after the Philippines of 17.3%.

Exhibit 18: South East Asia equity market performance

Source: Bloomberg

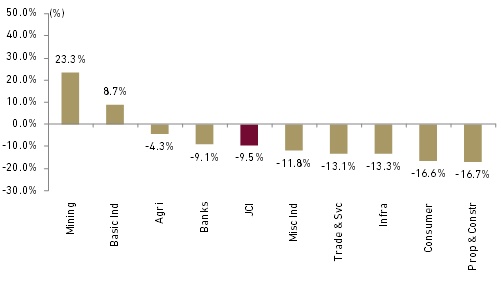

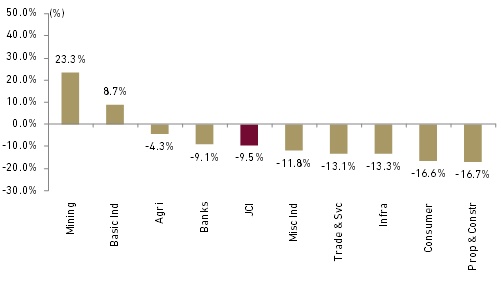

On sectoral indices, only mining and basic industry sectors booked positive return of 23.3% and 8.7% Ytd. Solid performance in mining stocks were led by gain in our coal analyst’s pick PTBA , BYAN and INCO. Basic industry strong performance was supported by strong gain in CPIN, INKP and TKIM. On the weak side, property (including contractors) have taken the biggest hit of all sectors, down 16.7% followed by heavy weight consumer sector of 16.6% , infra /utilities (incl. telco) of 13.3% and Miscellaneous industry (auto) of -11.8% that were the real culprits dragging down the index.

Exhibit 19: JCI sectoral indices performance

Source: Bloomberg

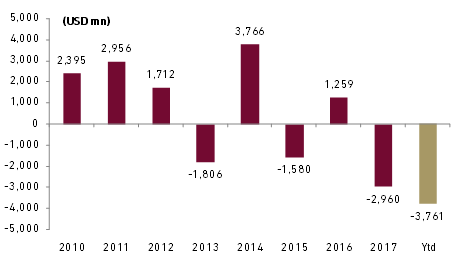

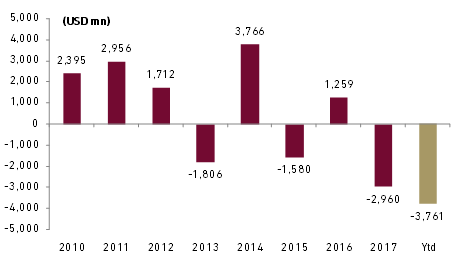

- Biggest annual foreign outflow in 2018

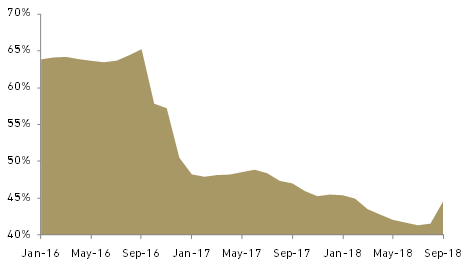

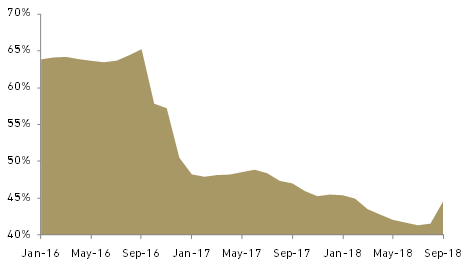

Foreign investors girded for the potential of further Fed interest-rate hikes to put a floor under the nation’s currency, which has hit its weakest against the dollar since 1998. Foreign investors have pulled out USD3.8 bn from equities market this year, set for the biggest annual outflow from Indonesia ever. Data from the Indonesian Central Custodian Depository ( KSEI) also shows foreign ownership in Indonesia equity has fallen steadily from 65% in Sep-16 to 41-42% in Jul-Aug 18, before picking up slightly this year to close to 45% in Sep-18.

Exhibit 20: Foreign net sell at Indonesia equity market

Source: Bloomberg

Exhibit 21: Foreigner ownership of Indonesian stock

Source: KSEI

Outlook for market in 2019

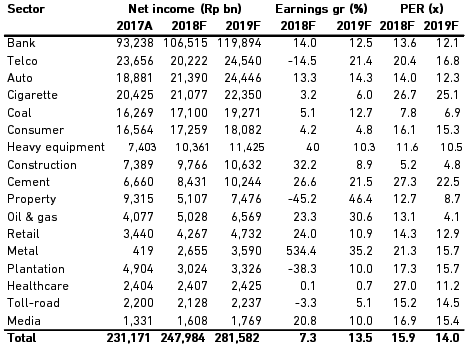

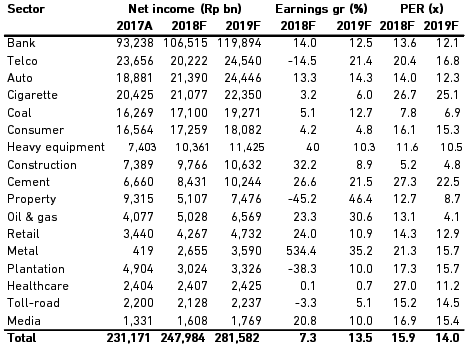

- Corporate earnings: 2019F universe EPS growth estimated at 13.5%

We expect 2019F market EPS (we use our universe EPS as proxy) to grow by 13.5% in 2019F (see table below). This will be boosted largely by the banking sector with net profit growing by 12.5% to Rp119.9 tn led by BBCA of 15.6%, BMRI of 11.4% and BBNI of 11.1%. Banking stocks earnings are expected to continue its double-digit growth from 14.2% in 2018F. This second contributor to aggregate earnings is Telco sector whose net profit seen growing by 21.4% to Rp24 tn. This is a recovery from 14.5% decline in 2018F earnings dragged by expected losses in Indosat. We only cover Astra in automotive sector and we also see it repeating its double-digit earnings growth from 2018F, which both yearly growth will be mainly driven by United Tractors. All of sectors are expected to book positive earnings growth in 2019 but we see some sectors posting negative earnings growth this year such as telco, property, plantation and toll-road.

Exhibit 22: Aggregate net profit forecast

Source: Ciptadana Sekuritas

- Election and better global sentiment to drive return, JCI target at 6,980

The Indonesian stock market seems nervous nearly seven months going into general election 2019. It is jostling weak emerging markets, rising rates, higher oil prices, slower earnings growth and relatively rich valuations. However, if past is anything to go by, Indonesian market has gained on three general elections that were held since 1998 reform era, namely 44.6% in 2004, 87.0% in 2009 (partly also due to low base effect of 2008 GFC causing JCI to drop 50.6%) and 22.3% in 2014. We believe the major reason why the market had been rising during the general elections were mostly expectation a political stability. Markets prefer a reform-oriented government under a strong leader. We also expect volatility of Indonesia equity market will ease in 2019 on better global sentiment owing to the following reasons: 1) trade war fear, which currently is terrifying investors, will gradually fizzle and is already priced-in 2) Fed will less aggressive in hiking rates and 3) Lower foreign ownership of Indonesian stocks as mentioned before which might lead to less net foreign selling.

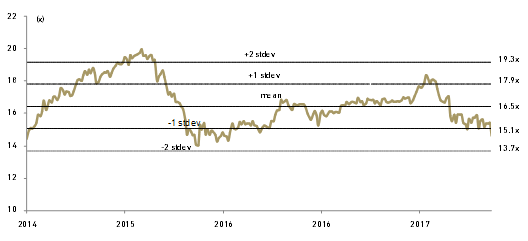

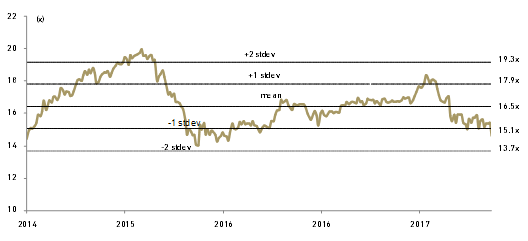

Therefore, we are positive on Indonesian equities going into 2019. We believe returns could be back-loaded as investors waiting for election results and trade war fear to ease. Applying market PER of 15.8x, which is based on -0.5stdev, and then multiple by forward market EPS of 442, we set year-end 2019 JCI target of 6,980. We believe, if corporate earnings move at a steady pace going into 2019 and reach the double-digit mark, fear about valuation should lessen. Therefore, we Overweight the Indonesian equity market as our JCI target implies 21% upside potential from current level of 5,756.

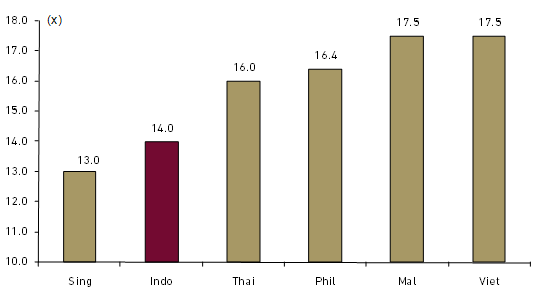

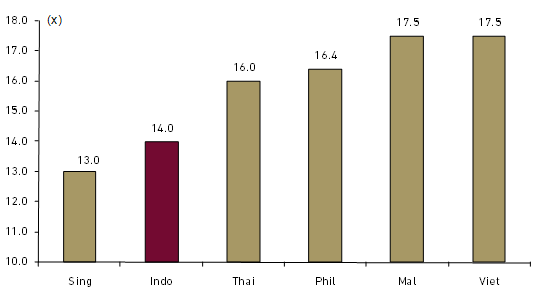

The Indonesia equity market is now trading at 2019F PER of 14.0x. This is much lower than 10-year average PE of 16.5x. The market PER has also come off from its peak of 19.9x in 2015. On regional comparison, the valuation is still interesting, the second cheapest after Singapore and more attractive than other SE Asia peers.

Exhibit 23: Indonesian stock market forward PER

Source: Bloomberg and Ciptadana Sekuritas

Exhibit 24: SE Asia equity market PER comparison

Source: Bloomberg and Ciptadana Sekuritas

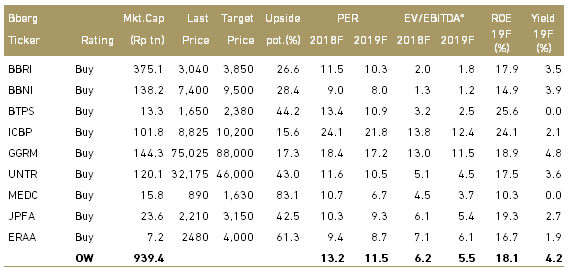

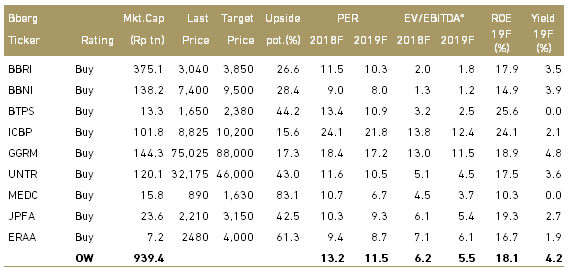

- Key themes and top picks for 2019

We have four themes for the market in 2019: i) banks that are expected to continue performing well during rising interest rate environment: BBRI, BBNI and BTPS (ii) beneficiary recovering household consumption on consumption-friendly policy ahead elections (GGRM and ICBP), iii) beneficiary of strong commodity prices and strong USD (UNTR and MEDC ) , iv) cheap valuation with attractive upside potential (JPFA and ERAA).

We believe BBRI to continue having strong loan growth from its subsidized micro and better upside from reduction of credit charge as they have became very conservative in the last two years. BBNI is also among the cheapest bank among the big four and underperformed the most in 2018, but we believe it will perform well under rising interest rates environment and deliver double digit earnings growth. We also continue to like BTPS for the non-big four banks on its double-digit NIM providing cushion against rising cost of fund.

We expect household spending to improve as the government has launched a number of fiscal stimulus program and more populist policy ahead of election. We believe cigarette producer (GGRM) and staple food producer (ICBP) will benefit from government increasing focus to lift low-income consumption. Given their revenues are in USD or USD-linked while we expect commodity prices to remain solid (coal is still seen above USD90/ton and oil to stay above USD78/bbl in 2019, respectively), we see these should benefit commodity plays such as UNTR and MEDC.

We also like poultry play JPFA as after series of culling program in previous years, limitation of quota on Grand Parent Stock (GPS) imports, and AGP (antibiotic growth promoter) ban eventually starting in early 2018 silver linings on selling prices have been appeared. We see government will keep their eyes on the sector and maintain its supply discipline in order to manage the current market equilibrium. Therefore, we view the price of DOC and broiler to remain resilient going forward.

We like mobile phones retail business industry too, due to its sensitiveness towards new product launch. There must be hype in Indonesia every time new product is coming and people will always want to be updated by having the latest series of mobile devices. ERAA is our top pick as it is trading an only 8.7x forward FY19F PER, 41% discount compare to its peers.

Exhibit 25: Our stock picks

*PBV for banks

Source: Bloomberg and Ciptadana estimates