Construction

Overweight

Sector Outlook

- The construction stocks are down 20% so far this year

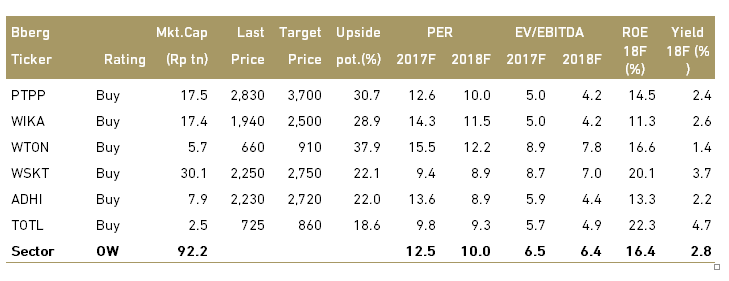

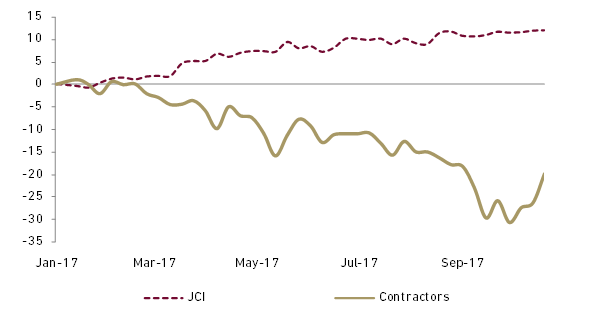

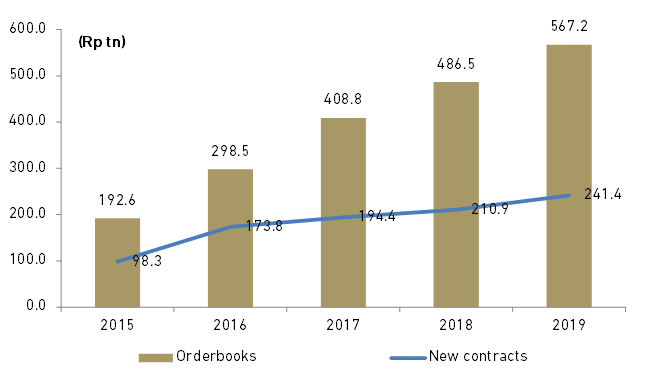

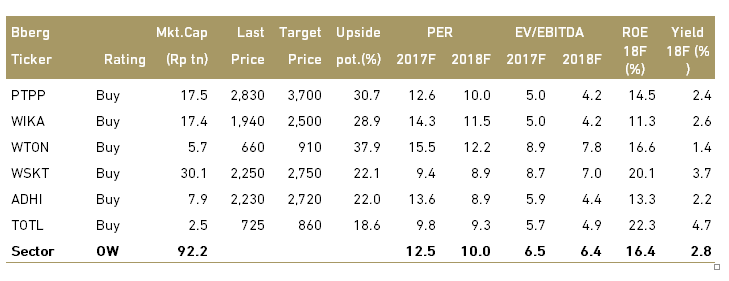

The construction sector plunged about 20% Ytd, underperforming the JCI significantly by 32%. This was due to investor’s concern for 1) contractors funding constraints, 2) reduced visibility of new contract growth on perceived government budget limit and 3) government’s plan to limit contractor sourcing precast from subsidiary by 50%. Construction has been one sector that has delivered consistent earnings growth, which justified their premium valuations over the years. However, the above investor’s concern has taken a toll on the construction sector this year. Most of the construction stocks are down between 15% and 30% from their respective 52-week highs, which include names such WSKT (down 20%), PTPP (down 30%), WIKA (down 25%). On Ytd basis, the construction stocks are down between 15%-24%, excluding ADHI which rose 3.3% Ytd. The sector valuation has seen severe de-rating to only 10.0x now (only slightly above -2stdev historical mean of 9.4x).

Exhibit 50: Construction sector shares vs JCI performance

Source: Bloomberg

Exhibit 51: Construction sector valuation (forward PER)

Source: Bloomberg and Ciptadana Sekuritas

- The concerns are overblown

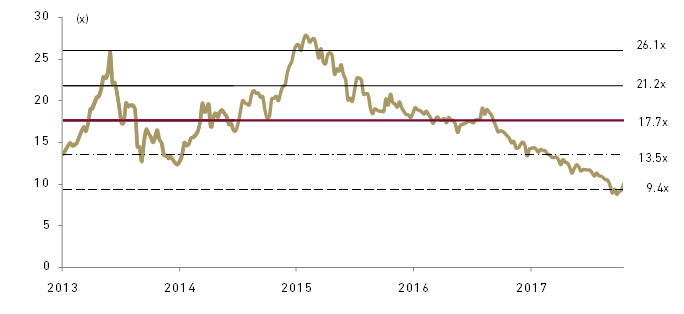

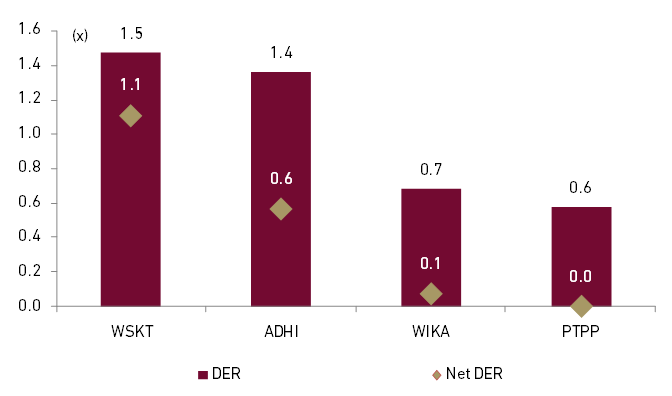

We believe most of the concerns are overstated. On funding constrain, we see most contractors have relatively strong balance sheets to support new contracts growth (including turnkey projects) and investment. As at end of June, PTPP has the least leverage balance-sheet with DER of 0.6x (NDER: 0.0x) followed by WIKA with DER 0.7x and NDER of 0.1x. Meanwhile, ADHI and WSKT have more leverage balance sheet with DER of 1.4-1.5x (NDER of 0.6-1.1x). Moreover, these are far below their debt covenant level of around 3.0-3.5x.

Exhibit 52: SOE contractors DER and net DER at end of Jun-17

Source: Bloomberg and Ciptadana Sekuritas

Judging from data released by contractors, we see that government-funded projects currently accounted for less than 15% of SOEs contractors’ new contract in 8M17. Government projects in WSKT new contract only account for 2% while most of contract awarded by its own business development 55%, followed by SOE (40%). On PTPP, 53% of its new contracts were awarded by SOEs, followed by private projects of 34% and government of only around 13%. Pertaining to WIKA, around 40.2% of new contracts came from privateprojects, followed by SOEs project (30%) and the rest 29.8% from government project. This indicates that most SOE contactors are now less dependent on the government-funded projects.

We do not share view that government budget on infra is declining. In 2018 budget, government Infra spending as a percentage of budget rose to 18.5% vs 18% in 2017 and it also rose 6% YoY to Rp409 tn. The growth decelerated form double digit in the past due to high base of Rp387 tn in 2017 (+46% YoY). Land clearing reimbursement fund was also raised by 77% to Rp35.4 tn . We also see foreign loan of around USD90 bn are in discussion for infrastructure projects will help ease some of the funding concerns. Some of infra project such as toll road use availability payment scheme where the return on investment is made by the government through instalment payments within the agreed timeframe, while the toll revenue or tariffs will be collected by a business entity established by the government. Under the scheme, the toll road development investment will be borne first by the business entity, for subsequent replacement by the government by instalment over the contracted period. This has attracted some Chinese investors as well as SOEs such as WIKA and PTPP which has less leveraged balance sheet.

On government planned regulation to limit precast supply from subsidiary to contractors at maximum 50%, in an attempt to increase private participation in building materials, we believe it is still in very early stage. Due to their limited capacity and plant location, we strongly believe that private contractors may not be able to supply sizable quantity of precast and deliver product on time or meet strict quality requirements for specific projects such as port or elevated road at this point

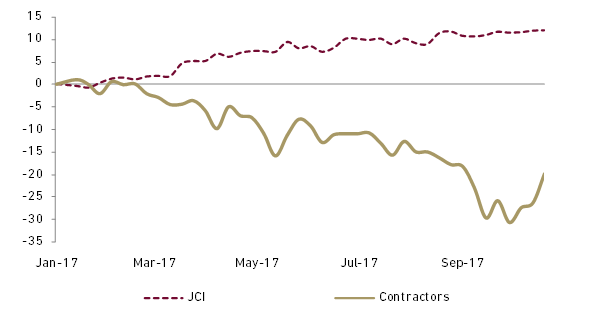

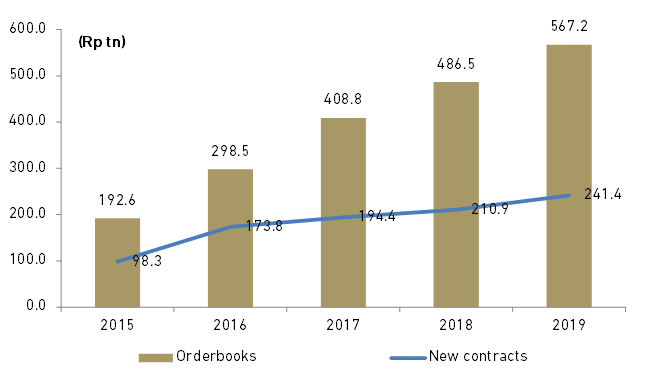

- New contracts up 19% in 9M17, expecting 10-15% growth in 2018-19F

SOEs contractors under our coverage booked Rp146 tn of new contracts in 9M17, still grow robustly by 19% YoY after 77% YoY in 2016. This also lead that all of contractors are sitting on very high order book, supporting earning visibility going forward as it is equal between 3-5 years of annual revenue . We expect new contracts win growth to decelerate to 10-15% in 2018-19F after strong growth in 2016-17. We see slower growth in new orders will not dent earnings outlook given that order backlog will guarantee earnings 23% CAGR in the next two years.

Exhibit 53: SOE contractor’s new contracts and orderbooks

Source: Company and Ciptadana Sekuritas

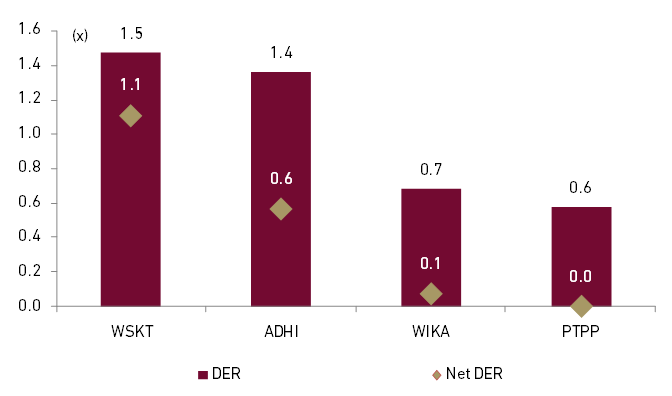

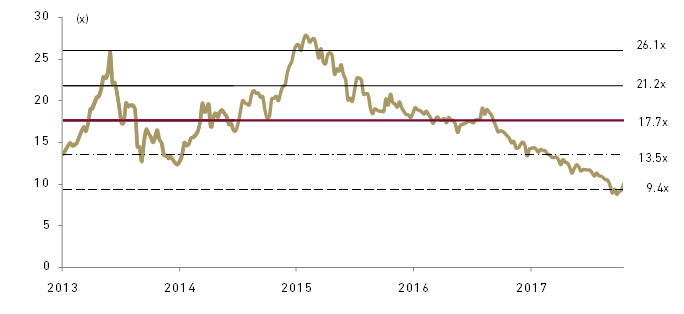

Valuations of contractors are trading below their long-term averages and we believe investors mostly agree on limited downside, which make a case for a rebound. We saw that contractors share price rebounding by 10% in month –to-date 10 October. We do not expect to see the glamour part of the construction sector where it has been trading at significant premium to market valuation. We may turn more bullish if WSKT succeeds in divesting its toll roads and ADHI receive LRT project payment from KAI. That is why we use -1stdev of historical valuation to set target price of our construction and precast maker companies under our coverage (SOEs and private). We have buy rating for all contractors under our coverage given their attractive valuation and upside potential from current share prices. We select PTPP and WIKA as our top picks on 1) their stronger balance sheet will help them to tackle future funding problems and 2) more conservative approach to win the contract reflected in their diversified contracts. The table below shows our pecking order in construction sector as well as their rating and valuation.

Exhibit 54: Construction stocks rating and valuation