Heavy Equipment

Overweight

Sector Outlook

- Strong rebound in heavy equipment sales in 2017

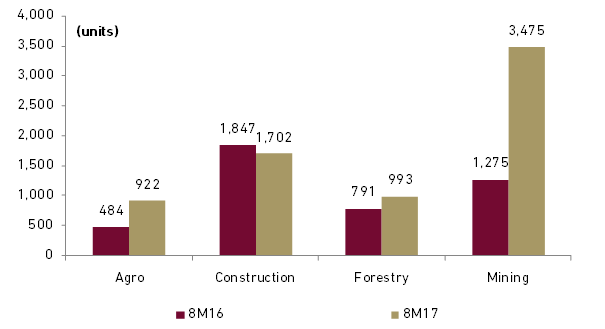

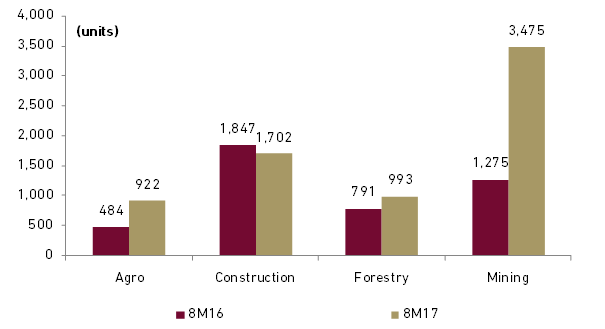

After seeing a 38% decline growth in 2015 to 6,068 units and a 8% growth in 2016 units to 6,554 units, Indonesia’s heavy equipment sales volume is back to double digit growth this year. As during 8M17, the nation’s sales heavy equipment sales expanded robustly by 62% to 7,091 units or already exceed full year 2016 sales. This is in line with the rapid growth of the industrial sectors that use heavy equipment particularly the mining, agribusiness, and forestry sector. Sales to mining sector saw the highest growth in term of unit volume and share. Mining machinery sales volume was at 3,475 units in 8M17 or growing by 173% YoY as strong increase in coal prices (37% YoY to above USD90/ton) and recovery in nickel prices have boosted demand for mining machinery. Mining machinery market share also improved significantly from 29% in 8M16 to 49% in 8M17.

The second highest volume growth was seen at plantation equipment of 91% YoY which we attributed to improved CPO production as we see 13-17% YoY higher in 1H17 in two biggest listed Indonesia’s CPO producers while the country’s export grew by 29%. Heavy equipment sales to forestry sector were also solid in 8M17, growing by 25% to 993 units, which we believe it was mostly driven by higher pulp price (+40% Ytd to USD911/ton). Construction sector was bucking the trend where sales volume to this sector were down by 8% YoY to 1,702 units in 8M17 with market share going down to 24% from 42% in 8M16. We believe the declining demand growth was attributable to high base effect as the sector saw big jump in 2015-16 following robust infrastructure development in Indonesia.

Exhibit 46: Indonesia’s heavy equipment sales by sector as of 8M17

Source: AEMR

- Komatsu to remain the largest brand

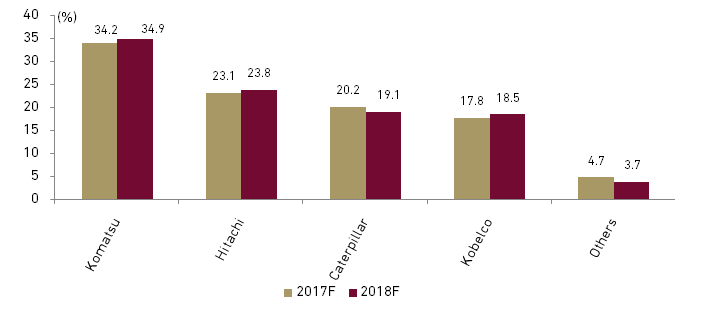

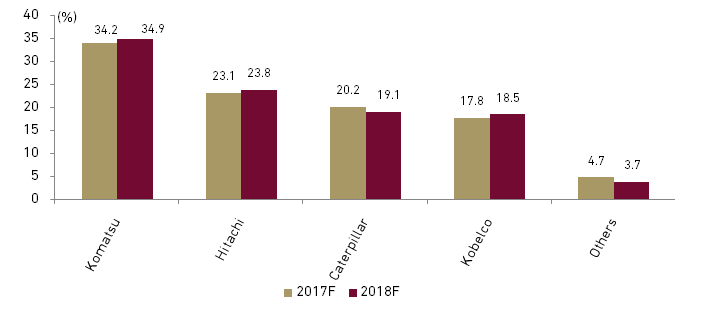

Pertaining to market share, we see Komatsu market share improving from 34.2% in 2017 to 34.9% in 2018 on higher mining machinery sales which has been its dominant product. We expect Hitachi (sold by HEXA) and to also gain market share from 23.1% in 2017 to 23.8% in 2018 on stronger small-to-medium excavator sales for forestry and plantation sector and improved big to giant mining dump truck and excavator for mining sector. Caterpillar is expected to hold the number three position with 19.1% market share (from 20.2% in 2017). However Caterpillar’s position could prove precarious as Kobelco is more aggressive in term of pricing and payment terms. Kobelco is now ranking 4th in Indonesia’s heavy equipment sales with 17.8% share and we expect its market share to reach 18.5 % in 2018.

Exhibit 47: Heavy equipment sales by brand

Source: Ciptadana and AEMR

- Expecting solid heavy equipment sales to continue in 2018, remain Overweight

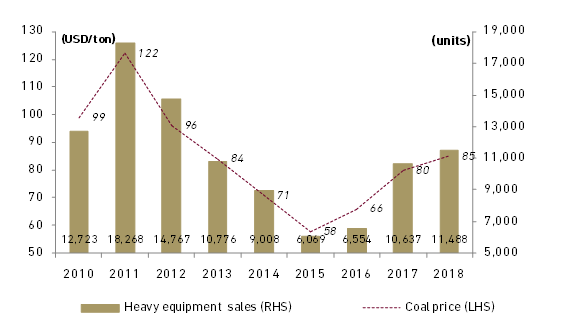

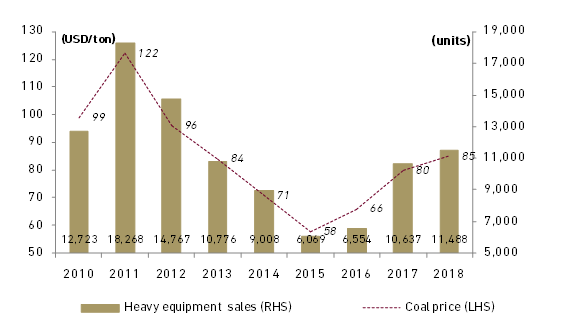

We are expecting an uptrend in in domestic unit sales of heavy equipment to continue in 2018, driven by the gradual replacement of ageing vehicles and in solid improvement commodity prices in 2017 to continue. We reiterate our positive view on the sector given sustained Newcastle benchmark high coal price , hovering at USD 75-90/ton, should be supportive for demand. This will encourage both big and small miners to increase production which will drive higher demand for mining equipment.

We conservatively foresee 8% YoY increase in national heavy equipment sales to 11,488 units for 2018 from 10,637 units this year. Solid coal price should underpin demand from mining sector which expect to grow to 5,972 units (+14% YoY) with market share gaining from 49% this year to 52% in 2018. We see upside risk to our sales forecast if coal price to stay between USD90-100/ton. Recall that heavy equipment demand reached almost 15,000 units when coal price averaged USD96/ton in 2012. Meanwhile, we see share of sales to plantation , construction and forestry sector at 1,493 units (+8% YoY), 2,552 units (-1% YoY) and 1,471 units (+8% YoY).

Exhibit 48: Correlation between heavy equipment sales and average benchmark coal price

Source: Bloomberg, AEMR and Ciptdana

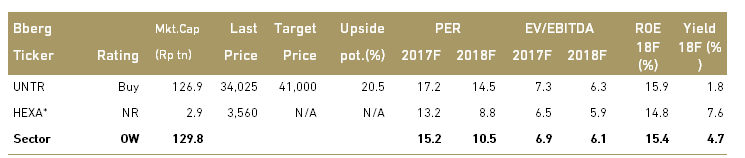

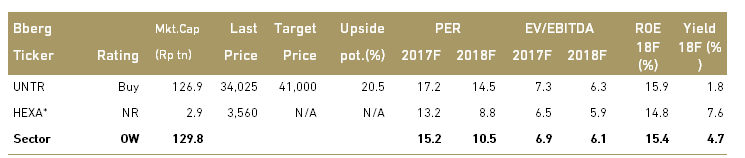

Given the above outlook while we see heavy equipment demand continues to remain strong with limited inventory so far (current backlog of between 4-7 months depending on the size) we reiterated our Overweight stance on the sector. We only cover UNTR in the heavy equipment space with TP of Rp41,000 and Buy rating due to attractive upside potential and favourable coal price outlook which will affect around 90% of its earnings.

Exhibit 49: Heavy equipment stocks rating and valuation

*Bloomberg consensus