Economic Outlook

Global economic: maintaining growth momentum with more balanced risk

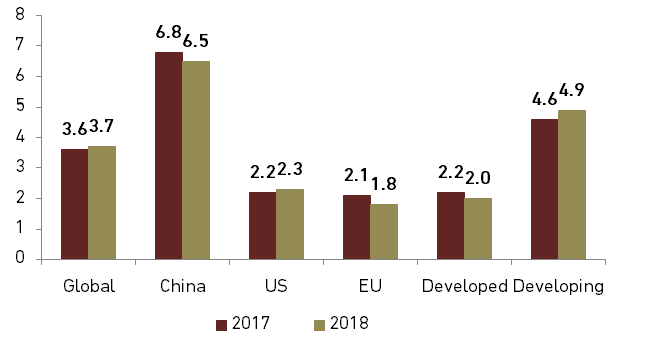

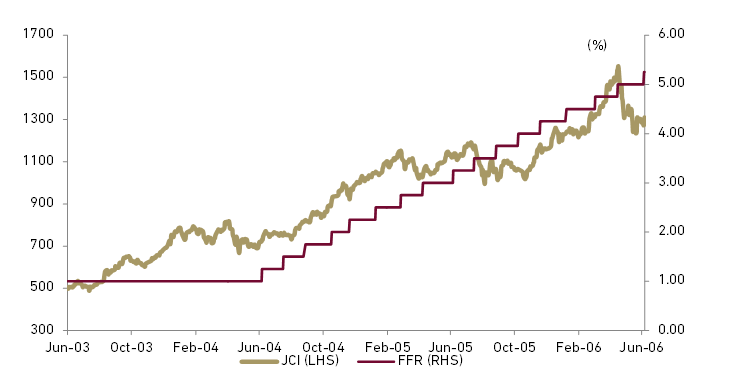

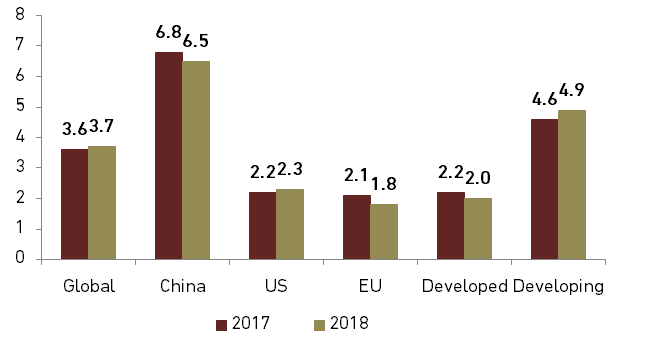

Global economyis projected by IMF to expand by 3.6% in 2017 and 3.7% in 2018. Growth will be mainly driven by developing countries which are expected to grow 4.6% in 2017 and 4.9% in 2018. Developed countries growth is seen to strengthen at 2.2% rate in 2017 before it moderates to 2.0% in 2018.

- Moderate growth seen for China

China’s growth is predicted to moderate in 2H17 to 6.8% and 6.5% in 2018 after recording 6.9% growth in 1H17. Market expectation was that The Panda Country will ease its stimulus and keep its debt at prudent level. Instead, China unexpectedly maintained its expansionary policy mix in order to reach its target of doubling its GDP between 2010 and 2020, resulting to higher public debt. However, our attention should be focused on the prediction of China slowdown in 2018, as China is the largest Indonesia’s export destination. In US, job market recovery brings US growth higher, even though Harvey and Irma storms give another challenge for the short term. Considering uncertainty from fiscal policies, USA is predicted to grow 2.2% in 2017 and 2.3% in 2018. EU’s growth projection is expected to strengthen by 2.1% in 2017 on the back of better global trade and declining political uncertainty after French election. In the following year and medium term, EU is predicted to face weak productivity, adverse demography trend and debt overhang; which bring 2018 growth estimation only at 1.8%.

- More positive global environment with balanced risk

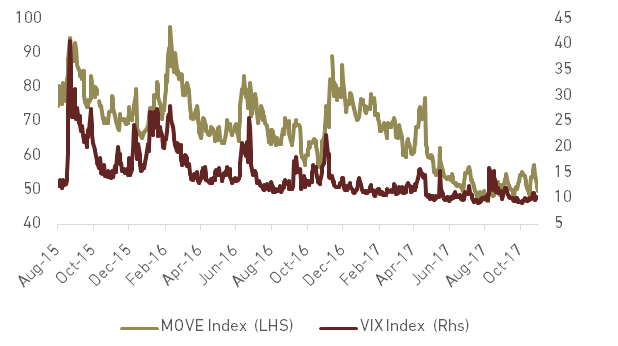

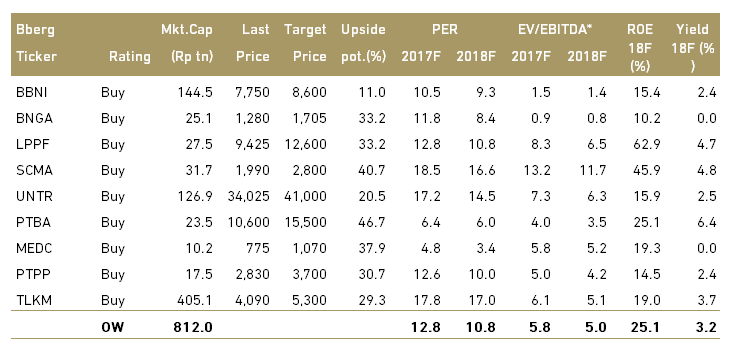

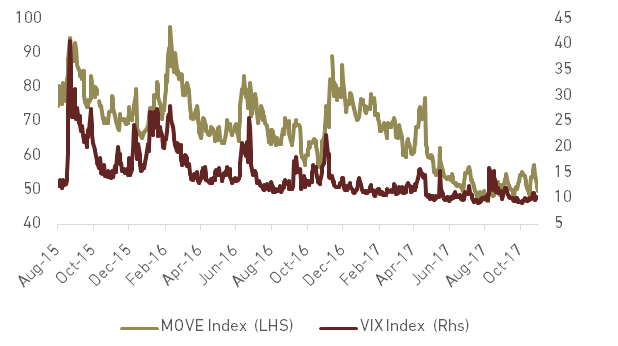

Global economic environment in 2017 is much better than 2016 when volatility came from Brexit decision and Trump’s unexpected win in US presidential election. Both VIX (equity market volatility indicator) and MOVE (bonds market volatility indicator) indexes show declining trend in 2017 (see exhibit 2). In 2017, political condition is more stable after Emanuel Macron wins French election against Marine Le Pen who tends to be anti EU. Furthermore, Fed’s plan for monetary tightening by increasing FFR and narrowing its balance sheet went smoothly without generating huge volatility in the market like in 2013 and 2015.

Exhibit 1: Global and selected countries growth outlook, 2017 - 2018

Source: IMF

Exhibit 2: VIX and MOVE Index

Source: Bloomberg

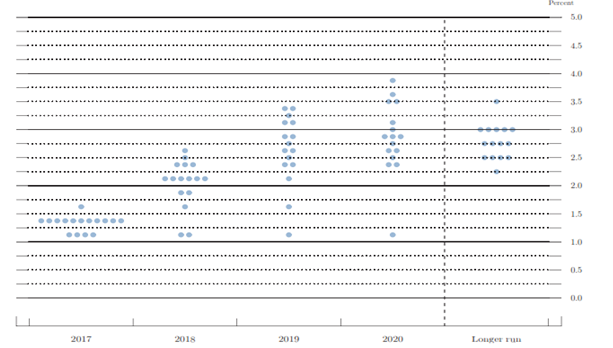

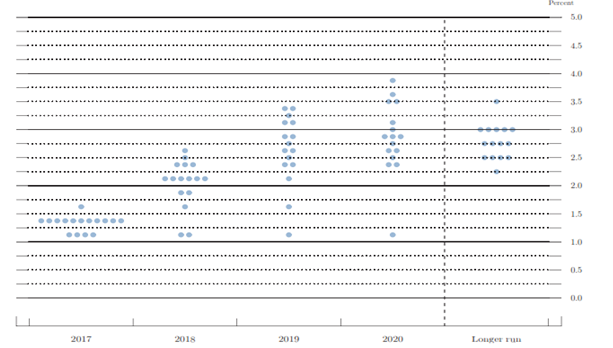

Fed communicated its policies very well, including its further plan to increase FFR and reduce its balance sheet. The elected governor, Jerome ‘Jay’ Powell is expected to continue Yellen’s gradual tightening for both FFR and balance sheet. Considering FOMC rate projection in exhibit 3, we may expect that Fed will increase FFR once more in 2017, three times in 2018, two times in 2019 before ending its FFR tightening in 2020 with one more increase to 2.75% - 3.00%. However, market only predicts one more increase in 2017 and once more in 2018. Meanwhile, European central bank (ECB) also started to cut its easing by reducing bonds purchase from EUR 60 bn/month to EUR 30 bn/month before removing its easing policy and start the tightening trend. However, the impact to Indonesia will not be too significant.

Some risks though still need our further attention, such as:

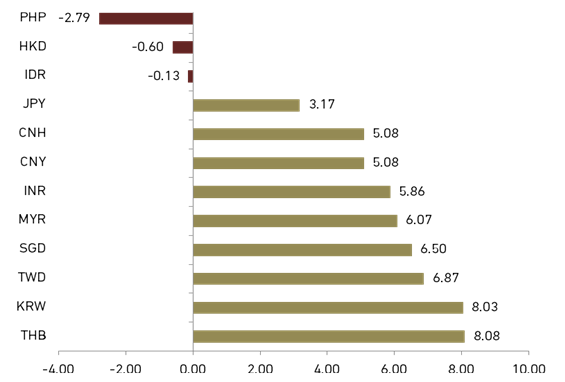

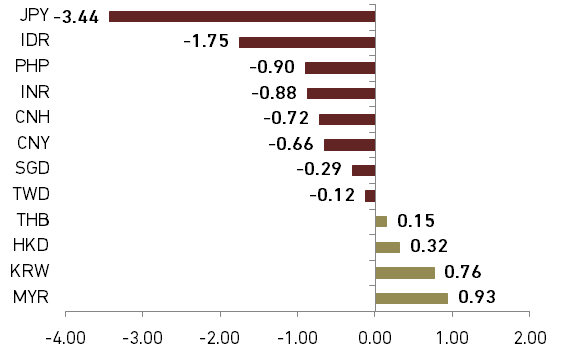

- Trump, tax reform and geopolitical developments

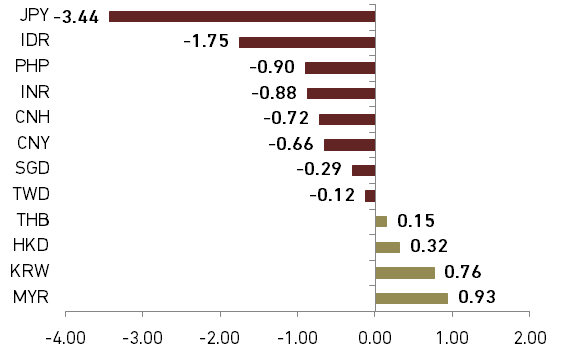

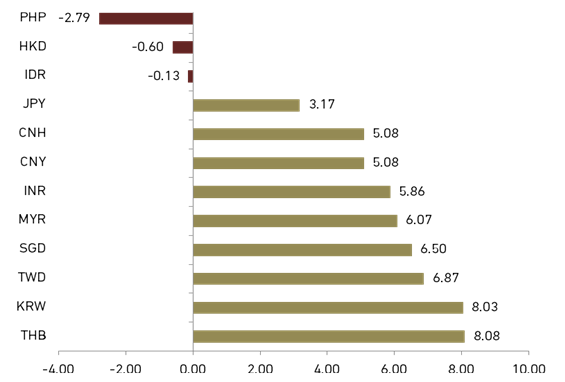

We can say that Trump’s tax reform bill became the game changer of Rupiah movement in 2017. Soon after the tax reform bill was announced in late September, Indonesia’s bond market ended its “investment grade honeymoon” as 10-yr yield increased from 6.3% to around 6.8% and Rupiah also depreciated by 1.5% within a week after the announcement to Rp13,515/USD. US tax reform will provide for better growth outlook in medium term and trigger capital outflow from emerging markets. Exhibit 4 shows currency return when the tax reform was announced by Trump and Rupiah becoming one of top losers among Asian countries.

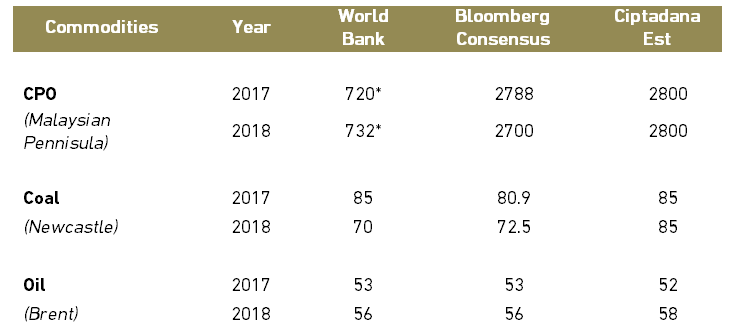

- 2-edged sword of commodity prices and China’s slowdown

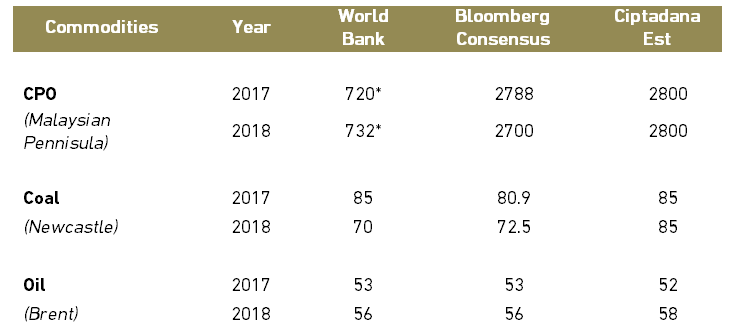

High commodity prices are not always good for Indonesia’s economy and so do the low ones. It is good for trade balance but it will negatively affect inflation, especially for oil price. Currently, Brent oil price already breaks USD 60/barrel level as the result of OPEC production cut. Oil market is now accessing US production as it can make significant change in oil price. Another risk also comes from China’s weaker growth expectation as it is predicted to soften its fiscal expansion. Weak China growth can lower demand for coal and CPO which can damper their prices. However, we still believe that both coal and CPO prices will be stable in 2018. Exhibit 15shows our forecast as well as from several other institutions on commodity prices.

Exhibit 3: FOMC Participants View on Future Monetary Policy

Source: Federal Reserve

Exhibit 4: Currency Return from Sept 1 to Nov 1

Source: Bloomberg

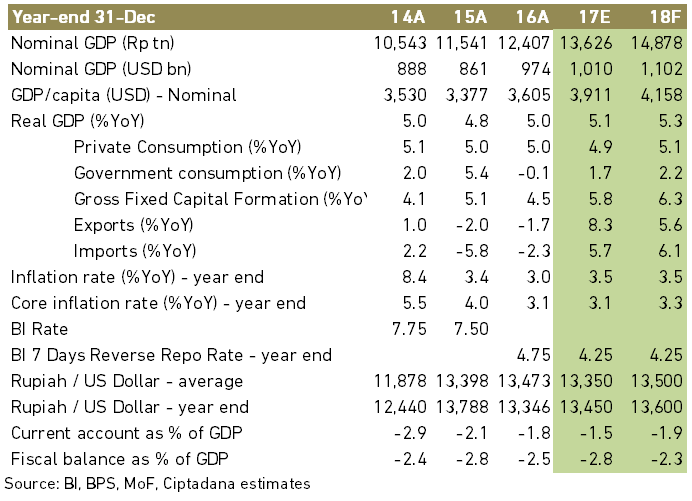

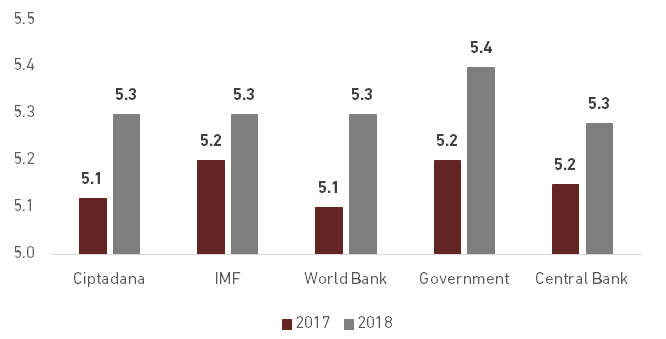

Modest pick–up in 2018 economic growth

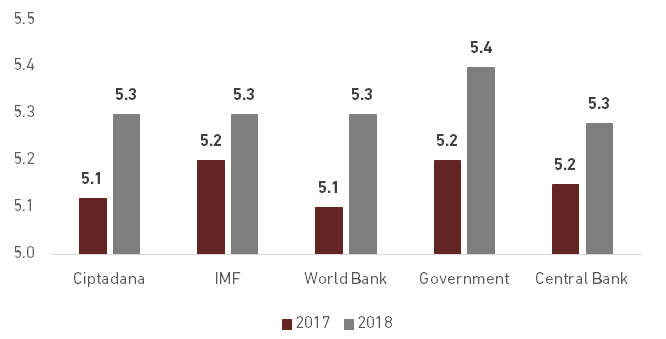

Indonesian economic growth rate in 1H17 was flat at 5.01% and slightly increase to 5.06% in 3Q17. Growth is much driven by exports and investment. We see that economic growth of more than 5.2% in 4Q17 is still achievable and will bring 2017 growth figure to around 5.08%. In 2018, our analysis expects a modest pick up to 5.3% growth on the back of better investment and gradual recovery of consumption; predicted lower than state budget bill but in line with central bank, WB and IMF (See exhibit 5)

- Consumption, savings and purchasing power

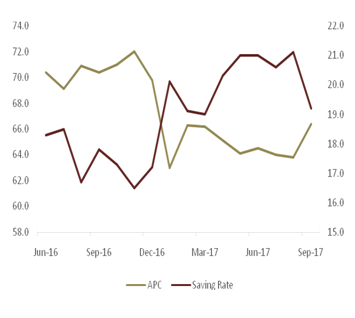

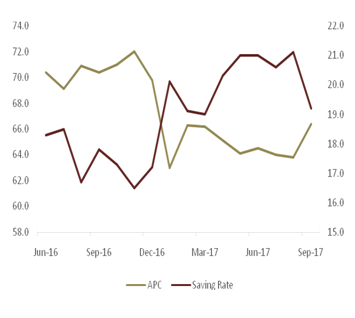

Purchasing power became the highlighted issue in 2017 as consumption growth faced its lowest point in 1H17 since Jokowi took the presidential office as it only grew by 4.94% in 1H17 and 4.93% in 3Q17. Weak retail growth at 2.4% YoY as of September 2017 (2016 average: 11.04% YoY) strengthens the argument that there is a problem with purchasing power. More than 100% electricity price hike for 900VA customers plays a big role in weakening purchasing power of the middle lower segment, the growth machine of Indonesia. Furthermore, we also see that the tax scrutiny and political instability played a role for holding back people’s consumption encouraging them to save. Central bank data where people’s income allocation for consumption decreased from 70% in 2016 to 65% in 2017 and banks’ third party funds increased around 10.0% in 2017, strengthens our view.

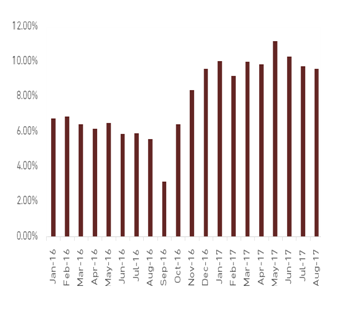

Although 2017 has been tough for the consumption segment, we still see positive catalysts for 2018. First, we believe that electricity price hike effect will start fading in next year. We can see in exhibit 6athat consumers start to reduce their APC since January when the electricity price hike started. We expect APC to normalize during 2018. We believe the lower inflation target will trigger middle income consumption higher. Secondly, government higher social spending is believed that can trigger middle lower segment consumption in 2018. Government also plans to give unconditional cash through village fund transfers in some projects. Thirdly, central bank rate cut from 4.75% to 4.25% is believed to have effects within the first 6 – 12 months or in 1Q18 the earliest time. Last but not least, we see that Asian Games 2018 will give a positive impact, though to lesser extent than the previous three catalysts.

Exhibit 5: Economic growth forecast from several institutions

Source: IMF, WB, MoF, BI, Ciptadana estimation

Exhibit 6a: APC and Saving Rate

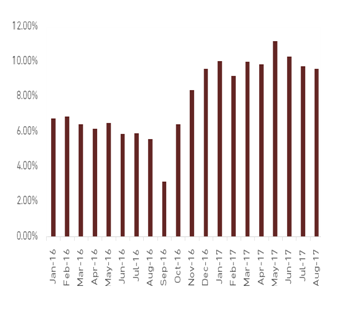

Exhibit 6b: Third Party Fund Growth

Source: BI, OJK

However, we need to be more cautious for some domestic risks in 2018. The first one listed in our note is the possibility for fuel price hike. The Government and House decision to put ICP assumption at USD 48 and slightly increase budget subsidy, opens wide the possibility for fuel price hike. We are afraid that fuel price increase may hamper consumption recovery in 2018 and unfortunately, slash the purchasing power again. Next is continuity of tax scrutiny in 2018 as we see that the target for tax revenue is still hard to be achieved (pls. read fiscal policy outlook part for further info). We view that extra effort of finance ministry to collect tax will have negative impact on consumption as people will be afraid to spend their money. The last risk is high chances for political instability. West Java, Central Java and East java, which cover more than 50% of Indonesian population, will hold elections for new Governors. Of course, there is likelihood for political tensions to occur similar to those during DKI Jakarta election. Furthermore, Indonesia 2019 presidential and parliamentary elections dynamics are predicted to start gaining force in 4Q18 which will add uncertainty to the political environment.

Given those conditions, we expect that consumption will only have a gradual recovery in 2018. We expect 4.9% consumption growth in 2017 and a mild increase to 5.1% in 2018.

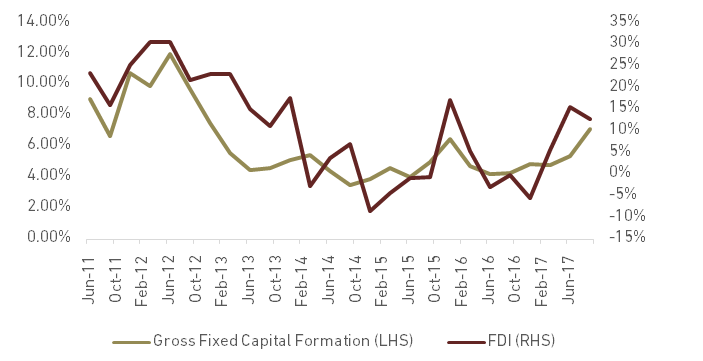

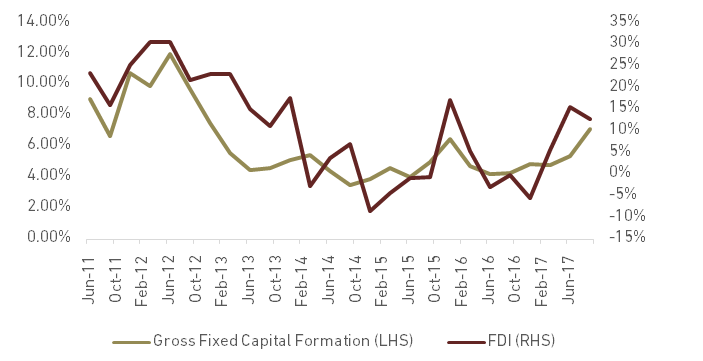

In 2017, investment was the main driver of growth as it registered 5.33% YoY growth in 2Q17 and 7.11% in 3Q17. Government massive infrastructure projects start to give positive sentiment to investment in 2017 after only growing by 4.5% in 2016. We see that infrastructure development will have more significant effect for investment in 2018 and 2019 as many projects will finish within that period. Domestic direct investment realization (23.1% growth in 9M17) drove investment realization higher which brought total investment realization in 2017 at 13.2% YoY. Foreign direct investment realization is reported higher by 7.9% in 9M17 (Rupiah term) or 11.3% (Dollar term). From historical data, higher FDI will lead to higher gross fixed capital formation or the investment segment in GDP as seen in exhibit 8.

Exhibit 7: Regional Election 2018 Schedule

Source: KPU

Exhibit 8: Gross Fixed Capital Formation and FDI Correlation

Source: CEIC

In 2018, we still expect that investment will be the main driver of Indonesia’s economic growth. In turn, Infrastructure development will become the main catalyst of investment next year, especially for toll road. Government has targeted 1,850 kms toll road to finish by next year. Furthermore, we see that better ease of doing business index in Indonesia will sustain investment growth in near future. Indonesia jumped to 72nd position in ease of doing business (EoDB) report and getting near to Jokowi’s target at 40th position. The jump of EoDB in 2017 resulted from better FDI flow (in Dollar term) which increase 11.29% YoY as of 9M17. Another jump in EoDB, better infrastructure and also investment grade rating from S&P are expected to boost investment in 2018. All in all, we see that investment will grow at 5.8% this year and at faster pace of 6.3% in 2018.

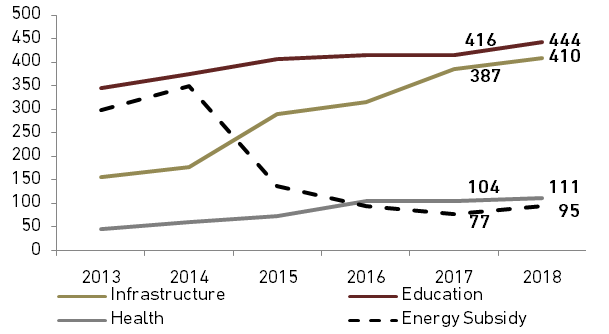

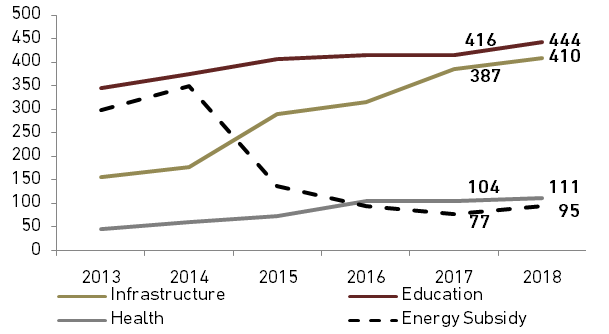

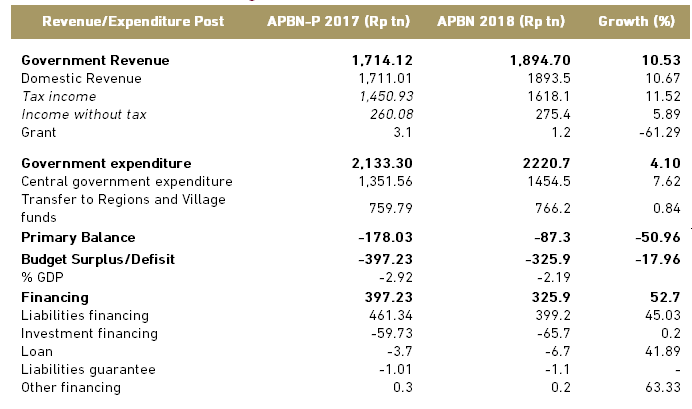

More populist fiscal policy to support middle lower purchasing power

Government expenditure is set to increase by 4.1% to Rp 2,220.7 tn or togrow the lowest since Joko Widodo took office in order to minimize the deficit. Infrastructure spending is set at Rp 410 tn, higher than previous period at Rp 387 tn. Government tries to boost the infrastructure projects to reach its target by 2019, such as 1,854.5 km for toll road. The rising star is the social spending which is set at Rp 283.74 tn or 12.8% of total spending. Social spending will be focused on family hope program or “Program Keluarga Harapan (PKH)” -whoserecipients group increased from 6 mn households to 10 mn households- to increase social welfare and reduce inequality. This program followssimilar pattern with ex-president Susilo Bambang Yudhoyono (SBY), who also increased his social assistance budget by 27.5% when he campaigned during 2009 presidential election. This may become a good catalyst for consumption next year, especially for middle lower segment which become the victim of subsidy adjustment for electricity price in 2017.

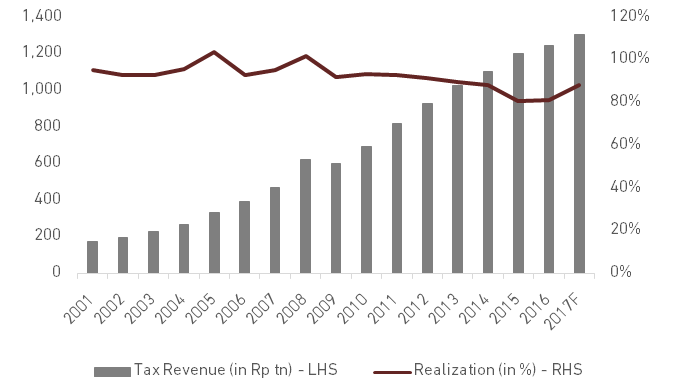

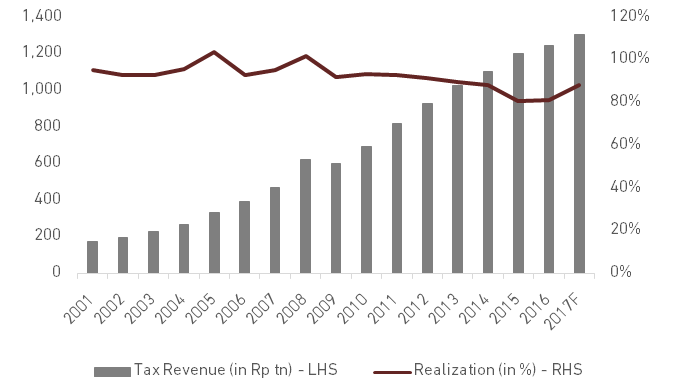

- Challenging tax revenue target

Despite the weak realization in 2017 tax revenue target, government still targets 11.5% tax revenue growth for next year with 11.6% tax ratio. This target is very challenging as the current tax realization is still weak, even after including the tax amnesty program. Exhibit 10 shows that tax realization in Jokowi’s term experienced challenges due to unrealistic target for increasing infrastructure spending, weaker economic growth and softer inflation.

Exhibit 9: Government expenditure budget 2018 by sectors

Source: MoF

Exhibit 10: Tax revenue Realization

Source: CEIC, Ciptadana Estimation

As of September 2017, tax revenue only reached 60% of the target Rp 1,450.9 tn (including duties). In its outlook, government still believes it can achieve the target of Rp1,472.7 tn while we only expectthe government to achieve 88.57% of its target. If there are no significant actions from the tax office, we are afraid that tax revenue growth will equate tothe summation of GDP growth and inflation rate which effectively means that the 2018 tax realization can be below 90% again. Significant action is needed to enlarge the tax base as there are still many economic groups not yet inspected by tax authorities.

- Fuel price to increase next year?

Subsidized fuel price is one of our biggest concerns for next year. We see an opportunity for government to increase the price due to higher oil price. Current ICP price has reached USD 54.02/barrel while Brent oil price has gone up by more than USD 60/barrel. We see OPEC’s effort to cut oil production to be quite successful in increasing its oil price. With the widening oil price, government only has Rp 46.96 tn in its budget for fuel subsidy. Maintaining fuel price at current level will hurt Pertamina significantly as it will absorb the burden. We still see commitment from government to give all of its effort to maintain fuel price as elections are approaching. Government may either re-negotiate the budgeted subsidy in the revised state budget 2018 if the oil price continues to be high or direct the burden to Pertamina.

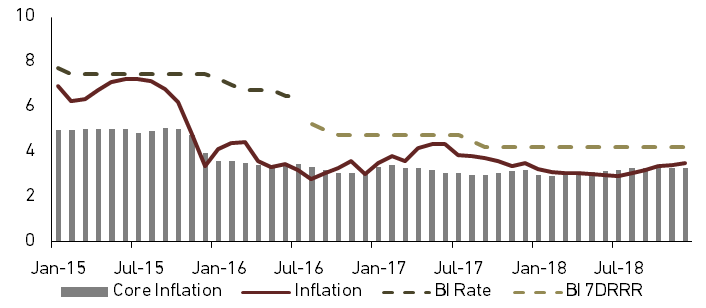

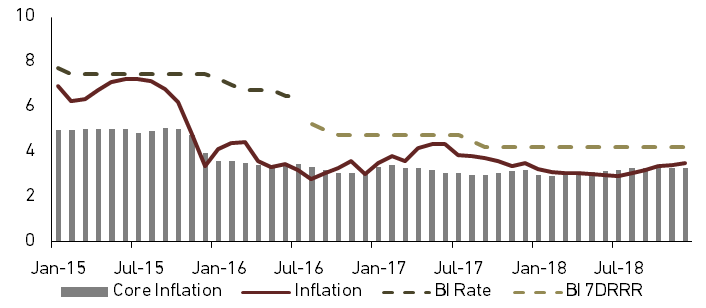

Inflation to soften with risk on fuel price increase

Inflation levels in 2017 reflect the government success in muffling food inflation, especially during the festive period. Although subsidy adjustment for electricity price pushed inflation up in 1H17, government succeeded to maintain it within the 4%+/-1% target. At its peak in June, inflation reached 4.37% YoY and started the downtrend until October to 3.58%. Government’s effort maintaining food supply in traditional market and determining food’s price ceilings were the main reasons behind low food inflation. Moreover, there were no significant effects from either El nino or El nina which could disturb food supply. We also see that moderate domestic demand in 2017 played a role in low inflation.

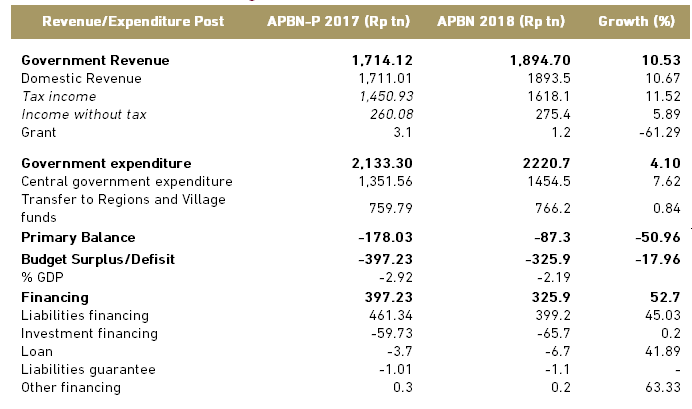

Exhibit 11: Government’s budget for 2018

Source: MoF

Exhibit 12: YoY Inflation and policy rate

Source: CEIC, BI, Ciptadana Estimation

- Soft inflation to continue in 2018

We are optimistic that 2018 inflation will remain moderate since the government and central bank also reduced their inflation target to 3.5%+/-1%. Food inflation is expected to remain low in 2018 as we believe that successful implementation of the current program will continue. Furthermore, both el nino and el nina have low probability to occur in Indonesia until the next harvest season in April according to BMKG. Stable weather means stable food supply which guarantees the continuity of food price stability. Government needs to pay close attention to food inflation as it can affect poverty line and poverty rate significantly. It is worrisome that if food inflation surges up, the poverty rate will increase and make Jokowi’s administration less popular. All in all, we predict that 2018 inflation will be around 3.5% by year end.

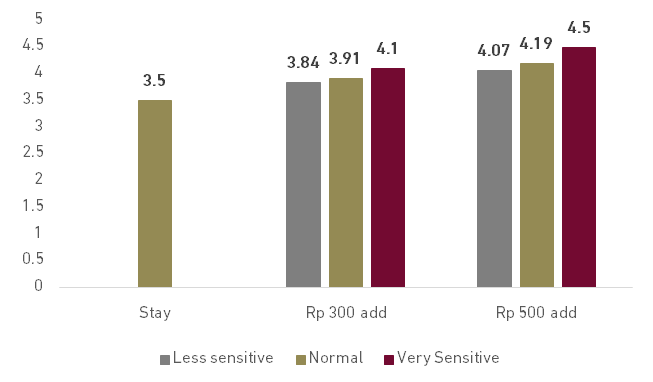

- Stay cautious on fuel price

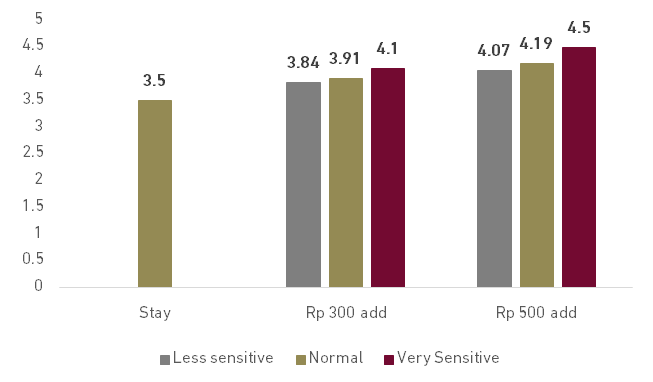

Previously, government has promised to keep the fuel price not changed until the end of 2018. However, the uptrend of oil price may force the government to re-consider it as it could hurt Pertamina significantly if government passes on the subsidy burden. If the government decides to increase the fuel price, we expect the increase to be between Rp 300 – Rp 500 on both Premium and Solar prices. Exhibit 13 shows the results of our estimation. We separate this into two scenarios, when the increase is absorbed by the transportation sector aggressively and the not too aggressive. However, we still predict that fuel price will remain stable in 2018 as Indonesia enters its political year in 2019. Maintaining fuel price is needed to keep the popularity of current government, especially after it took electricity subsidy in 2017.

Trade balance will have another period of surplus

Trade balance in 2017 experienced high surplus due to better exports growth. As of 3Q17, real export YTD growth reached9.79% YoY and 17.7% YoY in value terms. The awakening of exports is driven by better growth of China’s industry growth of 6.5% in 2017 after facing hard times in 2015 and 2016 (see exhibit 14). Better industry growth brings higher demand and price in Indonesia’s main commodities, coal and CPO. Higher demand also comes from India where Indonesia succeeds in expanding its CPO market. Higher demand from these countries brings Indonesia’s YTD export growth to China to jump by 50.0% and India by 46.9%.

Exhibit 13: Inflation forecast if fuel price increase

Source: Ciptadana Estimation

Exhibit 14: China Industry and Indonesia Real Export Growth

Source: Bloomberg

On the flip-side, Indonesia’s imports experience weak growth only because of low domestic demand, especially the manufacturing sector. Our oil and gas analyst expects Brent oil price to move around USD 58/barrel next year and bring ICP to above USD 50/barrel. Coal price will be determined by China’s demand and supply, Although China’s effort to reduce its domestic supply by reducing miners’ working time, the country also tries to reduce coal utilization to move to more sustainable energy sources. Weaker China’s industry growth could lower coal demand in 2018. Our Coal analyst expects coal price (Newcastle) will be stable at USD 85/ton. CPO price (Malaysian) is predicted to be stable at or MYR 2,800 as the abundant supply will meet increasing global demand. Moreover, Indonesia has access to new markets for CPO in India and Pakistan.

We expect that Indonesia will have another period of trade surplus but with lower value. Exports are expected to have lower growth as the economic growth in some of Indonesia’s main export destination countries are expected to soften (see exhibit1). Milder growth can be translated to softer demand of commodities from these countries. Furthermore, import is expected to increase due to better domestic demand as we have mentioned before. We expect that exports to grow by around 5.6% and imports by 6.1%.

- CAD to slightly widen as trade surplus soften

We see that current account deficit will slightly widen to 1.9% of GDP in 2018 from our estimation of 1.5% of GDP in 2017 due to effect from lower surplus expectation. We do not see significant changes in other CAD elements of service balance, primary income and secondary income for 2018.

Rupiah highly dependent on US policies

Rupiah has been very stable at around Rp 13,330/USD in 2017, at least up until September. Rupiah movement events ranged only within Rp13,300 – Rp13,350 area when dollar index and other currencies move quite significantly in the period March – September (see exhibit 16). Good coordination and communication of global policies, especially from The Fed, played a key role inforex market stability. However, Rupiah started to fluctuate when Trump initiated the new tax reform bill.

Exhibit 15: Commodities Price Forecast

Source: WB, Bloomberg, Ciptadana Estimates

Exhibit 16: Asia Currencies returns YTD as of Nov 3

Source: Bloomberg

Market assesses that the tax reform has the ability to change the US economic outlook in the medium term which can make emerging countries outlook not as prospective as before in return. Next year, we view that Rupiah will be highly depended on US policies. The uncertainty of tax reform will be the biggest concern that should be cleared by Trump’s administration as soon as possible to prevent higher volatility in emerging market currencies. Risk related to The Fed seems to fade as Jerome ‘Jay’ Powell is elected the new chairman and he is expected to follow Yellen’s path. On domestic side, we still predict that inflation will be stable within central bank’s target at 3.5% +/- 1%. Current account deficit is also predicted to be stable at -1.9% of GDP and budget deficit at 2.3% of GDP. We expect that Rupiah will depreciate to Rp 13,500/USD in next year.

Expecting BI 7DRRR to hold in 2018

In 2017, central bank decided to cut BI 7-day reverse repo rate (BI 7DRRR) by two times from 4.75% to 4.25%. Bank Indonesia saw inflation was lower that it was expected which opened the door for monetary easing. Furthermore, low inflation also reflected low economic growth which in 1H17 only grew flat at 5.01% with low consumption growth. Furthermore, Rupiah was also stable and current account deficit was manageable at below 2.0%. However, we note that central bank stopped its monetary easing after Rupiah was fluctuating in early October.

We see that central bank will maintain its low policy rate at 4.25% which is still needed to support growth recovery in 2018. However, the lower rate may negatively affect Indonesia’s economy. Fed monetary plan prevents BI to keep lowering its BI 7DRRR as it will make Rupiah even weaken. In our opinion, the chance for easing the rate will be open again if the inflation falls below 3.0%. Central bank may start to increase the rate in 2019 if the economic growth is getting better.

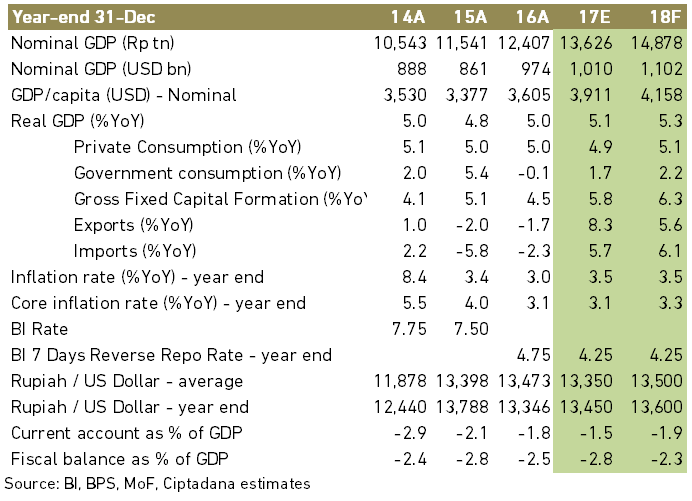

Exhibit 17: Key Macroeconomic Indicator

Source: BI, BPS, MoF, Ciptadana estimates

Strategy

- Positive fundamentals to keep market trending higher

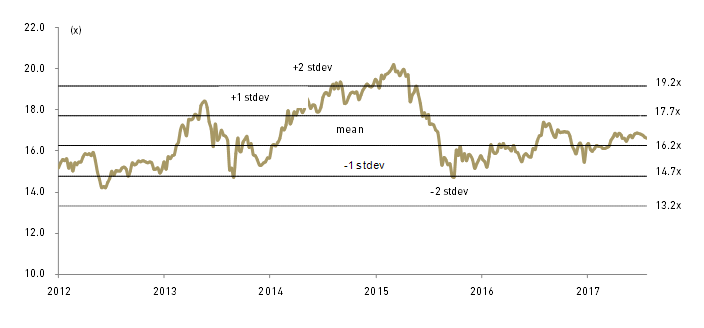

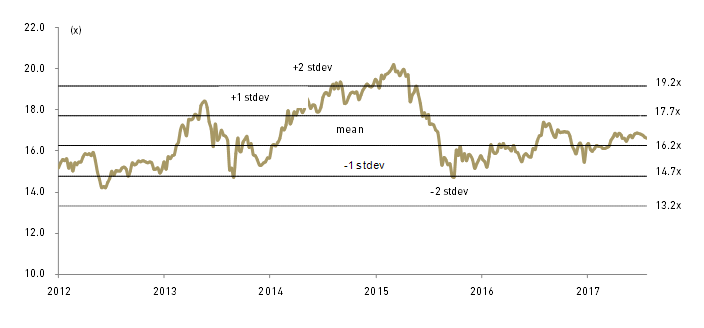

Despite stock market rally in 2017, we are still bullish on Indonesia as underlying fundamentals continue to support growth. We see the following investment themes in 2018: recovery in consumption, higher loan growth, commodities, continuity of infrastructure program and political stability. On top of improving macro outlook we believe the equity market can extend the gain for the following three reasons: 1) 14% higher aggregate EPS growth in 2018, 2) the return of foreign inflows seen on strong hopes about a recovery consumption 3) valuation of market still attractive at16.5x2018F PER, slightly above historical mean of 16.2x. We introduce our YE-18 JCI target of 6,950, offering 14% upside potential from our YE-17 target of 6,100.

- Improving macro indicators

We believe expected acceleration in GDP growth next year should help boost positive market sentiment. Our economist assumes 5.3% GDP growth in 2018F led by both government (infrastructure) and private sector investment with a follow through on private consumption given robust momentum in employment dynamics and consumer confidence. With macro stability objectives has largely been under control, we think the government can shift focus to boost growth using both fiscal and monetary policy. We do not expect to see weakness in private consumption as a result of fiscal policy drag anymore, asthe government does not have plans to hike administrative prices. We believe the government won’t tighten the budget so much ahead of the Presidential election in 2019. We believe the recent 50bps interest rate cut has started to gain traction and is expected to contribute to the loan growth next year. Our banking analyst is forecasting robust 2018F loan growth of 12%, a significant acceleration from the current 9%.

As the outlook for Indonesia’s economy remains rather sanguine with our in-house GDP growth estimates for this year and next expected at 5.1% and 5.3% respectively, we do not foresee the equity market turning bear anytime soon. Having said that, even amidst continued decent macro growth, we remain mindful of intermittent cyclical pullbacks that may take place as a result of situational issues which are affecting market sentiment. The local factors could also play a vital role in next year’s expected economic recovery, namely measures for the restoration of investor confidence, consumption recovery and policy continuity.

- Political stability to remain strong next year

With 17 months to go before the 2019 presidential elections, we still expect continued political stability, which is an important indicator for business and consumer confidence. The incumbent President is in a strong position, in our view. His approval ratings are good, and some parties have already declared they will throw their weight behind him. He also has support from the public. In the recent poll carried out by CSIS, 68% of 1,000 respondents interviewed claimed they were satisfied with Jokowi’s performance, despite his failure to reduce inequality. Only 67% and 51% said so in similar surveys in 2016 and 2015, respectively, according to the think tank.Jokowi scored the highest in infrastructure and maritime development, with 75% of respondents saying they approved of Jokowi’s work in the sector. In another poll where pollsters put him up against 17 potential rivals, he received 45.6% of the votes with no other candidate breaking the 10% mark. Ahead of the 2019 election, the existing rules remain in place, in our view. Jokowi scored the highest in infrastructure and maritime development, with 75% of respondents saying they approved of Jokowi’s work in the sector. We believe that conviction in the continuity of reforms and infrastructure programs could drive private sector investment which further helps to boost equity market sentiment.

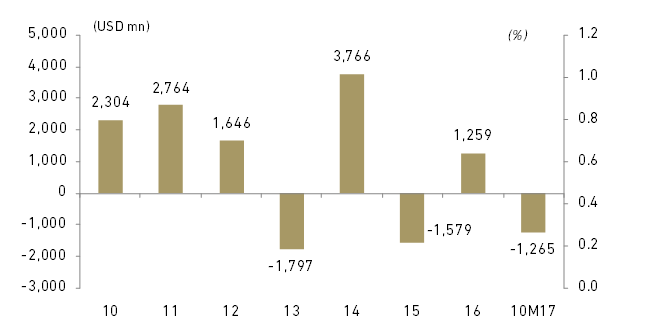

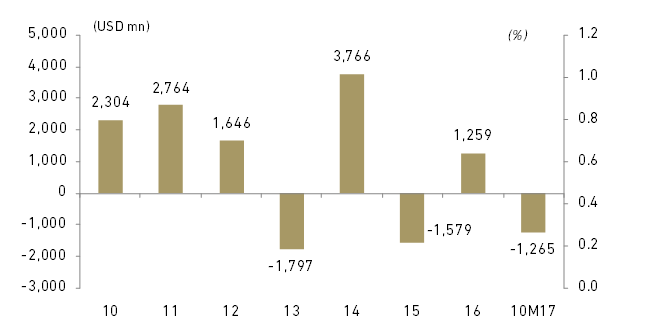

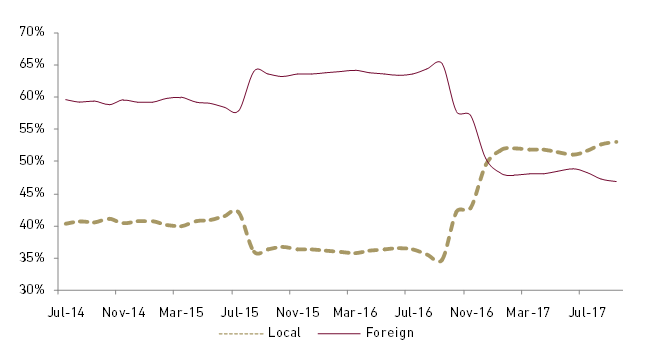

- Expecting foreign inflow to return

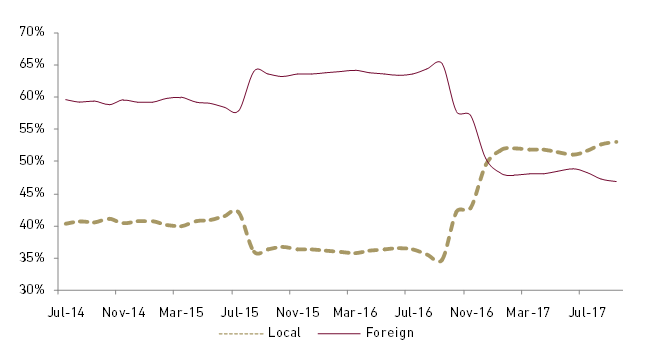

Foreigners have sold USD3.3 bn of Indonesian equities since end June, making them net sellers of USD1.27 bn year to date. They seemed deserting equities in favor of bonds following a sovereign rating upgrade and the central bank’s signal that it’s open to more interest rate cuts to spur growth. Overseas investors are muscling in on their share of Indonesian bonds, lured by the highest yields in Southeast Asia. The share of foreign ownership has surpassed 40% for the first time, bringing the benchmark yield to lowest level of 6.2% this year. Therefore, the 11% Ytd increase in stock market

index was supported by domestic liquidity despite the foreign selling. This led to local investor’s asset portion increasing to 53% in Aug-17, according to data from KSEI, where it has always been below 50% in the past. Local flows could be structural as Indonesians are under invested in equities and exposure to equities should keep going up. With a smaller portion of foreign ownership after their net selling, we expect lower volatility in stock market going forward and see foreign investors to return after next year after aggressive selling since 3Q17. The stock market is expected to attract foreign investors next year because of its relatively lower valuation compared with Asian bourses and less attractive bond yield after strong increase in bond price this year.

Exhibit 18: Net foreign buy at Indonesian stock market

Source: Bloomberg

Exhibit 19: Portion Indonesian equity ownership

Source: KSEI

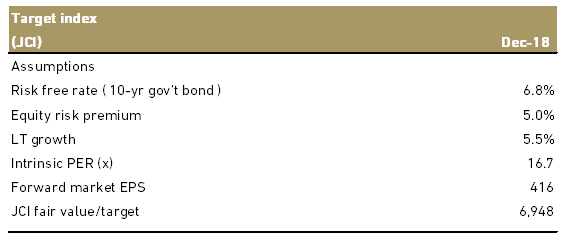

- Year-end 2018 index target of 6,950 – Overweight

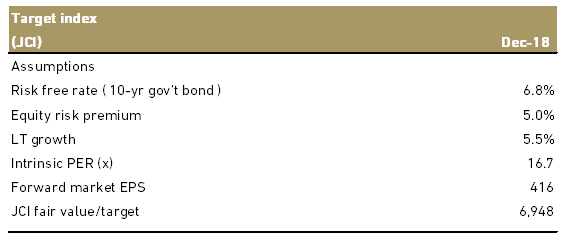

We reaffirm our year-end 2017 JCI target of 6,100 points which equates to PER-18F of 16.5x , at slightly above historical mean of 16.2x. We introduce our YE18 JCI target of 6,948 (rounded up to 6,950) which implies 14% YoY return and coincidentally tracking market EPS growth. We use risk free rate of 6.8%, risk premium 5% and LT growth of 5.5% to derive intrinsic market PER of 16.7x and then we multiply with forward market EPS of 416. We remain overweight on Indonesian stock market on attractive potential return. The consensus 2018 EPS growth rate for Indonesia of 15% (ours is 14%) is superior to its Asean peers such as Thailand (8%) more than double that of the Philippines (7%) and five times that of Malaysia (3%).

Exhibit 20: JCI forward PER band

Source: Bloomberg and Ciptadana Sekuritas

Exhibit 21: Our calculation for JCI fair value/target for end-2018

Source: Bloomberg and Ciptadana Sekuritas

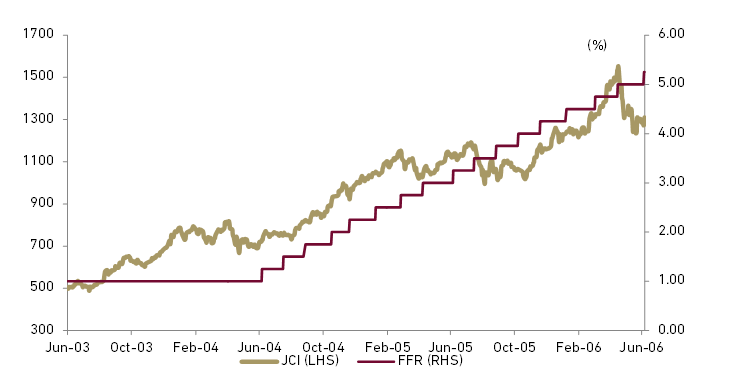

Meanwhile, we are not too concerned on Fed's rate hike next year where our economist expects fed to raise three times in 2018. The historical data appear to debunk several myths about how it will react when the Fed finally does raise rates. Indonesian equity market fared relatively well during Fed rate hike cycles in 1999 and 2004, especially in the first 6 to 12 months. During Jul-99 to May-00, the Fed hiked its rate by 175 bps from 4.75% to 6.5% and the JCI rose by 27%. As for Jun-04 to Jun-06 period, JCI performed very well rising by 162% when fed rate was hiked by 425 bps from 1% in Jul-04 to 5.25% in Jun-06.

Exhibit 22: JCI performance vs. Fed rate hiked in 2004-2006 period

Source: Bloomberg and Ciptadana estimates

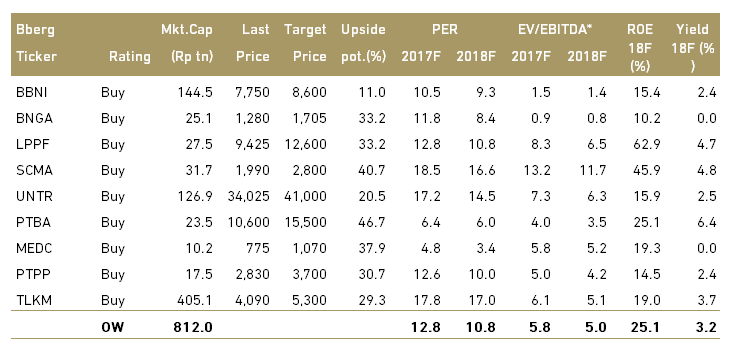

Based on our investment themes in 2018 which are 1) higher loan growth, 2) recovery in consumption, 3) commodities, 4) continuity of infrastructure program and 5) buying opportunity from recent underperformances, we select the following stocks as our top pick: BBNI, BNGA, LPPF, SCMA, UNTR, PTBA, MEDC, PTPP and TLKM. We like BBNI on its relatively attractive valuation with 2018F PBV 1.4x vs other big four banks (1.7x-3.5x). We believe BNGA will deliver strong earnings recovery high double digits earnings growth at 29% CAGR in 2017-19F while it is trading at only 0.8x 2018F PBV. On top of LPPF’s solid fundamental (zero debt level, highest ROE, highest profit margins and strong cash flow generator), we expect double digit increase in government subsidies should ease the weak consumption this year, spurring higher consumption and will benefit retail stock. SCMA would be a direct beneficiary of any potential recovery in the adspend in FY18F on consumption recovery and rise political campaign spending ahead of election.

On commodity related space we like UNTR, PTBA and MEDC. UNTR should be beneficiary of an uptrend in rising heavy equipment demand, driven by the gradual replacement of ageing vehicles and in solid improvement commodity prices. PTBA remains our top pick in the coal sector on its valuation at 6.0x 2018F PER, the cheapest among peers and lessening investors’ fear from domestic coal price proposal.

We expect PTPP to post strong 29% CAGR EPS growth in 2017-19F, while the contractor has strongest balance sheet and diversified projects. Post share weakness, we believe TLKM will remain the key beneficiary of rising internet demand on its dominance in the mobile and fixed broadband market coupled with strong earnings growth and attractive valuations.

Exhibit 23: Our stocks pick

*PBV for banks

Source: Bloomberg and Ciptadana estimates