Metal Mining Overweight

Sector Outlook

- Nickel prices normalising after big fall early in March

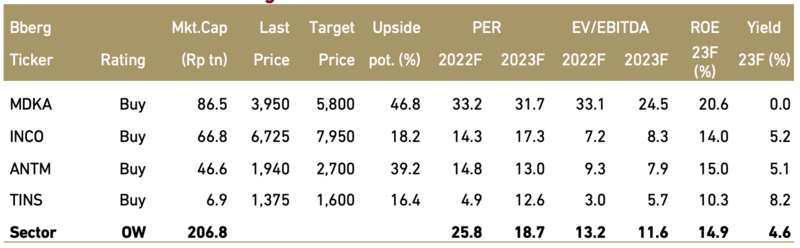

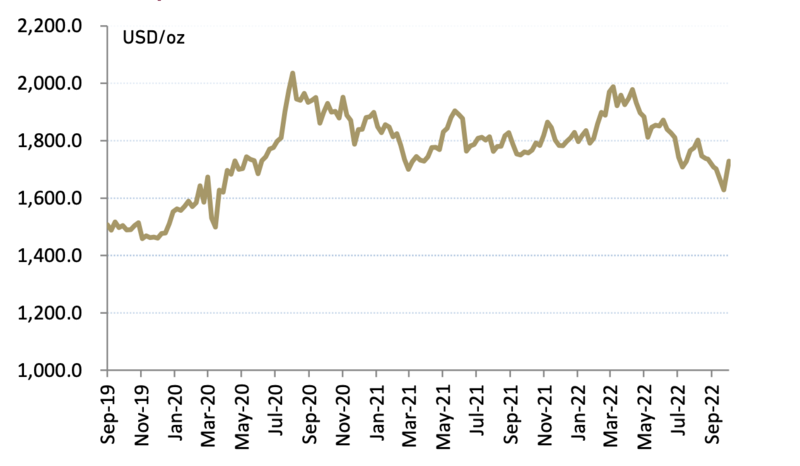

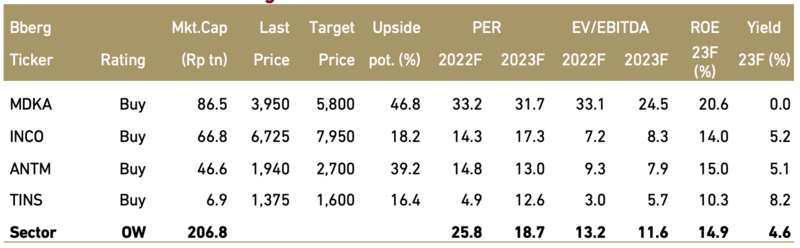

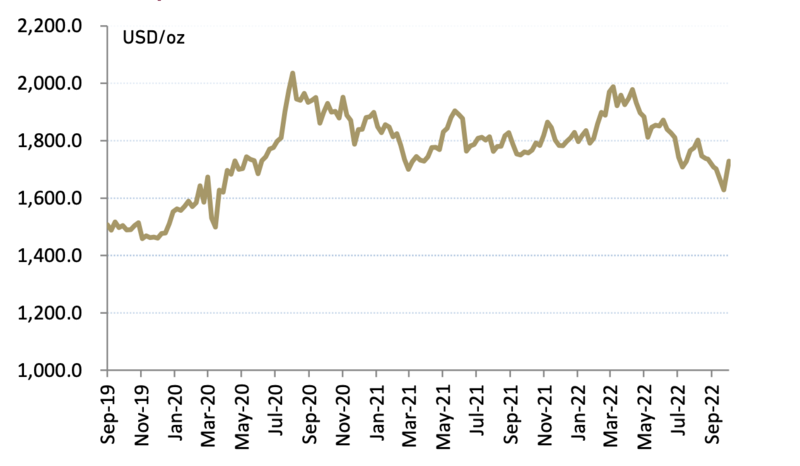

After rising to a record high (USD48,078/ton in mid-March) following the Russian invasion of Ukraine late in February, nickel prices have taken a beating dropping to a low USD19,385/ton in July. This is primarily due to falling demand, following China’s lockdown, rising interest rate and fear of Tsing Shan rapid expansion in Indonesia flooding the market with class 2 nickel products such as Nickel Pig Irons (NPI) and Ferro Nickel (FeNi). However, relaxing lockdown policies, commencement of Chinese steel mills, potential sanction of Russian metals from the LME and stimulus from China have soften the price fall and manage to maintain nickel prices averaging at USD22,111/ton so far in 3Q22.

Exhibit 83: LME Nickel price and inventory

Source: Bloomberg

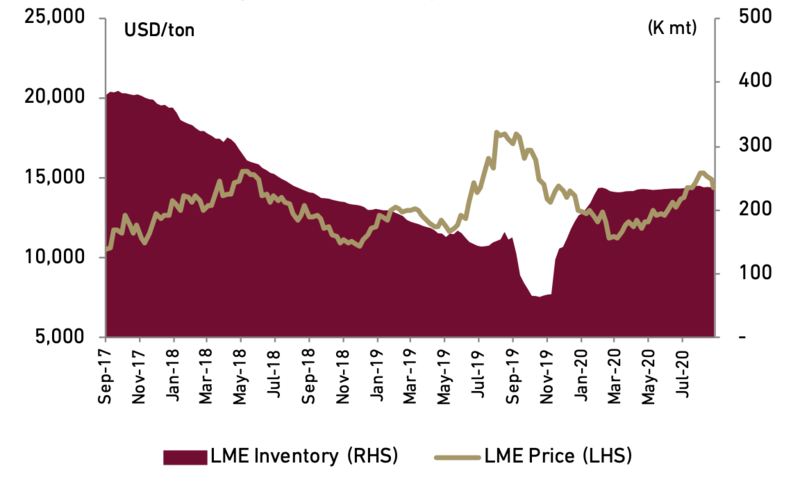

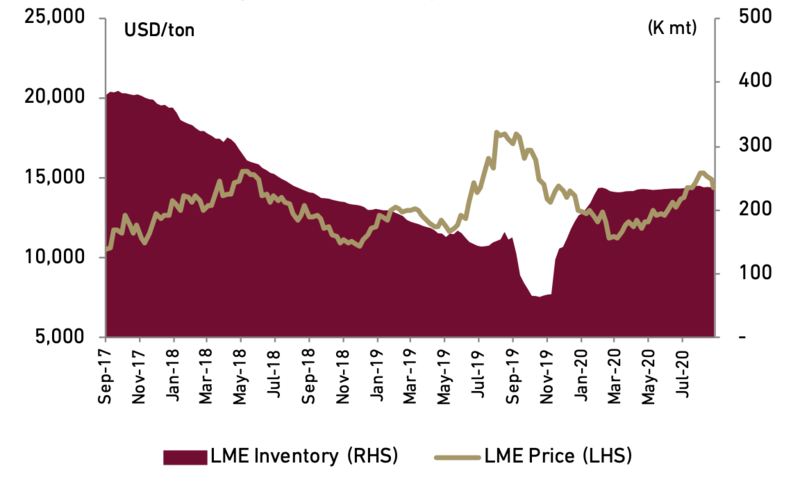

- EV still is the medium-long term growth driver for nickel

Despite reported chip shortages, EV’s nickel consumption still accounted for around 10% (296k wmt) of global nickel demand in 2021, according to S&P Global. In our view, nickel usage in electric vehicle (EV) batteries will still be the primary driver of growth for nickel consumption in the medium to long-term. We estimate that nickel consumption from EV batteries will grow by 82.5% to 540k wmt in 2025 and a further 233% to 1.8 mn wmt in 2033. Although technology advancement should reduce nickel content in EV batteries in the long run, based on the current production pipeline, nickel rich Nickel Manganese Cobalt (NMC) cathode is still a key part for the production of EV battery.

Exhibit 84: Nickel consumption for EV

Source: Bloomberg, Ciptadana estimates

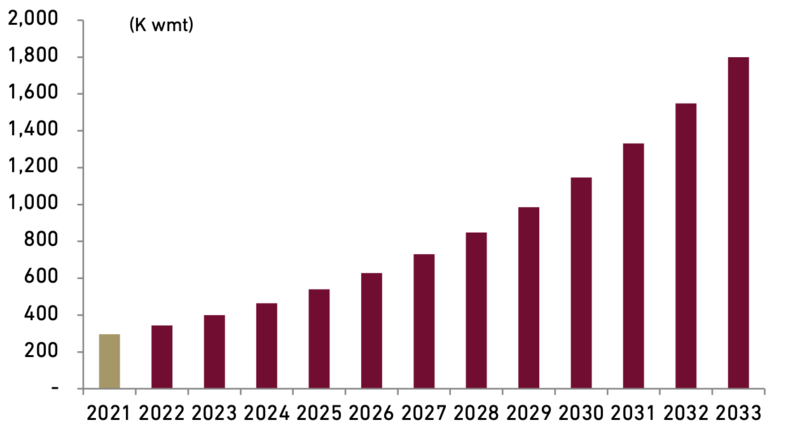

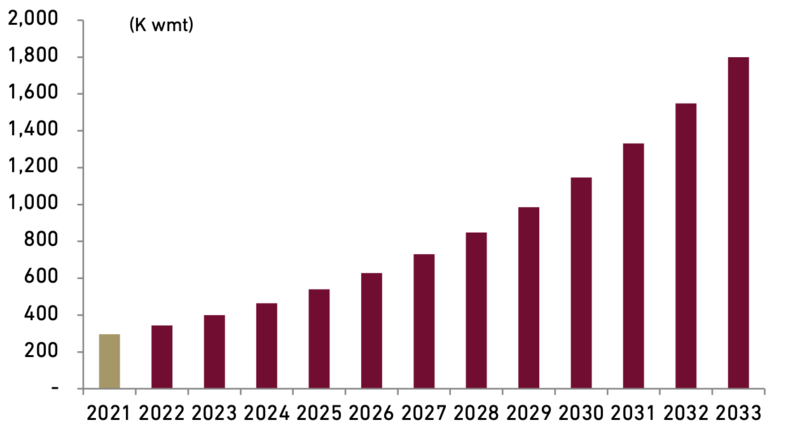

We expect the nickel market to be in the surplus in FY22 and FY23F, primarily due to the industry as a whole has over-invested in capacity (particularly in class-2 nickel capacity) in the last three years, and are likely to enter period of oversupply in the next two years before demand starts to catch up. However, we remain bullish on long term nickel outlook, rising demand sparked by the EV growth and possible LME nickel sanction on Russian metals. With that in mind, we forecasted our FY22-24F nickel benchmark prices at USD22,000, USD20,500 and USD21,000/ton, respectively.

Exhibit 85: Nickel price benchmark

Source: Bloomberg, Ciptadana estimates

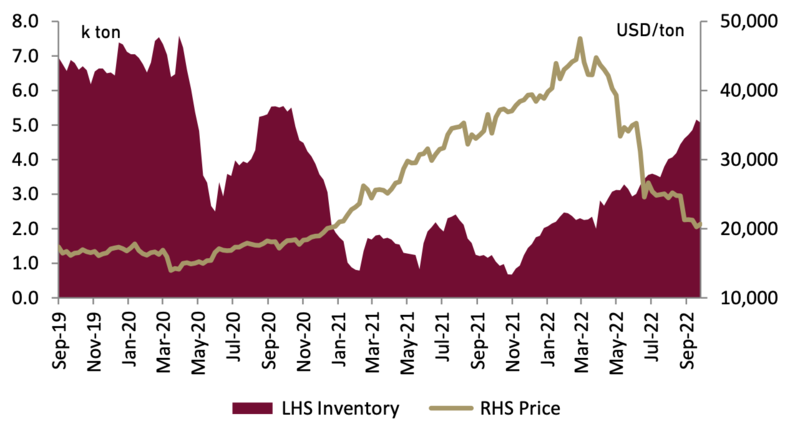

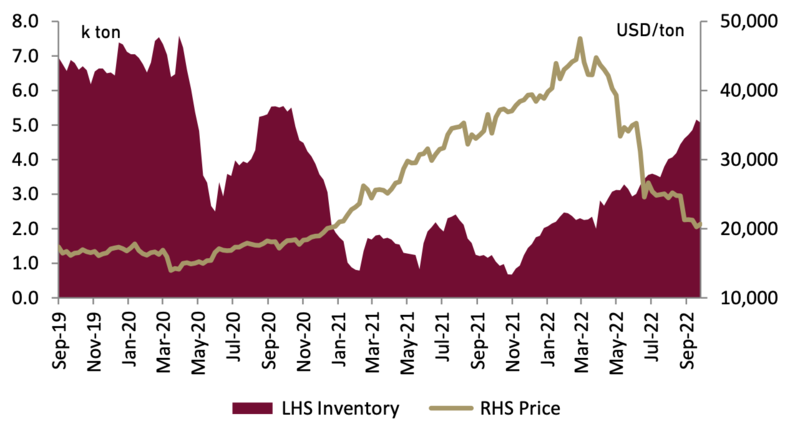

- Gold facing short term headwind

During the month of March gold rallied 10.1% to USD1,978/oz sparked by the Ukraine war, as investors sought high quality liquid hedges amidst increasing geopolitical uncertainty. To date however gold has lost its earlier shine dropping 14.4% from its highest point in March to USD 1,729/oz at the time of writing, as investors shifted their focus to monetary policy and higher bond yields. Though rate hikes may create headwinds for gold in the short run, we still believe geopolitical risks and possible economic stagflation or recession will most likely support the price of gold to stay strong averaging around USD1,800/oz in FY22-FY23F.

Exhibit 86: Gold price

Source: Bloomberg

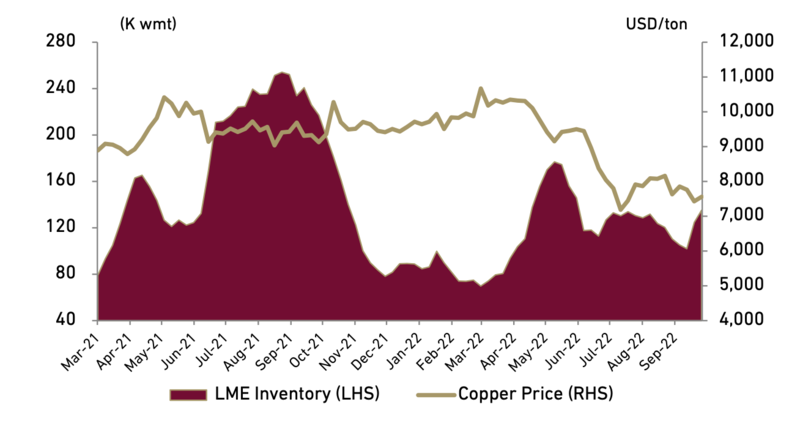

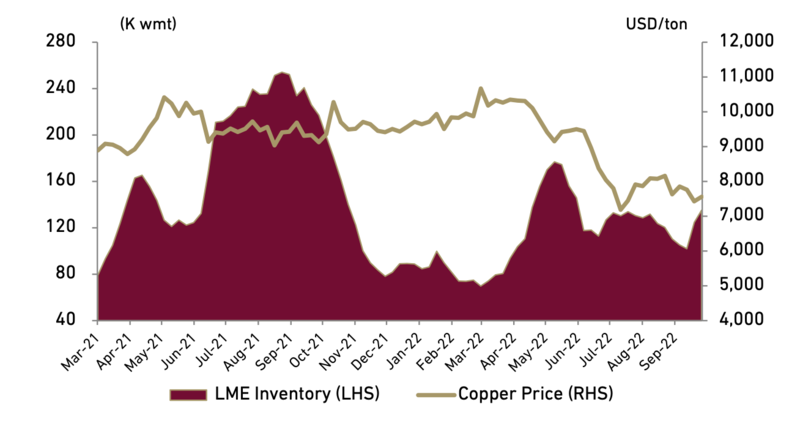

- Weak Chinese copper demand overshadows supply problems

After rallying to a high USD10,353 in April, Copper prices dropped 44% to USD7,190/ton on mid-July, chiefly due to weak demand and tightening global monetary conditions. Overshadowing supply-side challenges such as low inventories and reduced production, with top producer like Chile reporting an 8.6% YoY drop in output to 430,028 tons in July. In the long term however, we still believe that copper is an essential component to drive and supply the current trend for renewable power. Moreover, with the increasing need for more EV cars and EV charging stations to accommodate for increasing EV car usage, the usage of copper cables required to support the rise in EV cars, EV charging stations and renewable infrastructure, should generate a high level of copper demand in the long run. Though there is a possibility of a sanction of Russian metals from the LME in March 2023 further crunching supply, we still expect the copper market deficit to constrict in FY22F and FY23F. As such we forecast FY22-23F copper benchmark prices at USD USD9,500 and USD8,900/ton, respectively.

Exhibit 87: LME copper price and inventory

Source: Bloomberg

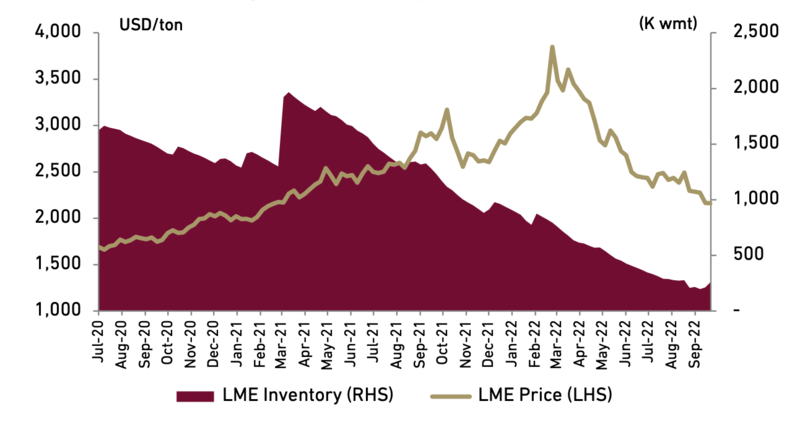

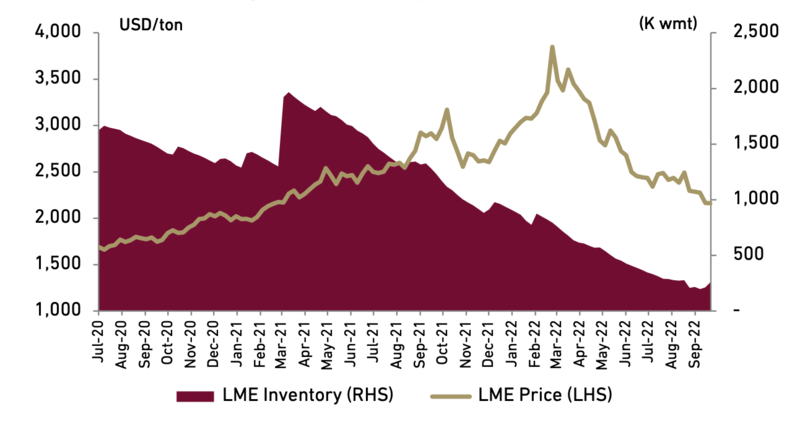

- Aluminium demand growth may slow in the short run

According to Bloomberg, China aluminum demand could shift to a more high-end aluminum product such as aluminum alloy used in autos and lightweight aluminum frames used in constructions, from the demand for low-end products used in products such as cans and foils. As such, demand growth for the metal is predicted to slow down to just 1% to 40.6 mn tons in 2022 from a 5.1% growth in 2021, constricting FY22-23F deficit to 0.08 mn tons and 0.05mn tons, respectively. We maintained our FY22-23F Al prices to USD2,700 and USD2,500/ton, simultaneously we maintained our long-term aluminum price range of USD2,500/ton.

Exhibit 88: LME aluminum price and inventory

Source: Bloomberg

- Tin heading for a surplus in FY23F

After a nearly two yearlong bullish trends in the market, in which tin prices rose to a record high of USD47,450/ton in March fed by the pandemic. However, tin prices decreased by 56.5% to USD20,674/ton in October as buyer exhaustion soon overtook the market leading to a price decrease. Moreover, demand could drop due to limited supply outside of China, as energy shortages and limited manufacturing output plague the EU, putting further pressure to tin prices. On the supply side, incentivized by high tin prices, outbound shipments from Indonesia have reported a 10% increase in 8M22 at 51,200. With that in mind, the combination of improved supply and weakening demand should constrict deficit in 2022 and potentially create a surplus in 2023 for the tin market. As such we forecasted tin price to average USD32,500/ton in FY22F and USD24,000 in FY23F.

Exhibit 89: LME tin price and inventory

Source: Bloomberg

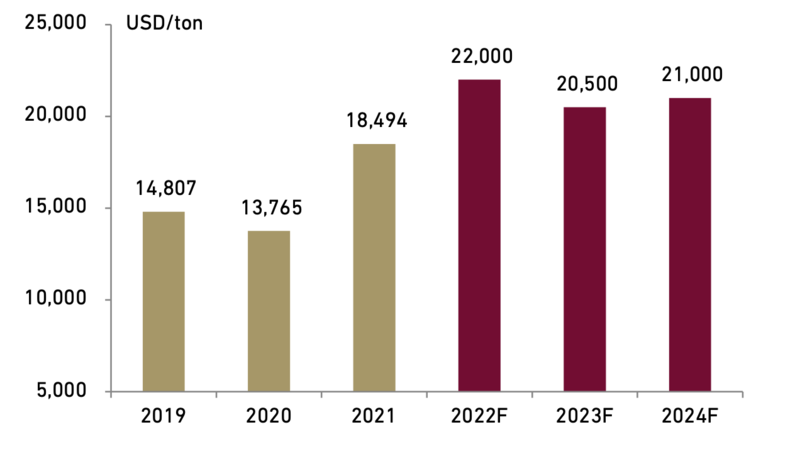

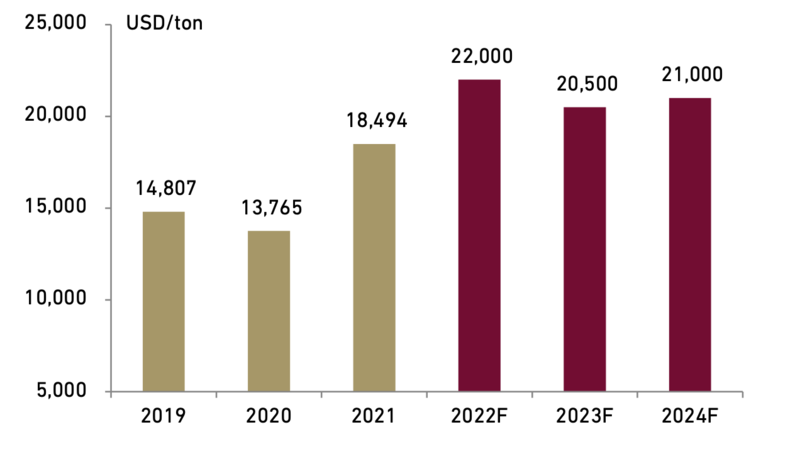

- Maintain Overweight rating for metal sector

We maintain our overweight rating for metal sector on account of bullish long term nickel price outlook, sparked by rising nickel consumption from the EV market. We select MDKA and ANTM as our top pick with a TP of Rp5,800 and Rp2,700, respectively. We continue to like MDKA due to the company’s gold, nickel and copper producing capabilities and its prized projects namely Nickel, Copper, AIM and Pani. We also like ANTM, due to its ongoing partnership with IBC and CATL to develop EV battery and its diversified metal portfolio.

Exhibit 90: Metal stock rating and valuation