Consumer Overweight

Sector Outlook

- Consumer behaviours in an era of soaring inflation.

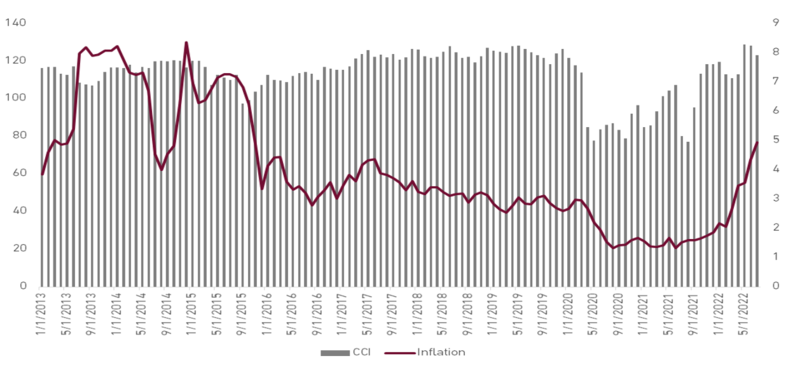

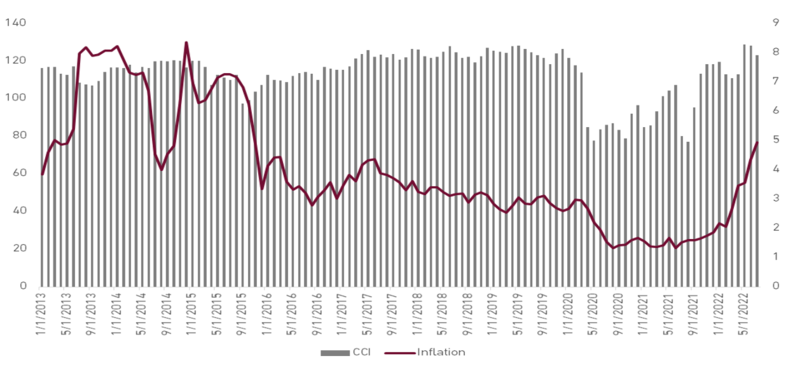

The consumer staples sector has been under pressure in 2022 owing to a surge in global commodity prices. Stepping into 2023F, the staples sector continues to face notable headwinds from the unprecedented inflationary with Bank Indonesia (BI) predicted domestic inflation would print around 6% in FY22F following the fuel price adjustments and slow down to 3.3% in FY23F. In a high inflation environment, unevenly rising prices inevitably reduce purchasing power and affect consumer spending patterns. This is in line with Nielsen recent survey that future consumer spending intentions continue to be reshuffled amid soaring inflation as consumers tend to select lowest price, monitor cost of overall basket, and lean on promotions. However, the silver lining is that consumers would prioritize daily necessities and companies have more flexibility in passing cost increase to customers by raising selling prices, we believe that should benefit consumer staples sector in FY23F.

- Recovery in purchasing power to be more gradual

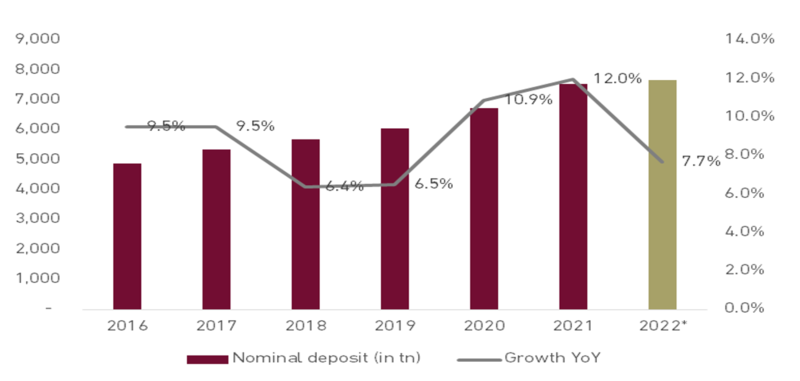

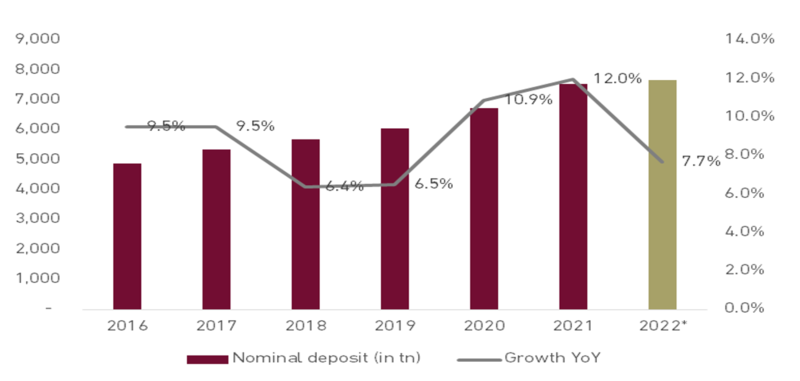

Consumer Confidence Index (CCI) remained in the optimistic territory (>100) during 1H22, mainly supported by the resumption of economic activity. With an expectation of more challenging times ahead, the CCI is projected to weaken until on heightened inflation and it is projected to rebound to initial levels given the assumption that inflation could reach more moderate levels in 2H23. Moreover, consumer also prefer to put its discretionary income in banks rather than spend it amid inflationary period. According to the data Indonesia Deposit Insurance (LPS), nominal deposits of commercial banks have increased by 7.7% YoY as of Aug-22, relatively lower than growth in 2021 and 2022 on the back of eased restriction and revenge spending activities, though the number may grow higher due to potential higher interest rate, resulting slower economic activity.

Exhibit 66: Nominal deposits of commercial banks

Source : YtD as of Aug-22, LPS, Ciptadana

Exhibit 67: Consumer Confidence Index

Source : APBN 2023, Ciptadana

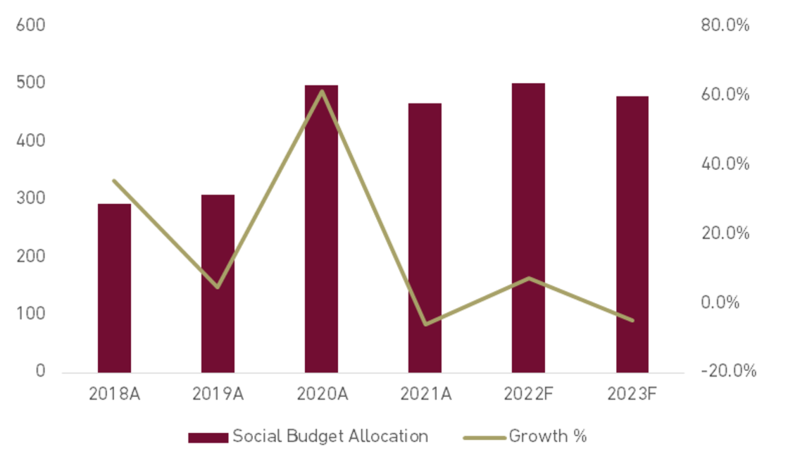

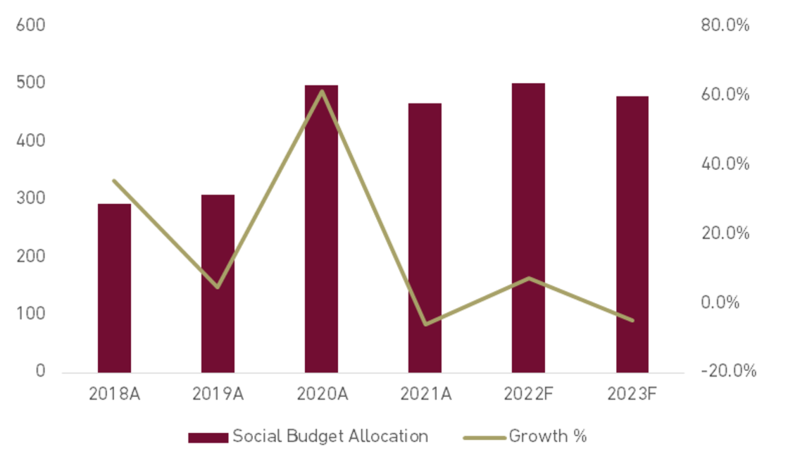

- Social assistance program: Breaking down Indonesia’s 2023 State budget, the Government has allocated of Rp479.1 tn (-4.7% YoY) for social assistance, mainly due to the end of the National Economic Recovery (PEN) Program. Although, the number is lower but it is higher than 2019’s pre pandemic budget by 55%. The social protection program will be back to the regular program which involves i) Family Assistance Programme (PKH) with targeted 10m household recipients, (ii) food assistance program (BPNT) for 18.8m household recipients, (iii) village funds, (iv) cash assistance programme (BLT). In 2022, the Government’s has provided cash assistance for cooking oil (BLT MiGor) amounting Rp300,000 in April for 20.5mn families and 2.5mn street vendors selling fried food (BT-PKLWN). This was followed by fuel cash assistance of Rp600,000/recipients to 20.65mn beneficiary families and wage subsidy assistance for workers who are members of the Employment BPJS with a salary of less than Rp3.5 mn per month. We think the quantum of government’s fiscal support would provide some relief but unlikely to be sufficient to offset the rise in total cost of living, thus purchasing power recovery especially for low income segment is expected to be more gradual.

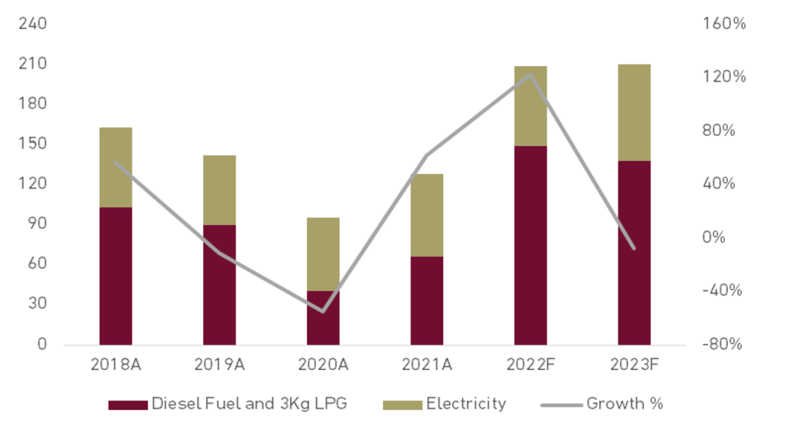

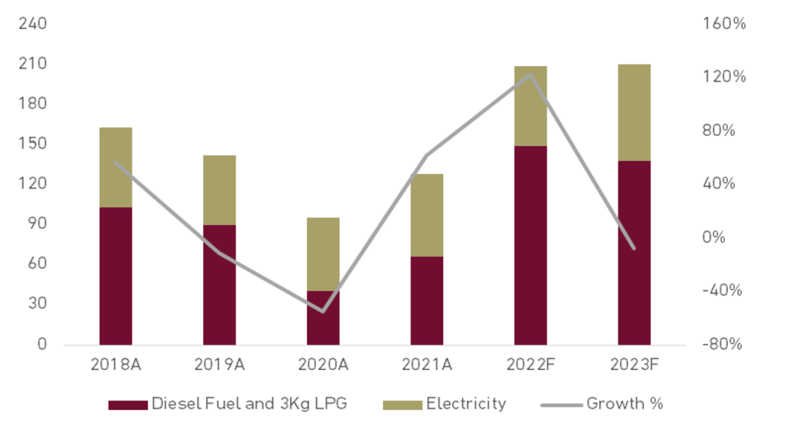

- Energy Subsidy Budget The government has allocated Rp210.7 tn in energy subsidies in 2023, slightly higher than its 2022 energy subsidies outlook of Rp209 tn. This allocation comprises i) Diesel fuel subsidy of Rp1,000/liter in the amount of Rp20.9 tn ii) 3 Kg Liquid petroleum gas (LPG) subsidy with a total volume 8m MT in the amount of Rp117.4 tn, iii) Electricity subsidy of Rp72.3 tn. In 2022, the government has raised fuel prices by about 30% which was triggered by rising global oil price and gas. However, in a relief to customers, electricity tariff with a capacity of 450 VA remain unchanged, while only applied some tariff adjustment for high income household with a power of 3,500 VA or higher.

Exhibit 68: Social Welfare Budget Allocation

Source : APBN 2023, Ciptadana

Exhibit 69: Energy Subsidy Allocation

Source : APBN 2023, Ciptadana

Consumer staples companies performance is inextricably linked to global commodity prices, with regard to raw materials. With an elevated price level of raw materials in 1H22 from CPO, oil, wheat, skimmed milk due to the war between Russia and Ukraine, it put gross margin of consumer staples stood at lower levels. On the positive side, we are witnessing commodity price have been falling since 3Q22, and this softening trend is expected to continue in FY23F. We list out the outlook of each key raw materials as follows:

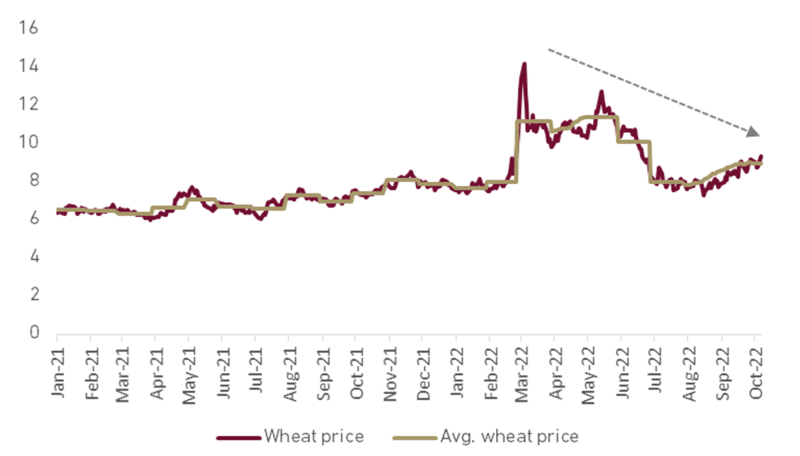

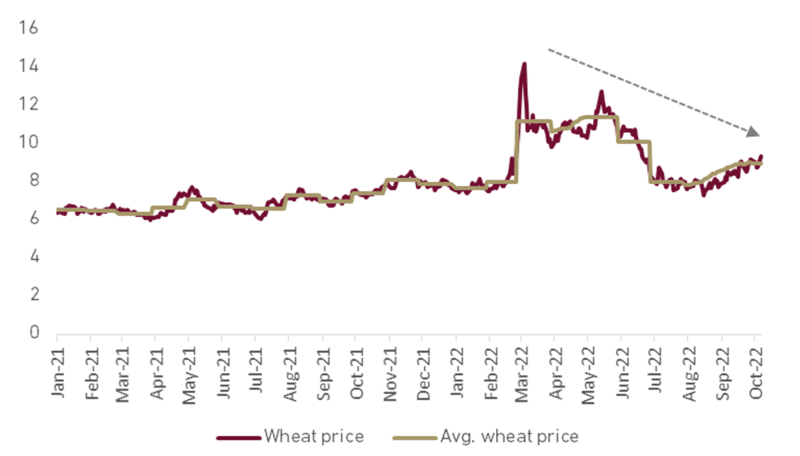

- Wheat: Escalating conflict between top wheat exporters Russia and Ukraine raised concerns over supplies from the Black Sea region, leading wheat prices reached at USD14/bu in 1Q22. But, the resumption of exports from the Black Sea ports in Ukraine as well as better than expected wheat harvest could restrain an increase in wheat prices and now is expected to stand at USD10-USD12bu in FY22F/23F.

- Coffee: the coffee price is expected to decline due to oversupply issue. At the start of 2022, ICE coffee inventories amounted to 1.54mn bags and fell to 0.61mn bags as of Aug-22. The fall in inventories was mainly due to logistical issues and higher demand related to stock. With Brazil coffee harvest is officially underway, thus it will continue to recover inventory. Although, global coffee consumption is expected to reach pre-pandemic levels, the anticipated strength in production is likely to cause some easing in prices in 2023F.

- CPO: Our plantation analyst is maintaining positive stance on CPO sector with CPO price assumption of average MYR5,200 per tonne in FY22F/23F. It represents normalization of CPO price in response to higher palm oil stock due to increase in export from Indonesia, after revoking the ban, followed by favourable weather conditions. We view this should be positive for staples margin.

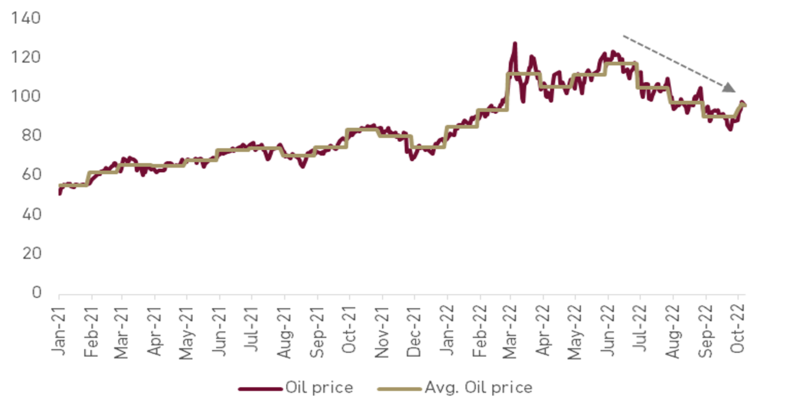

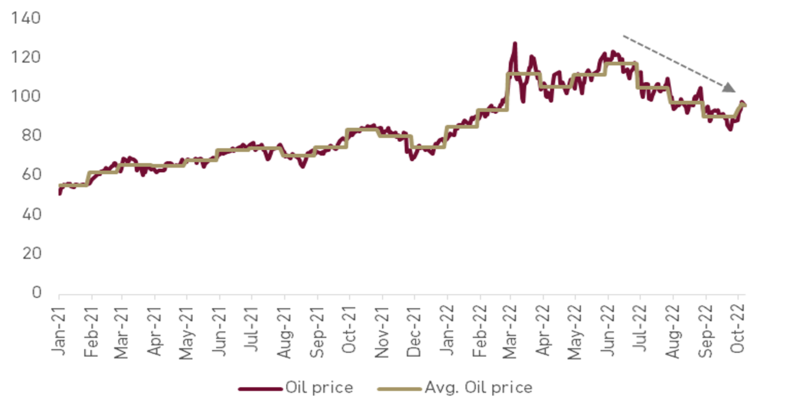

- Oil: Our oil analyst projects FY23F oil price to slightly decline compared to FY22F but remain at higher level on going geopolitical tension and as refineries struggle to meet demand recovering from the pandemic. As such, Brent crude oil price is projected to reach at average USD95/bbl in FY23F (vs. average USD 104/bbl in FY22F). Although, we have seen the correction in oil price in 2H22 after Central Banks tighten monetary policy to tame inflation and increase in global crude supplies.

- Sugar: According to the International Sugar Organization, the total production of sugar is projected to increase to 177.372 mn tonnes, while consumption reaching at 174.604mn tonnes in FY22F/23F. The sugar prices have been falling in response to the good production prospects in Brazil, with lower ethanol prices prompting a greater use of sugarcane to produce sugar. The weakening of the Brazilian real against the USD exerted further downward pressure on world sugar prices while encouraging greater exports. Thus, the favourable production outlook for the FY22F/23F season contributed to lowering prices.

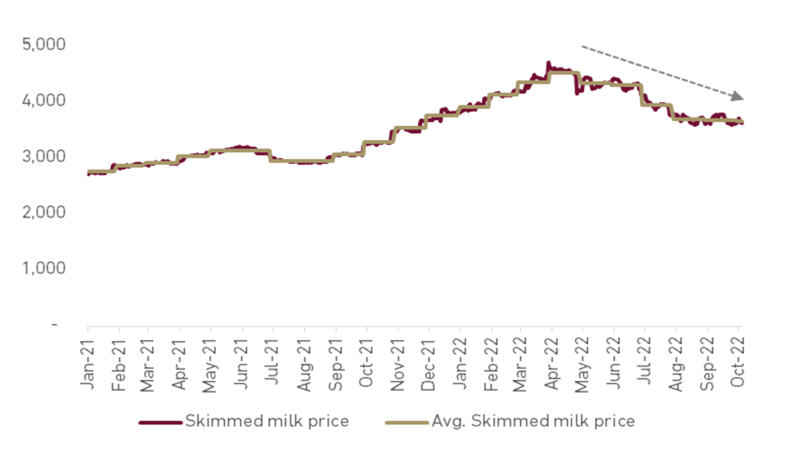

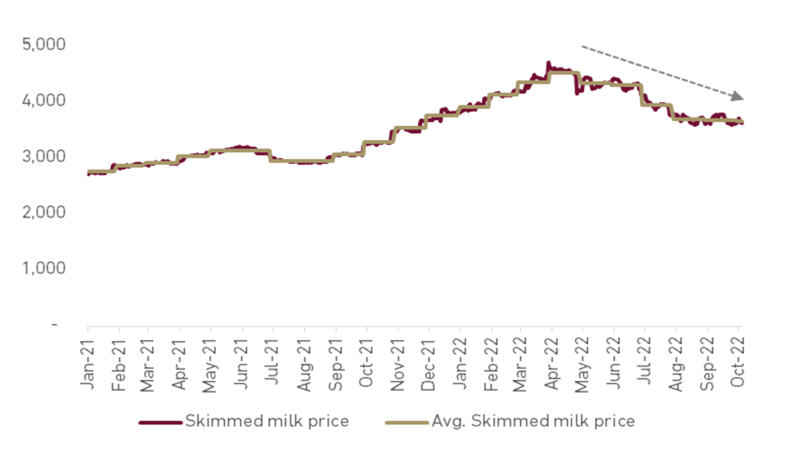

- Dairy: Dairy prices is expected to be more stable in FY23F after experiencing significant decline to average USD3,581/MT from its peak at USD4,709/MT in Mar-22. This was mainly due to limited demand outside and manufacturers are hesitant to extend aggressive offers because uncertainties regarding milk supplies. For now, inventories are sufficient to cover current demand.

Looking back into 1H22, we think most of consumers companies have a better positioning to pass on the cost increases in this year as the price adjustment taken by consumer under our coverage around 8%-15% and more underway in 2H22. With that being said, the improvement in staples gross margin is expected to be reflected in 4Q22 and onwards, after taking into account some inventory lag and price adjustment.

Exhibit 70: Wheat Price Trend (USD/bu)

Source : Bloomberg, Ciptadana

Exhibit 71: CPO Price Trend (MYR/MT)

Source : Bloomberg, Ciptadana

Exhibit 72: Oil Price Trend (USD/bbl)

Source : Bloomberg, Ciptadana

Exhibit 73: Skimmed Milk Price Trend (USD/MT)

Source : Bloomberg, Ciptadana

- Assessing the impact of fuel price hike.

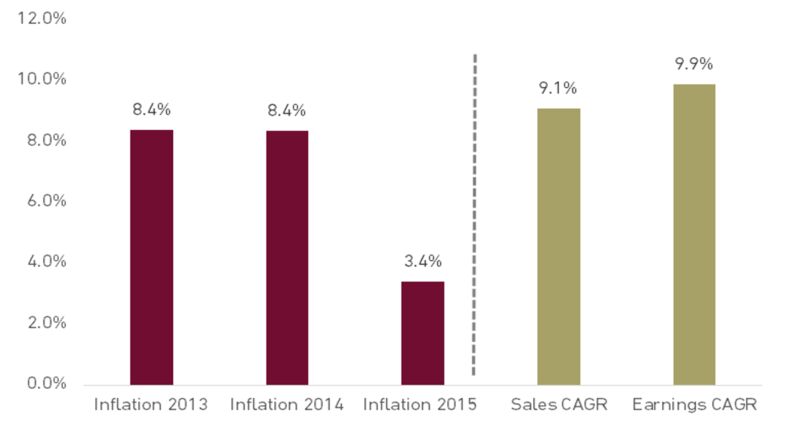

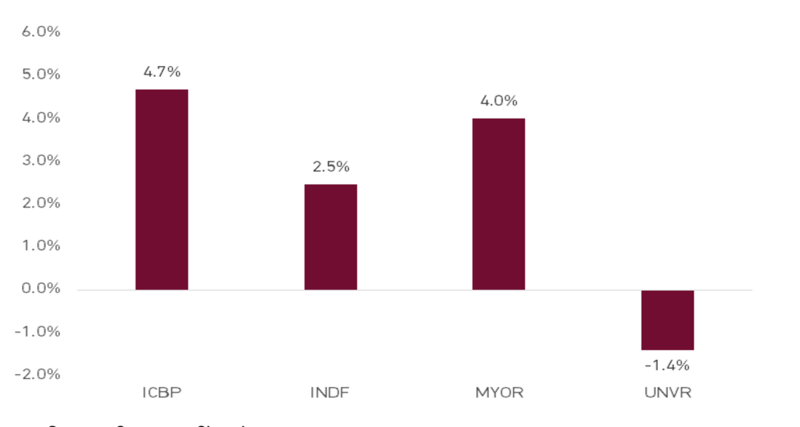

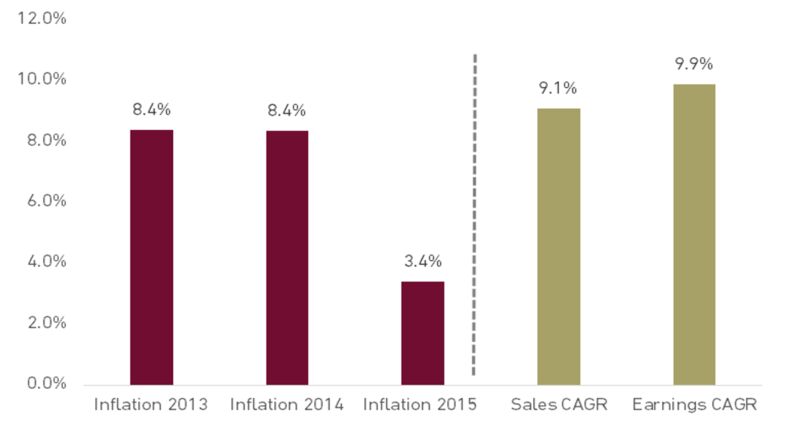

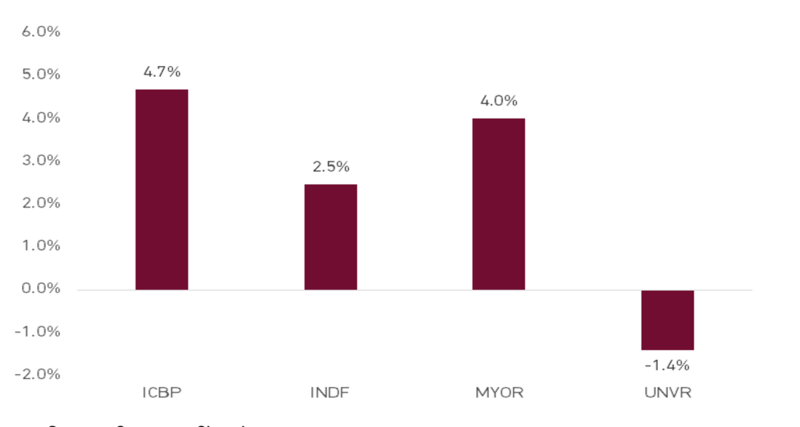

The government decided to raise subsidized fuel prices by 30% amid rising global oil prices and a depreciating rupiah, which has lately become main concern for consumer and consumer staples companies. Given this backdrop, we expect staples companies to experience higher domestic freight costs in 2H22 and ahead in response to a 15% tariff increase for loading and unloading services from Sept-22 along with higher fuel prices. Looking back into 2013-2015 when the government also imposed higher subsidized prices of fuel, we try to highlight several keys: i) The aggregate revenue of our coverage has increased at a CAGR of 9.1% with a 10% net income CAGR ii) relatively higher freight cost which equivalent to around 3-4% of total sales (vs. freight cost/total sales ratio at 2-3% in 1H22), iii) Operating margin on blended basis still expanded for ICBP, INDF, and MYOR, except UNVR. Going forward, judging by the projected higher inflation figure in the next year, we see consumer staples earnings hold up as long as core raw material remains stable, while bigger companies made use of better economies of scale, enabling efficiency, and strong pricing power. As such, we are now looking at 9-10% sales growth and 1%/14% earnings growth for our coverage in FY22F/23F.

- Excise risk on packaged sweetened beverages.

The plan of imposing an excise duty on packaged sweetened beverage was mentioned again in the 2023 state budget draft, though the implementation has been delayed for the past few years. Apart from being another source of government revenue, taxation on sweetened beverage is an effective intervention to reduce sugar consumption, thus preventing obesity and diabetes. Meanwhile, the revenue collections from the newly excise tax object is projected to reach around Rp1.5 tn p.a. based on Perpres 104/2021, or less than 5% of total excise tax in FY23F. We think excise on sweetened beverages may hurt the consumer staples companies under our coverage such as ICBP and MYOR as they need to increase its ASP by 5%-25% to compensate cost increase. In a view of the tight beverages competition, we think the company will pass on excise tax tariff either partially or gradually over period of time.

Exhibit 74: Inflation vs. Sales and Earnings CAGR

Source : Company, Ciptadana

Exhibit 75: OPM Expansion 2013-2015

Source : Company, Ciptadana

- Overweight rating on the sector with ICBP and MYOR as our top picks

With current condition, we think things may reverse to favour more consumer staples led by optimism on better earnings visibility in 2H22 and 2023F. However, we see some headwinds are still in place. First, lower social assistance budget in FY23F due to the end of National Economic Recovery (PEN) program and more allocations for infrastructures. Second, higher cost of living due to greater inflationary pressures. Third, rising domestic freight cost due to higher fuel price. Fourth, implementation taxes on sugary drinks. Nevertheless, most companies have taken price adjustment to counteract the higher cost, and we expect this effort is continue although with a milder hike in FY23F. Therefore, we think the winners in this challenging situation would be those with 1) strong pricing power to pass on cost inflation 2) Limited concentration to domestic market and having dominant export presence, 3) market share gains with less exposure from higher commodity price. We maintain our recommendation to be selective picking in staples. Our top picks in the sector are:

- ICBP is currently trading at 2023F PER 14x, at -1 std. dev of 5-year mean. We like the company as the firm have capability to raise ASP aggressively whilst still posted solid volume growth given its market leader in instant noodles. Thus, we believe it should provide strong earnings outlook going forward once input cost back to normalize.

- We prefer MYOR as our top pick due to strong presence in all its business segment with market share gain amid tightening competition. Meanwhile, its export revenue contribution will allow the company to have superior growth amid an expectation of weak purchasing power in the domestic market and more complete hedge in terms of forex risk. Currently, MYOR is traded at 2023F PER of 26.5x.

Exhibit 76: Consumer Stock rating and valuation