Metal Mining Overweight

Sector Outlook

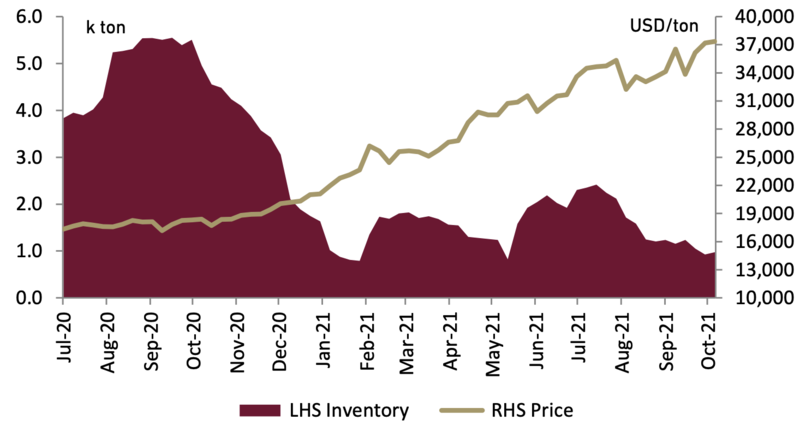

- Solid demand and persisting supply issues keeps nickel prices high

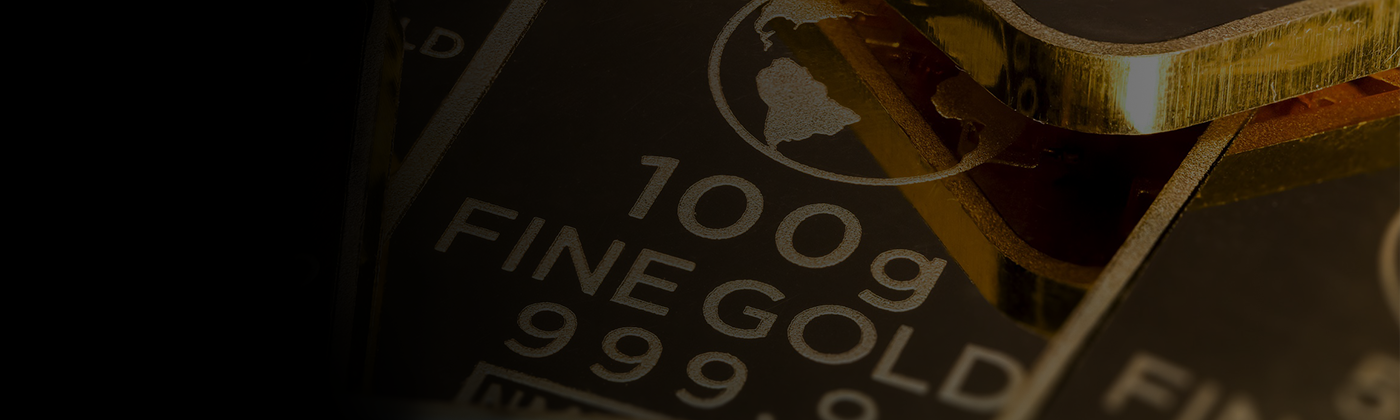

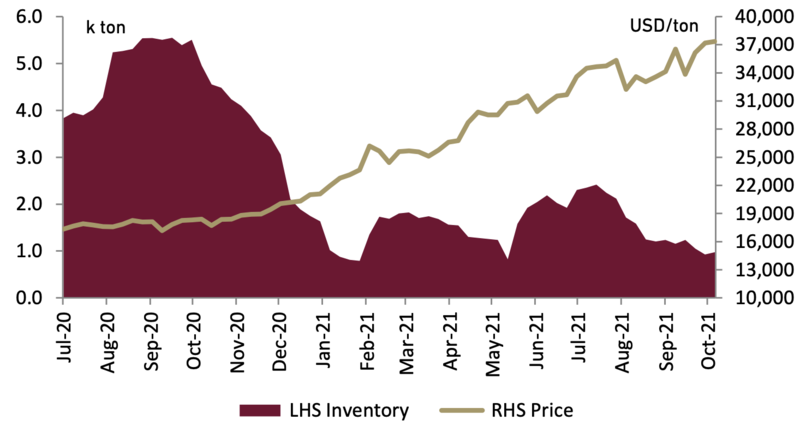

Despite bearing the brunt of China’s energy crisis caused by inflating coal and oil prices, nickel prices have surprisingly remained resilient increasing by 19% Ytd to USD19,739/ton and LME nickel inventory continued declining by 42% to 142 k wmt. This is chiefly due to persisting supply troubles still plaquing the industry and solid demand from China’s nickel based stainless steel production and the long-term demand growth of the EV industry.

Exhibit 88: LME Nickel price and inventory

Source: Bloomberg

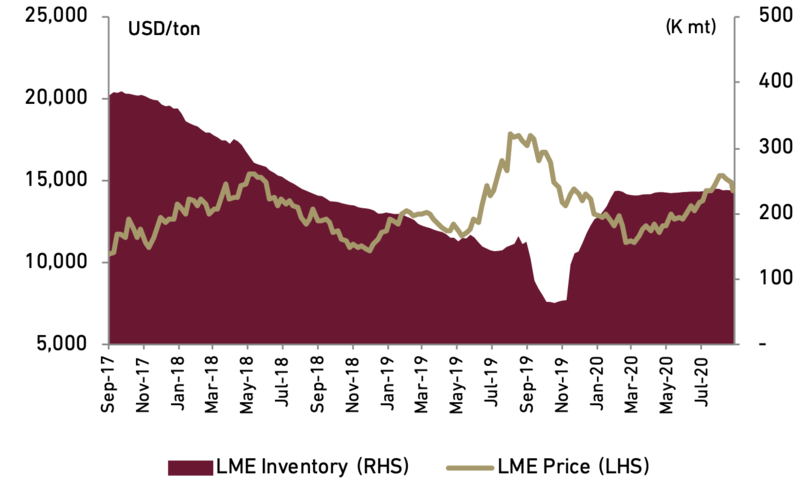

- China’s stainless-steel production staying resilient despite energy crisis

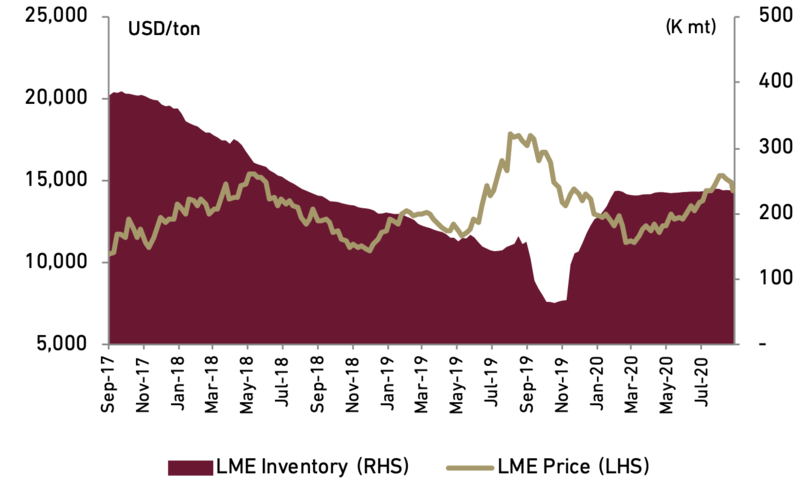

China’s gluttony for nickel is still evident with its recent nickel based stainless-steel production. The production rose by 18.8% from its lowest point in February at 1.9 mn tons to 2.3mn tons in July forming 63% of our forecast, in line with our expectation as we assume that nickel based stainless steel production output to slow down during the 3Q21 and part of 4Q21 due to the energy crisis causing forced blackouts in some of its production facility. With that in mind we maintained, our Chinese stainless-steel production FY21-22F at 25.0 mn and 25.5 mn tons.

Exhibit 89: China monthly nickel based stainless steel production

Source: Bloomberg

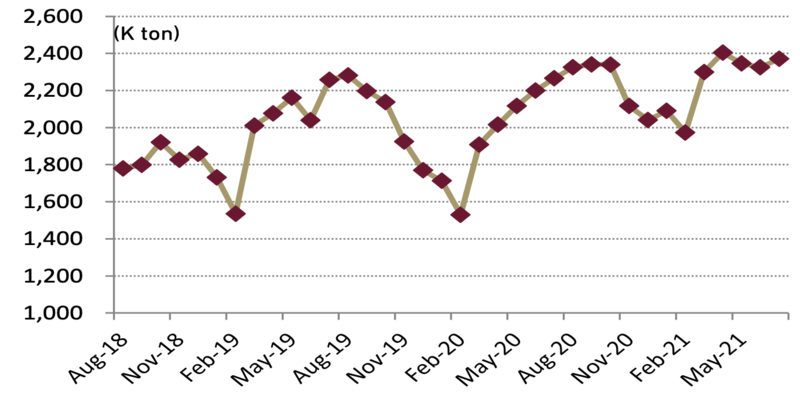

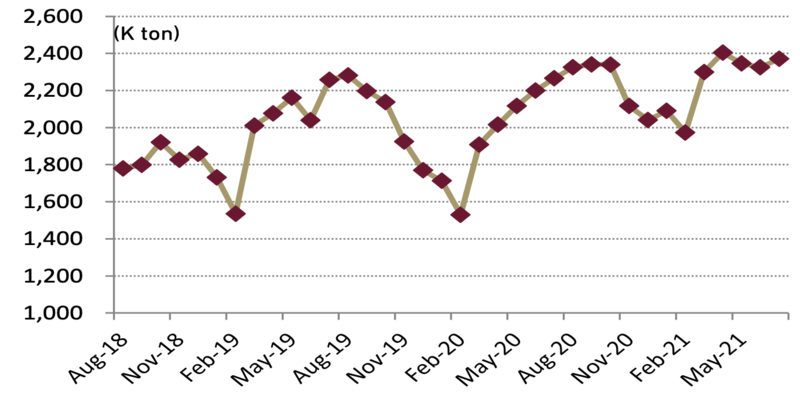

- EV still the main driver for growth for nickel

In our view, we still believe that battery usage in electric vehicle (EV) will still be the main driver of growth for nickel consumption in the future. We estimated that nickel demand from EV batteries will grow at 77.8% CAGR from 2020-2030, driving up nickel consumption in the EV batteries by around 36% annually to around1.8mn tonnes by 2030 as more and more cars are becoming hybridized and or are already electric based vehicle.

Exhibit 90: Nickel consumption for EV

Source: Bloomberg, Ciptadana estimates

- China NPI producers still finding difficulty in sourcing nickel ores

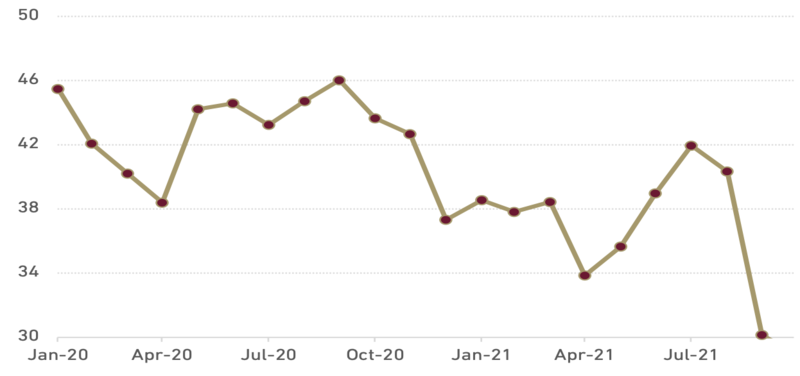

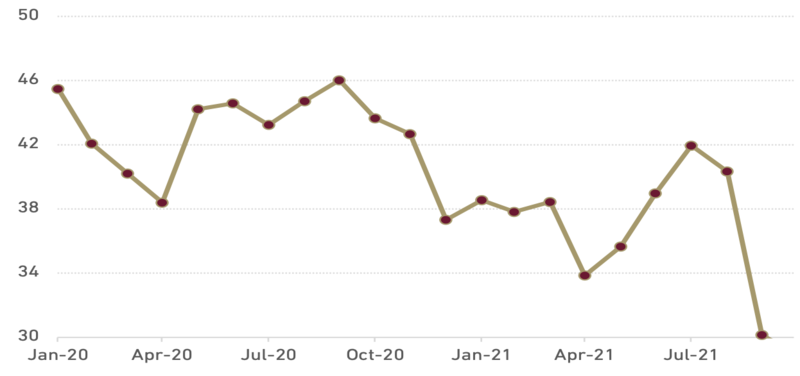

China’s Nickel Pig Iron (NPI) output has declined significantly 24.7% Ytd recording a paltry 29.0k ton at the time of writing. This highlights the impact of the Indonesian ore export ban, Russia’s temporary nickel export tax levy and Philippine’s mine closures, resulting in China’s pig iron production to remain low for the remainder of the year.

Exhibit 91: China monthly nickel based stainless steel production

Source: Bloomberg

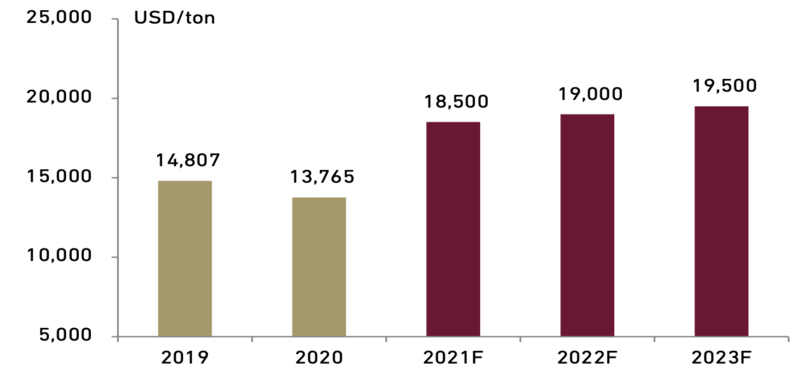

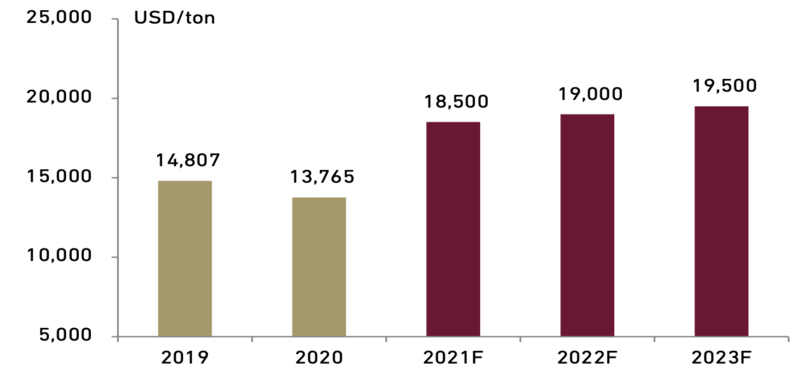

Based on the aforementioned reasons, we expect the nickel market to be in the deficit of 56.1k tons in FY21F before widening further to 67.3k tons in FY22F. We remain bullish on long term nickel outlook, driven by solid Chinese nickel consumption and rising demand sparked by the EV growth. With that in mind, we maintained our FY21-23F nickel benchmark prices at USD18,500, USD19,000 and USD19,500/ton, respectively.

Exhibit 92: Nickel price benchmark

Source: Bloomberg

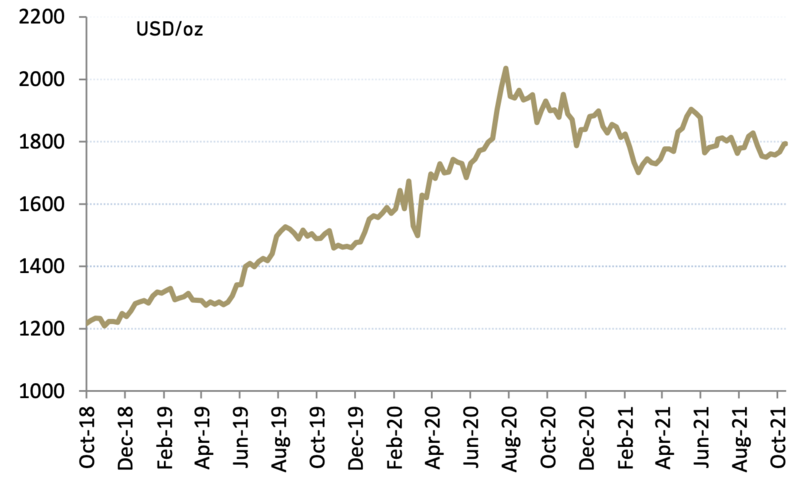

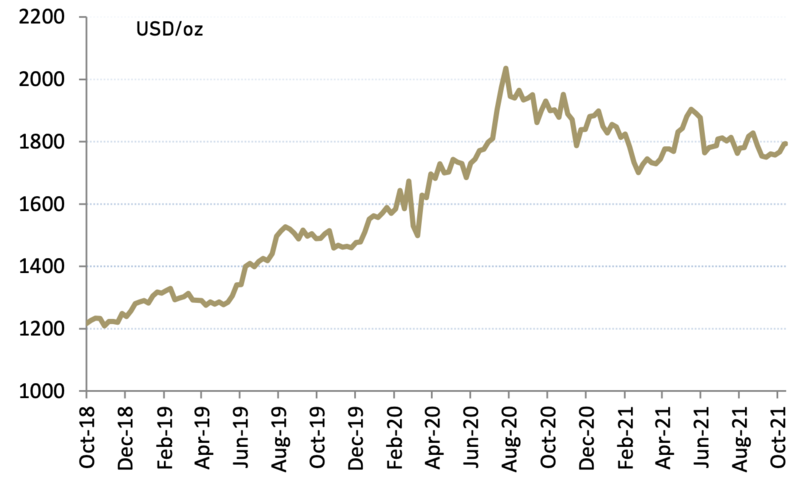

- A more stable gold price on a better-than-expected economic recovery outlook

Despite a more positive economic outlook driven by vaccine and a rapidly recovering economy post pandemic, gold price has surprisingly remained stable averaging USD1,800/oz Ytd. In our view however, increasing retail gold demand buoyed by positive economic recovery, low interest rate and threat of an increasing covid-19 infection rate, will continue to support the price of gold to stay strong averaging around USD1,800/oz in FY21-FY22F.

Exhibit 93: Gold price

Source: Bloomberg

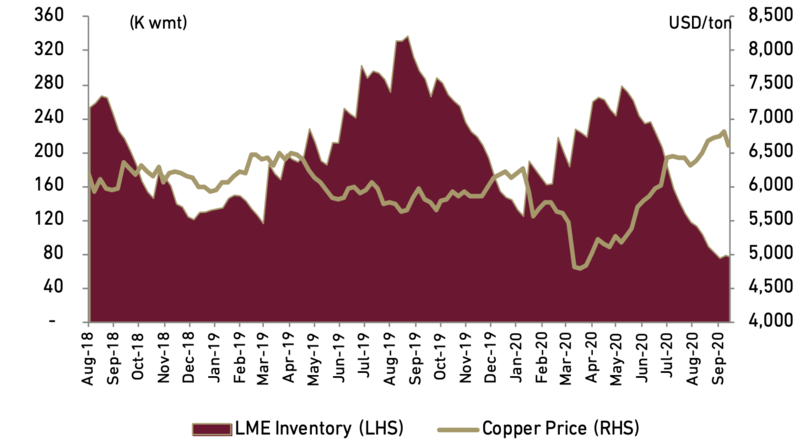

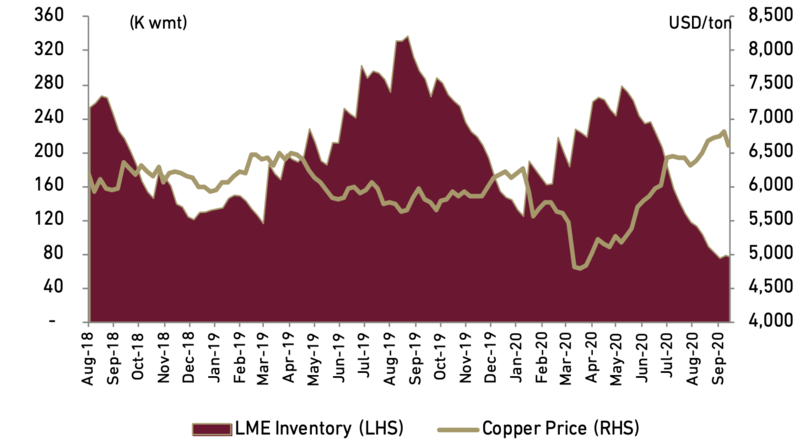

- Healthy demand for copper lift copper price up

With China’s recent energy crisis slowing copper consumption and the London Metal Exchange (LME) taking steps to limit trading of the metal, LME inventory stands at 162k wmt, up 49.7% Ytd from 108k wmt. However copper prices remained resilient rising 25.2% Ytd to USD9,704/ton. Driven by concerted efforts by China’s and various world governments Zero carbon initiatives and the global EV boom. Copper is essential in order to drive and supply the countries need for renewable power generation, EV charging stations to accommodate for increasing EV car usage and copper cables required to support the infrastructure, generating a high level of copper demand in the long run. As such, we expect the copper market deficit to widen in FY21-22F, maintaining our FY21-23F copper benchmark prices at USD9,300, USD9,500 and USD9,800/ton, respectively.

Exhibit 94: LME copper price and inventory

Source: Bloomberg

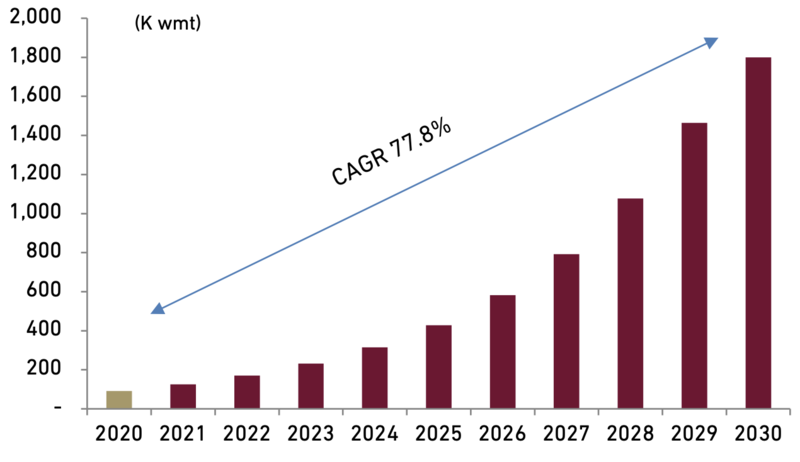

- Rising Chinese demand stoking tin prices

Tin prices have soared by 83.8% so far to USD37,350/ton, driven by 1) increasing demand for computers and other electronic devices 2) increasing demand for EV and 3) China stockpiling the metal to meet its goal of self-sufficiency in semiconductors. On the supply side, Myanmar’s thinning tin ore production levels and Indonesia’s declining refined tin production level also contributed to the rise in tin price. Moreover, Tin international remarked that supply will again lag behind demand by 8,000 tons in 2021, resulting in a third consecutive year of deficits. As a result, we maintain our FY21-23F tin benchmark at USD30,000 USD28,000 and USD28,500/ton, respectively.

Exhibit 95: LME tin price and inventory

Source: Bloomberg

- Maintain Overweight rating for metal sector

We maintain our overweight rating for metal sector on account of positive gold, copper, tin price outlook and bullish long term nickel price outlook. We select MDKA our top pick with TP of Rp4,100, we like MDKA mainly due to the company’s gold and copper producing capabilities and its prized projects namely Copper, AIM and Pani.

Exhibit 92: Metal stock rating and valuation