Strategy Overweight

2021 in review

- 2021 has been one of the most volatile years for equity investors

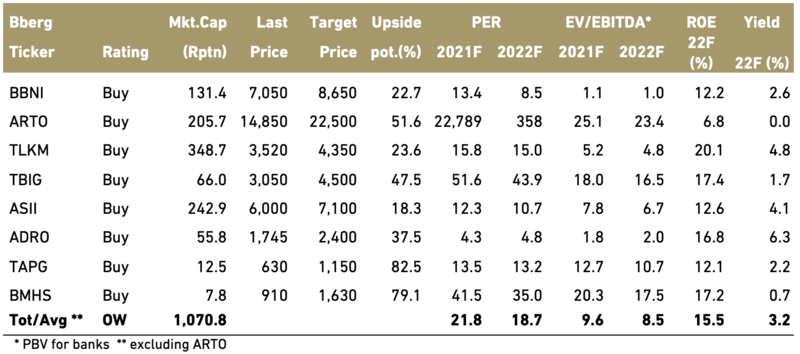

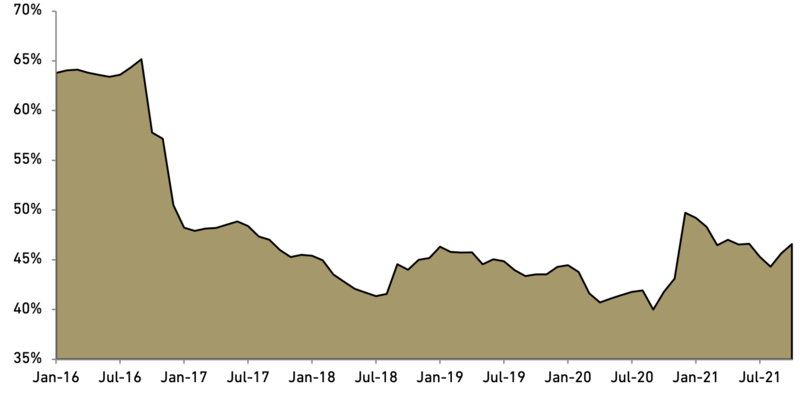

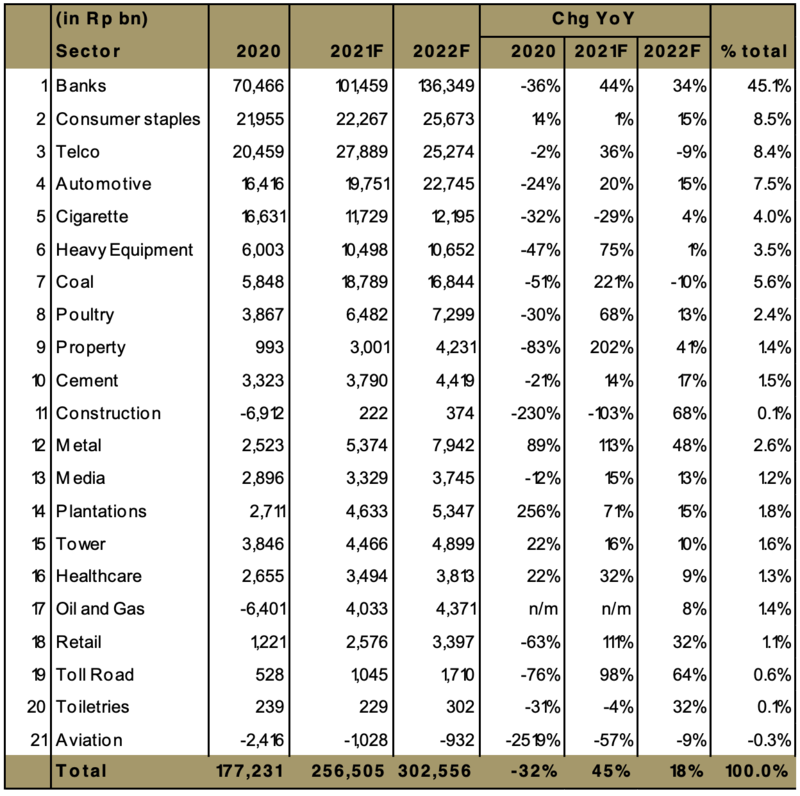

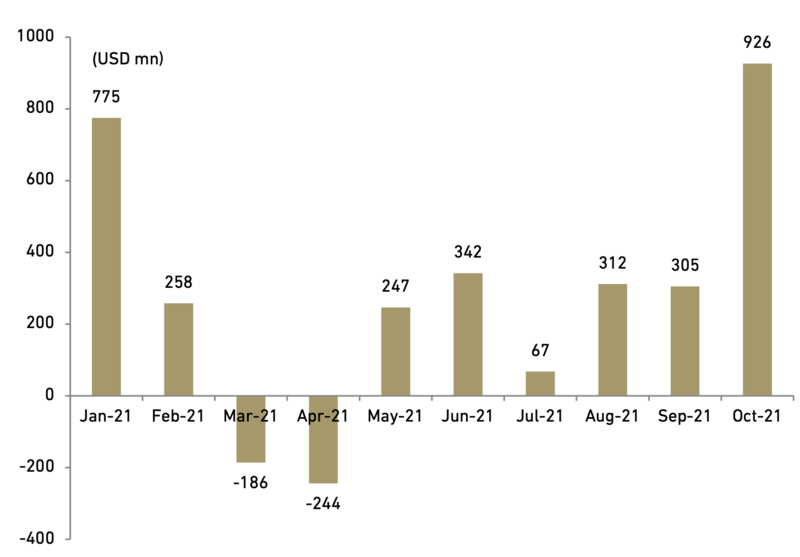

The JCI index, having lagged peers in 2020 with a 5.1% decline, played catch-up rising by 8.8% to highest monthly level of 6,505 on 21-Jan-21. However, after that, the JCI went from hero to zero, losing significantly due among others to negative local sentiment from among others soaring Covid-19 topping 1 mn cases and margin call, led the JCI to end January on a gloomy note down by 2% to 5,862. In February, the JCI strongly recovered by 6.5% to 6,242. A rise in US bond yields and the uptrend in dollar index (DXY) coupled with local negatives such as continued lower in bank loan growth, car sales, and cement volume led to the JCI dropping by 4.1% to 5,986 in March. After that JCI had moved sideways while volatility persists for nearly four months in the range of 5,900-6,100 affected by more negative Covid-19 situation and despite better-than-expected 2Q21 GDP growth.

The JCI was able to break the shackles and move above the 6,200 mark in the first week of August. In September, global markets appear to have largely priced in the tapering program as US dollar and bond yield have been relatively soft but it was followed by Evergrande’s financial difficulties in China. Despite of these mixed global factors, the JCI defied the odds of a sorry September, gaining by 2.2% in September to 6,287. JCI maintained its strong performance in October on persistent foreign inflow and stronger-than-anticipated commodity prices with coal and CPO hitting all time high. These brought JCI to highest intraday level of 6,687 in 21-Oct-21 (nearly all-time high level of 6,689 on 19-Feb-18) before closing at 6,591 (+4.8% MoM, +10.2% YTD) on 29-Oct-21.

Exhibit 18: JCI performance in 10M21

Source: Bloomberg

- 2021 has been one of the most volatile years for equity investors

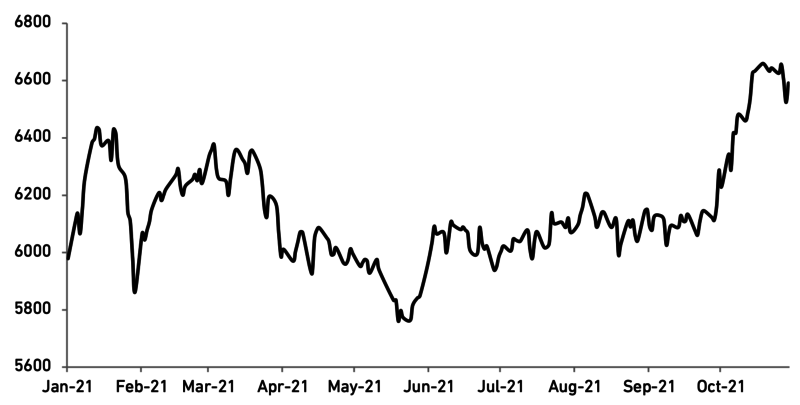

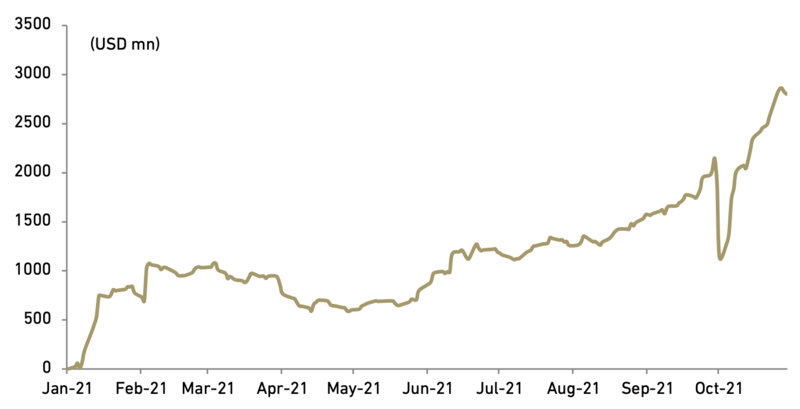

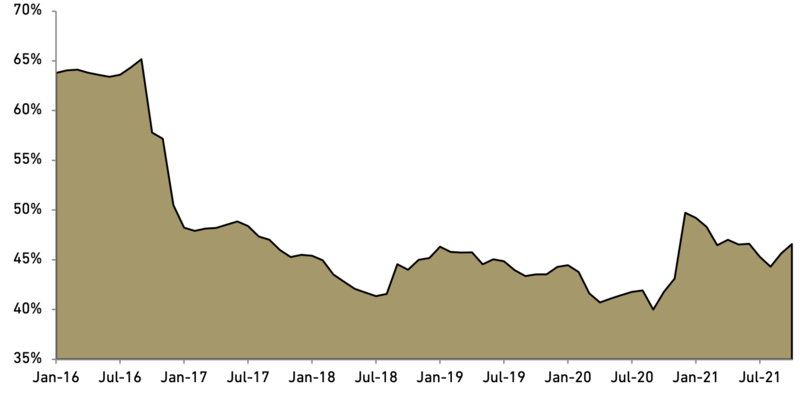

Indonesia stocks have continued to appeal to foreign investors as evident persistent foreign inflow in 2021. Foreigners had been net buyers of Indonesian stock every month except in Mar-21 and Apr-21, with the total YTD inflow amounting to USD2.8 bn as at end of Oct-21. At the end of 2020, foreigners were net sellers of USD3.2 bn Indonesian stock. The value of foreign holdings reached USD152 bn as of the end of Oct-21, accounting for 46.6 % total market capitalization (free-float shares).

Exhibit 19: Monthly net foreign buy

Source: Bloomberg

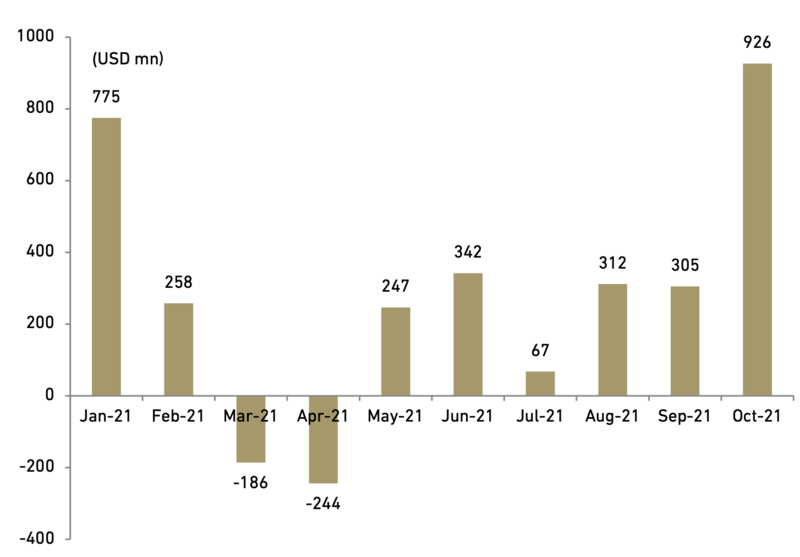

Among the Southeast Asian markets, only Indonesia that recorded year-to-date net inflow with an net inflow of USD2,802 mn as compared to Malaysia (USD520 mn net outflow), Thailand (USD2,010 mn net outflow), and Philippines (USD1,680 mn net outflow). Moreover, the net inflow of foreign equity portfolio investment can arguably be traced by the recent strengthening of Rupiah vis-à-vis US Dollar of 1.5% during August-October to 14,229/USD despite Fed’s tapering plan.

Exhibit 20: Accumulated net foreign inflow

Source: Bloomberg

Exhibit 21: Foreign ownership of Indonesian stocks

Source: KSEI

Foreign fund flows into Indonesia stock markets are expected to continue through next year, supported by global and local positive such as higher vaccination rates and demand revival that would help extend the recent period of strong GDP growth through next year. Meanwhile, the market’s trajectory so far this year bodes well for performance between now and the new year.

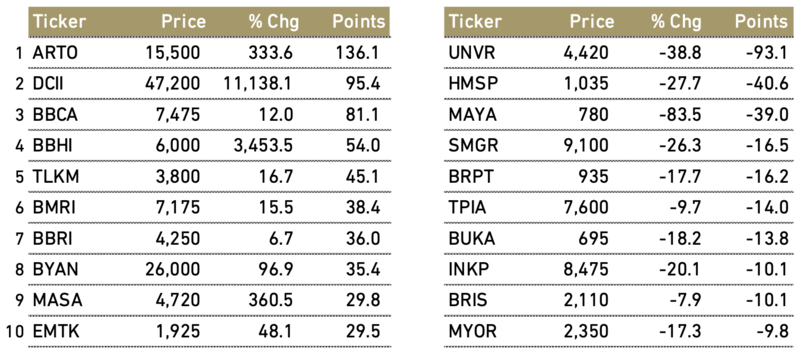

- The top laggards & leaders stocks

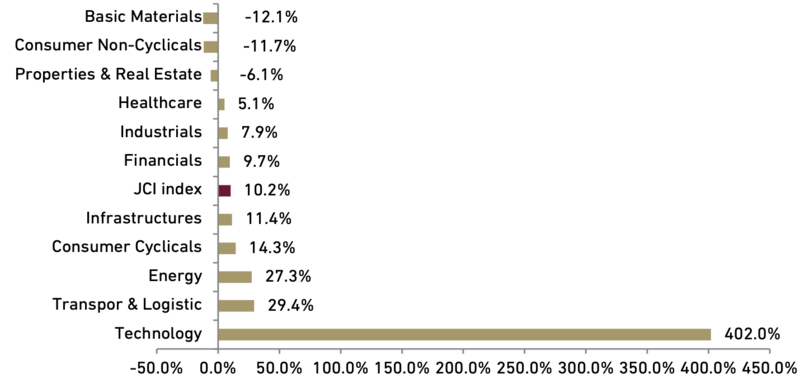

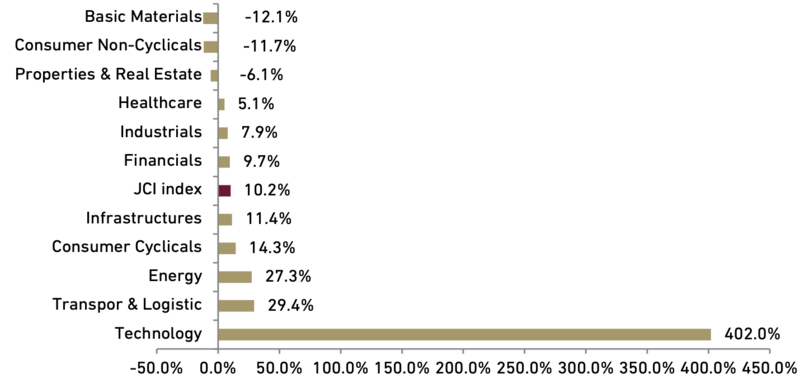

The JCI index was among Southeast Asian’s best performing market in 10M21 , gaining 10.2%, which is lower than Singapore’s STI of 13.2% and Thailand’s SET of 11.4%, but higher than Malaysia’s KLCI of -5.9% and Philippine’s PSE of -1.2%. On the sectoral front, technology sector had been the best performing sector in Indonesia stock market with 402% return. This could be due to their asset-light business model and high operating leverage, in our view. The other sectors that performed better than the JCI were Transportation & Logistic (+29.4%), Energy (+27.3%), Consumer Cyclical (+14.3%), and Infrastructures (+11.4%). The sectors that underperformed the JCI re were Financials (+9.7%), Industrials (+7.9%), Healthcare (5.1%), Property & Real Estate (-6.1%), Consumer non-cyclical (-11.7%) and Basic materials (-12.1%).

Exhibit 22: Sectoral indexes performance

Source: Bloomberg

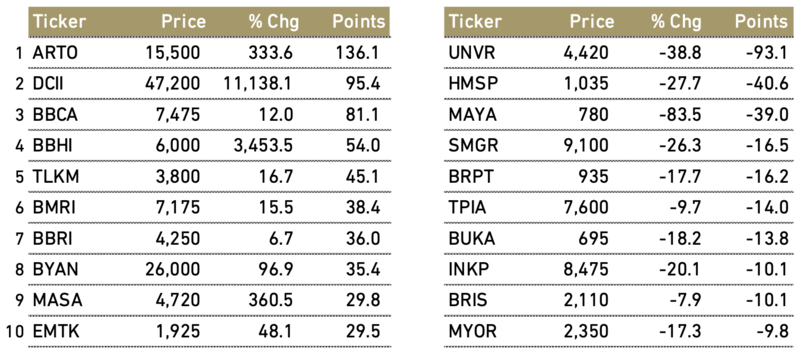

Among JCI constituents that have contributed the most to the rally (top leaders) were: ARTO, which rallied by 334% and contributed 136 points, followed by DCII (+11,138%, 95 points), BBCA (+12%, 15 points), BBHI (+3,453%, 54 points), TLKM (+17%, 45 points) and BMRI (+15%, +38 points) . The major laggards in the same period were UNVR (-39%, -93 points), HMSP (-28%, -41 points), MAYA (-84%, -39 points), SMGR (-26%,-16 points), BRPT (-18%, -16 points), and TPIA (-10%, -14 points).

Exhibit 23: Top leaders and top laggards in JCI in 10M21

Source: Bloomberg

2022 : Recovery to gain traction

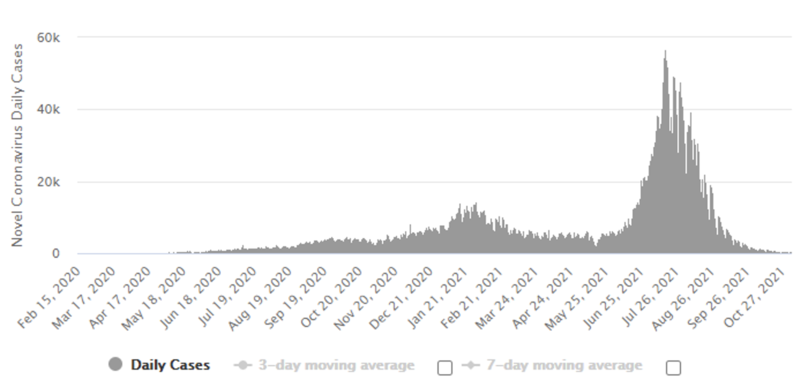

- Encouraging Covid-related situations

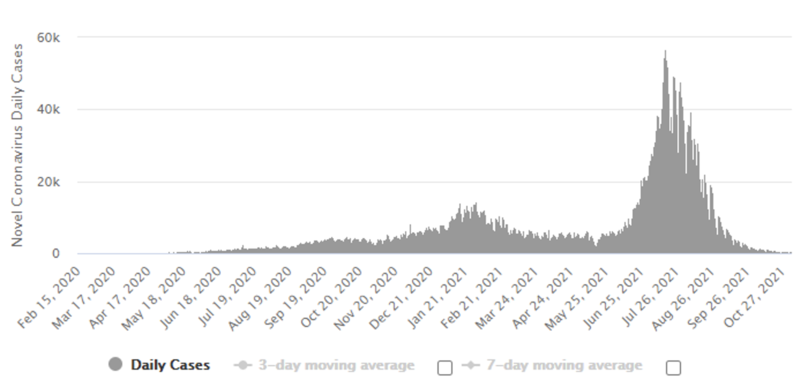

Indonesia has passed the peak of the coronavirus outbreak since July 2021. Indonesia’s new daily cases , which reached a peak of 56,757 new cases on 15-July-21, continued trending down to 620 cases as at end of 30-Oct-21. More than 119 mn people (44% of total population) have received their first doses of vaccines, while over 73 mn have taken the second doses. Indonesia has so far administered over 194 mn doses, including the third booster jabs. The Indonesian government is ramping up mass vaccination targeting at least 70% of the population partially vaccinated before the end of the year.

Exhibit 24: Indonesia new daily cases Covid-19

Source: Worldometer

The high vaccination rate has led to a decrease in Covid-19 cases and the government has reopened the economy gradually and eased movement restrictions throughout the country. The central government has officially lowered the status of the public activity restriction (PPKM) imposed on Jakarta from Level 2 to Level 1 and also in several cities in Java and Bali islands, whose economy accounts for about 60% of the nation.

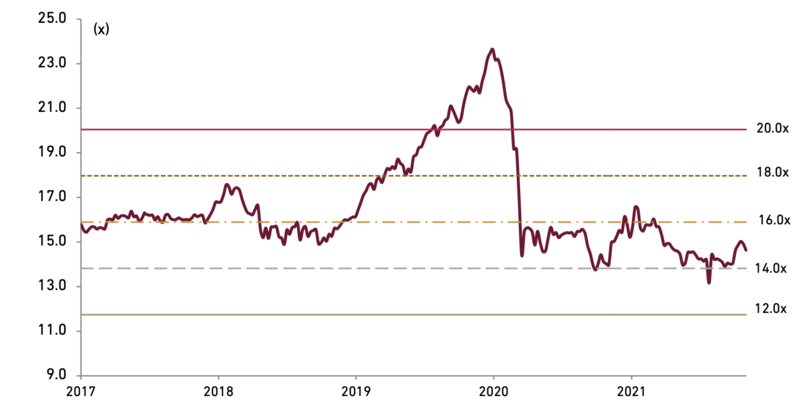

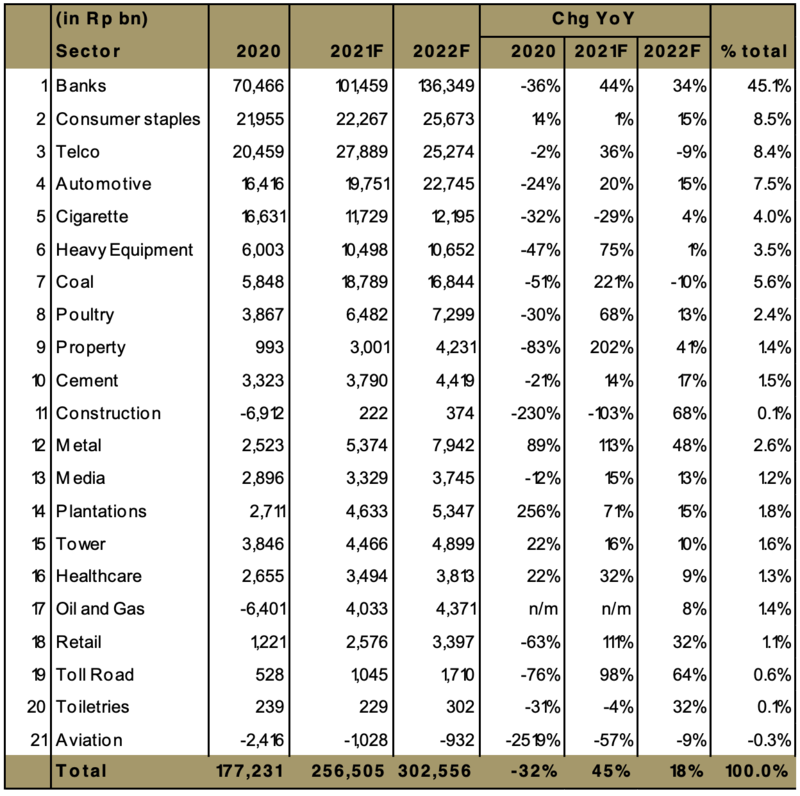

- Corporate earnings expected to grow by 18% 2022F

The combination of low base and gradual demand revival as economic activity improved would bring corporate earnings to grow by 44.8% in 2021F vs. -31.7% in 2020. Corporate earnings growth in 2021F were led by banks, telcos, auto, and commodities which together accounted for 72% of total earnings. This is based on earnings forecasts for the JCI constituents under our coverage (67% total market cap) with aggregate earnings of Rp256 tn for 2021F.

We expect earnings growth momentum to continue in 2022 when more sectors of the economy reopen. We see aggregate earnings growing by 18.2% to Rp302 tn , which will be above pre-Covid level of Rp259 tn in 2019. The market consensus is now forecasting the JCI to chalk 41.6% yoy earnings growth in 2021 and is forecast to register 18.6%yoy earnings growth in 2022. Among heavyweight sectors, Bank will still lead growth with highest earnings growth of 34%. Most sectors, including consumer staples, cigarettes, construction, which were hit in 2021, are also expected to see recovery from their low base this year. Our aggregate earnings forecast implies 2021-22F market EPS forecasts of 386 and 456.

Exhibit 25: Sectoral earnings

Source: Listed companies and Ciptadana estimates

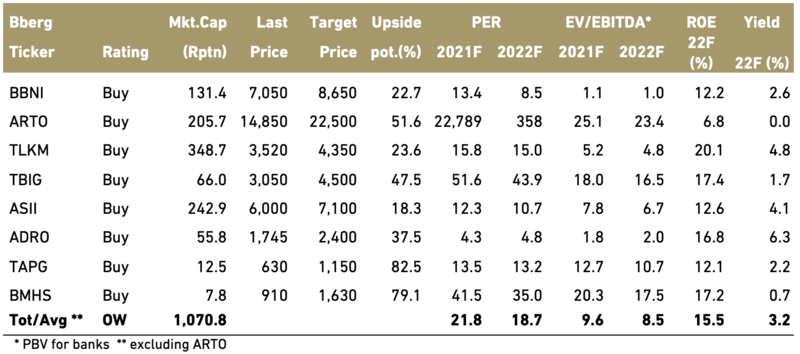

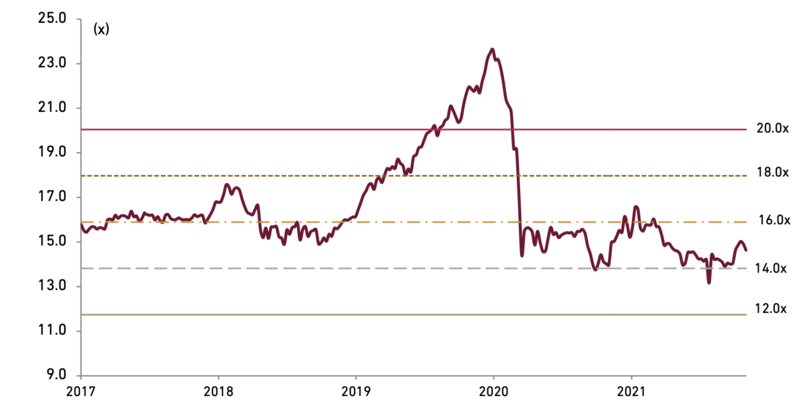

- Valuation and index target

We set year-end 2022 JCI target of 7,296 (rounded up to 7,300) which is based on historical average PER of 16.0x and 2022F market EPS of 456. This implies a gain of 10.8% over end of 10M21 level of 6,591. We see Indonesian stock market showing resilience and scaling new highs amid encouraging corporate earnings and domestic macroeconomics revival, while Indonesia is also expected to benefit from a multi-year highs commodity prices. EPS growth for JCI of 18.2% compares favourably to Southeast Asian peers average of 12.7% while its current valuation of 14.5x is also lower than average peers of 16.1x.

Exhibit 26: JCI PER band

Source: Bloomberg and Ciptadana estimates

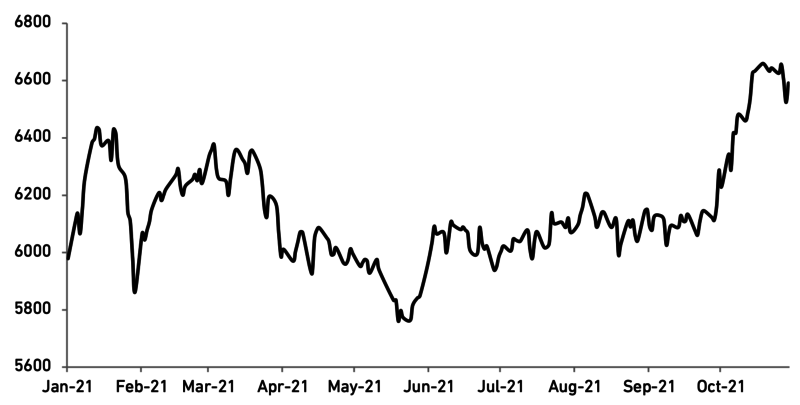

Our positioning in Indonesian equities is to invest in well-managed companies that can efficiently deploy large sums of capital to support growth. This is because the challenging macro environment in recent years has weighed on corporate sector balance sheets. These would include well-run banks, conglomerates, telcos, and towercos. We also like companies that are taking advantage of technology in their business such as digital bank, and we believe they will grow at higher rates than those that are sticking to the conventional ways of doing business. Another investment theme is the reopening of the economy, which would mean the worst is almost over for domestically driven sectors such as automotive. We also see the automotive sectors have been relatively resilient, reporting better-than-expected sales numbers despite the mobility restriction. The multi-year highs commodity (coal and CPO) prices will benefit coal miners and CPO planters. We also think the healthcare sector offers an attractive combination of defensive and long-term growth features, combining relatively inelastic demand and attractive long-term structural drivers.

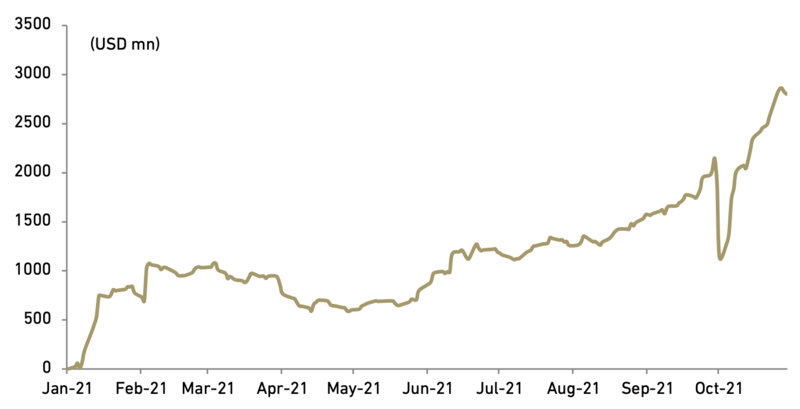

Our top picks under our coverage that fulfill those criteria are: BBNI, ARTO, TLKM, TBIG, ASII, ADRO, TAPG and BMHS. With so much uncertainty about Covid-19 and Fed tapering, we still believe a diversified portfolio with a mix of various stocks is the best approach, while some volatility may not be ruled out.

Sector wise, we are Overweight on bank, telco, tower, healthcare, metal, toll-road, cement, automotive, heavy equipment, plantation, property, media, healthcare oil & gas and retail sectors. We are neutral on cigarette, consumer staples, construction, coal and poultry. We assign an underweight rating on aviation.

Exhibit 27: Our top picks