Telecommunication Tower Overweight

Sector Outlook

- Main beneficiary of the rising data consumption trend in Indonesia

Indonesia is still in early stage of data adoption. With low data usage per subscriber, low smartphone penetration and relatively young population, we think data consumption still has long runways. We estimate 40% data traffic CAGR in 2019-22F. In parallel with the data traffic growth, telcos are required to continuously improve their network capacity. However, increasing capacity from acquiring new spectrum is not possible as spectrum availability is limited. Therefore, telcos would need to rely on 4G network infrastructure to facilitate growing data traffics. That said, incremental number of 4G BTS is vital to maintain network performance. On top of that, smaller telcos are also expanding their networks outside Java to realize new potential revenue source. They are gradually narrowing their coverage deficit to incumbent, which would result in new BTS orders. Trend in 2020 suggests that telcos are focusing more on network densification, but going forward, we believe telcos will continue to lay out new BTS for both network densification and network expansion purposes.

- Large towercos sit at the advantageous position to reap the potential

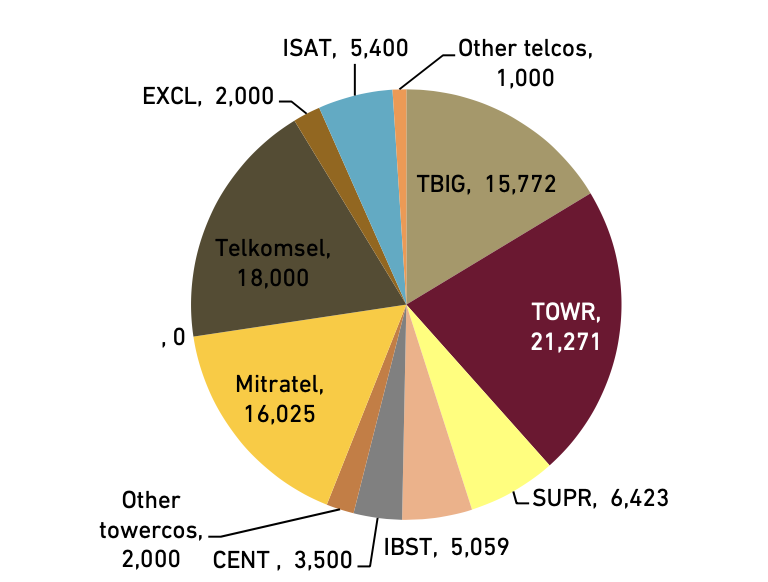

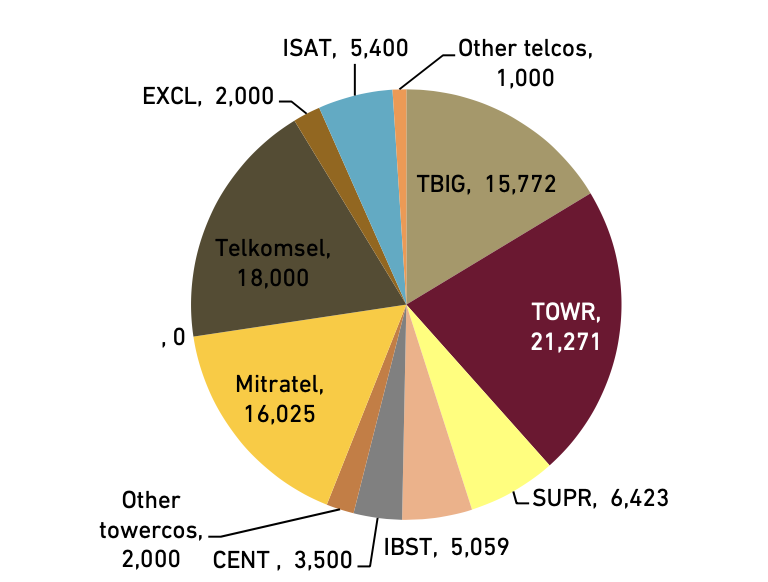

Large towercos set to benefit from the aforementioned telcos' network expansion. As operating scale is key to stay profitable in the business, we believe large towercos command a competitive advantage against their smaller counterparts. The industry landscape is quite consolidated with the top-3 towercos (TOWR, TBIG, and Mitratel) own c.55% of tower population. If we exclude towers held by telcos, big towercos’ share is c.76%. Compare to Mitratel, we believe TBIG and TOWR have the advantage as they operate as independent towercos. We believe TBIG and TOWR have achieved the required scale to operate efficiently and consistently grabbing orders from telcos. They are the only towercos who are consistently making profit.

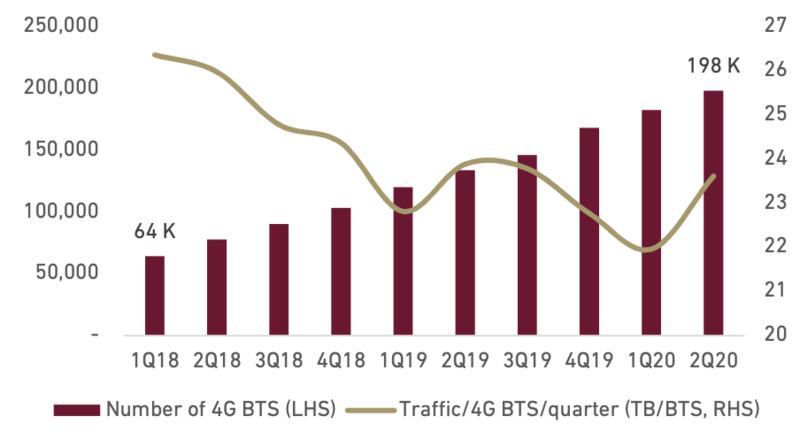

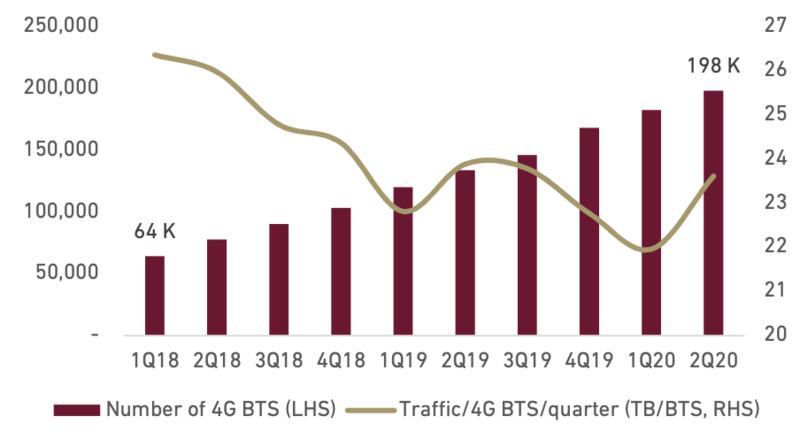

Exhibit 69: 4G BTS count and data traffic per BTS of top-3 telcos

Source :Companies, Ciptadana

Exhibit 70: Tower Holding in Indonesia as of 1H20

Source :Companies, Ciptadana

- Indonesia is in need for more towers

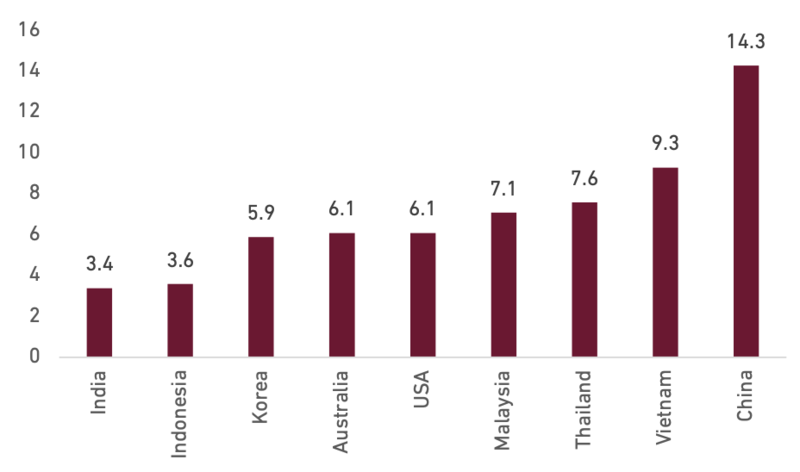

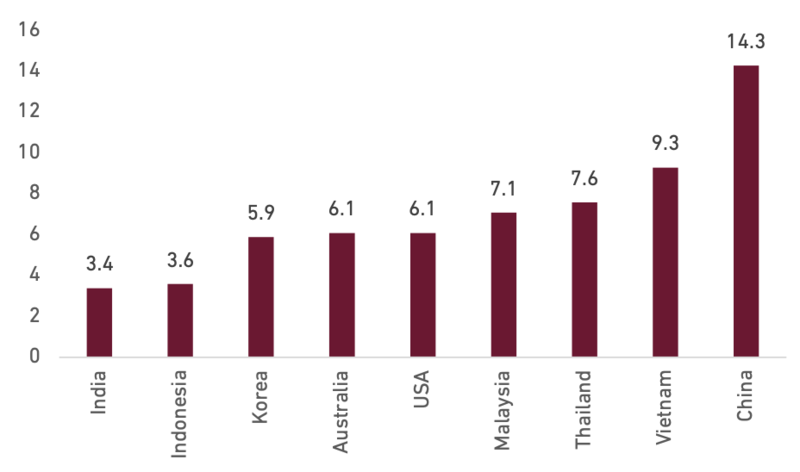

Align with the increasing digital lifestyle with rising data usage, we believe Indonesia is still lacking telecommunication towers. Even more so after the widespread of 4G rollout which requires a denser network architecture, hence more tower sites are needed. Indonesia’s number of towers per 10,000 populations is currently at around 3.6. According to Tower Exchange, the global average of number of towers per 10,000 populations is 8.1. To reach the average number, Indonesia would need to add around 122K new towers, more than double than the 1H20’s towers count of 96K.

- Prospective long term growth opportunity

Aside from comparing the number of towers to other countries, we try to analyse the BTS addition trends to get further insight of the industry prospect. As some telcos have already stopped adding new 2G/3G BTSs, we believe 4G BTS number will be a better proxy to learn about telcos expansion. Based on data from top-3 telcos, data payload per 4G BTS unit is trending down with seasonal pick-up in 2Q. 2Q20 is a little bit special, we believe, as it is the inception of WFH and SFH trend as a result of Covid-19 outbreak. Going forward, we expect telcos to continue adding more BTS to serve its network. Assuming 40% data traffic CAGR in 2019-22F and stable data throughput of 22TB/BTS, we expect the big-3 telcos would need to add 165K 4G BTSs until 2022F. To give a perspective, 165K 4G BTS is equal to 83% of installed 4G BTS as of 1H20.

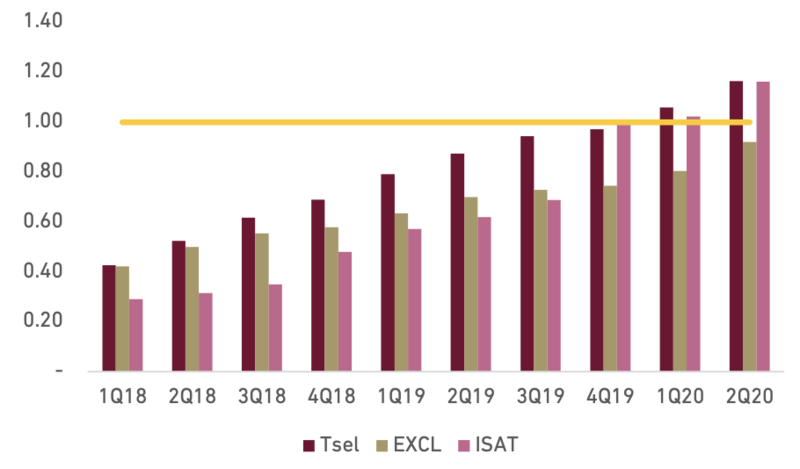

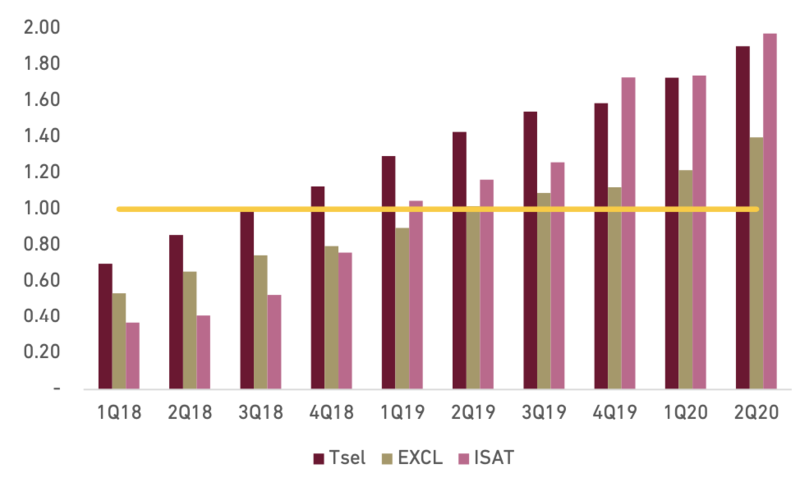

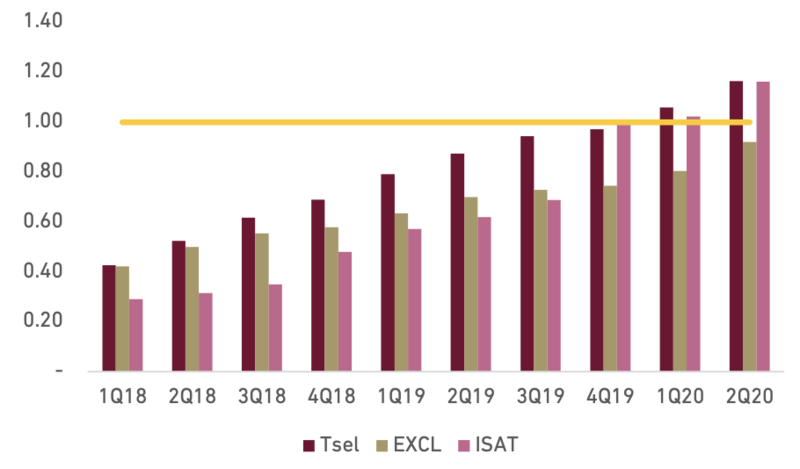

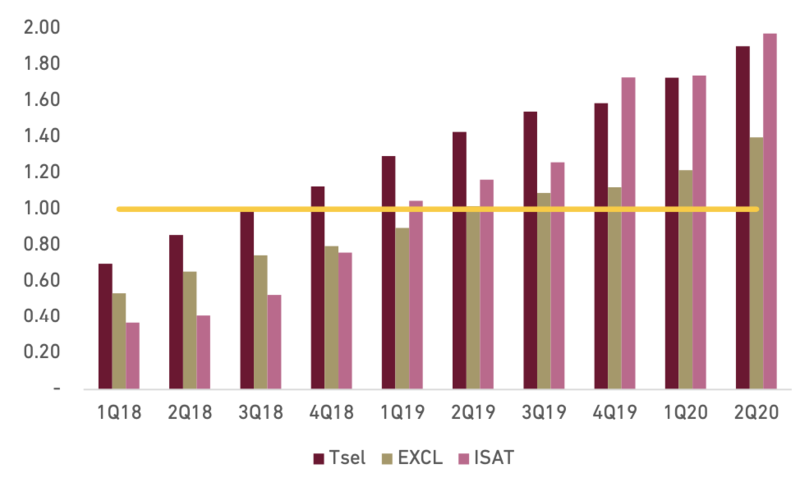

The next question is whether the projected 4G BTS additions will directly translate to build-to-suit or colocation oder. In the past, where telcos just began 4G roll-out, they can overlay the installation of 4G BTS to their existing 2G sites, hence not every newly installed 4G BTS would translate into new order. Meanwhile, at current situation, the 4G to 2G and 4G to 3G overlay ratio have already breached 1.0x (save for EXCL, which we expect to achieve that in 3Q20), meaning that additional 4G BTS would likely translate to more tenants. Therefore, we expect the next 1-2 years will be the important growth period for towercos to grow their tenancies.

Exhibit 71: Number of Towers/10,000 Populations

Source : CENT, TowerXchange, EIU, Ciptadana

Exhibit 72: Telcos’ 4G to 3G Overlay Ratio (x)

Source : Companies, Ciptadana

Exhibit 73: Telcos’ 4G to 2G Overlay Ratio (x)

Source : Companies, Ciptadana

- Rising trend of colo, build-to-suit is starting to pick-up

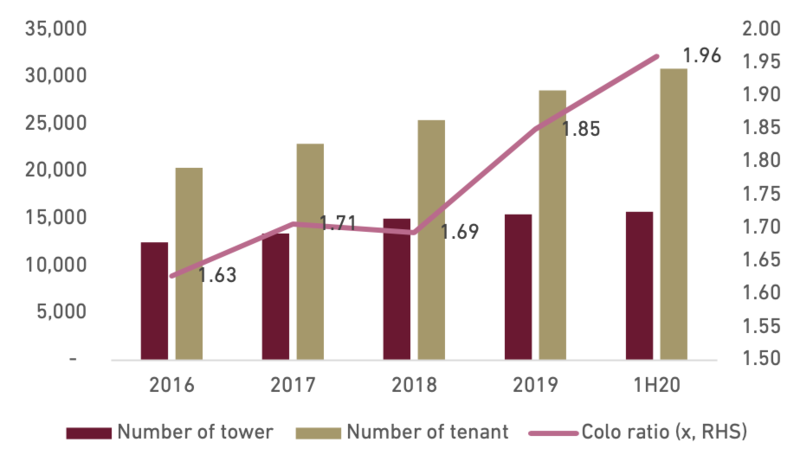

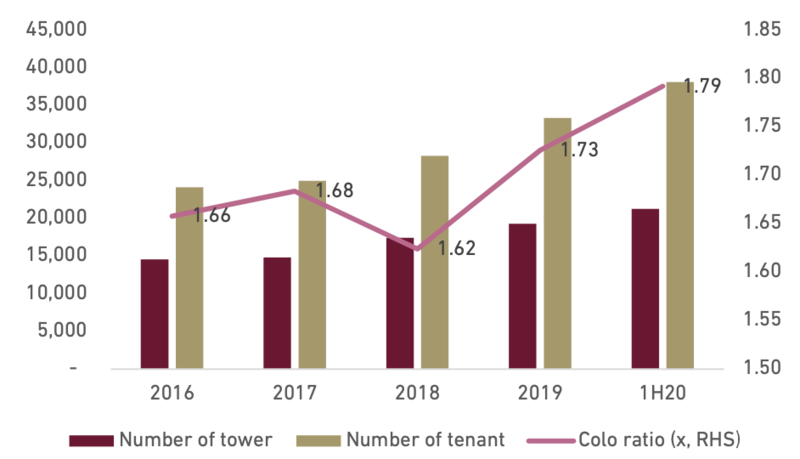

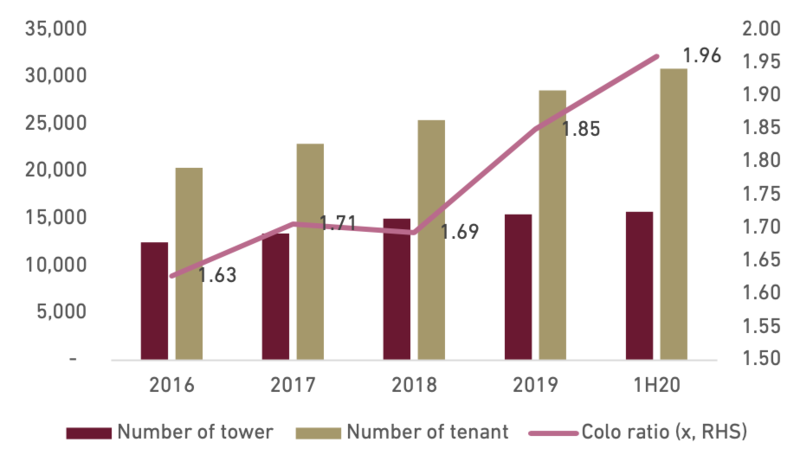

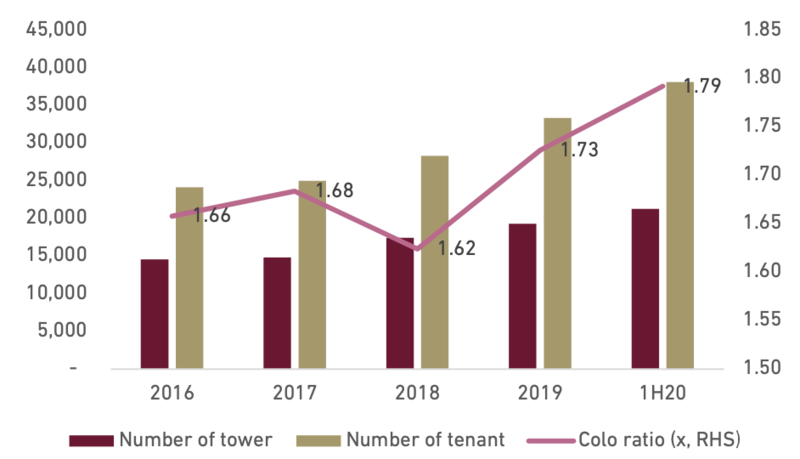

Of late, the majority of orders in the industry have been coming in the form of colos from smaller telcos as they are finding a quick way to densifying their networks as well as expanding to ex-Java by following the footprints of incumbents. This trends drive colo ratio up to 1.96x and 1.79x for TBIG and TOWR, respectively. We believe growth from colo is better than build-to-suit as it is the cheaper growth option (capex requirement is lower) and quicker to install. Colo requires Rp200-250 mn capex, while build-to-suit capex is at around Rp1-1.5 bn per site.

At the same time, build-to-suit orders have been muted largely because Tsel (the major build-to-suit clients) is trying to optimize their spectrum won in late 2017. According to TBIG, after muted for some years, Tsel’s orders are set to pick-up this year although the magnitude may not yet be as big as previous years. We believe this is positive as new towers could provide future upside potential through colo orders from smaller operators in the future. TBIG has the edge over TOWR in winning organic new tower orders.

Exhibit 73: TBIG’s Tower and Tenancy

Source : Companies, Ciptadana

Exhibit 74: TOWR’s Tower and Tenancy

Source : Companies, Ciptadana

- Sizeable long-term contracted revenues secure earnings

As of 1H20, towercos under over coverage have pocketed sizeable contracted revenues which are sufficient to cover revenue for the next 5-6 years. For TOWR, the amount rose from FY19 position of Rp51.0 tn to Rp53.1 tn in 1H20. TOWR has entered a master agreement with H3I to automatically renew expiring lease contracts until 2022. We believe TOWR entered into early contracts renewal to mitigate consolidation risks in the industry, an issue that has been prevalent for a long time. As in the case of EXCL-Axis merger, despite any combination, tower-lease contracts are irrevocable and will run until maturity. Consequently, TOWR’s rental rate will face some pressures until 2022F, we believe, although its tenancy growth and strong non-tower business revenue growth could cover for lower rental rate risks. On the other hand, TBIG sits on Rp26.3 tn revenue, equivalent to 5 years of projected revenue.

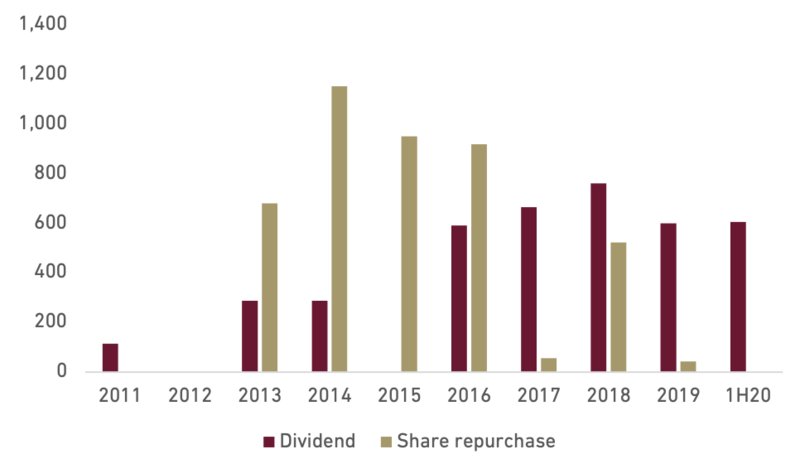

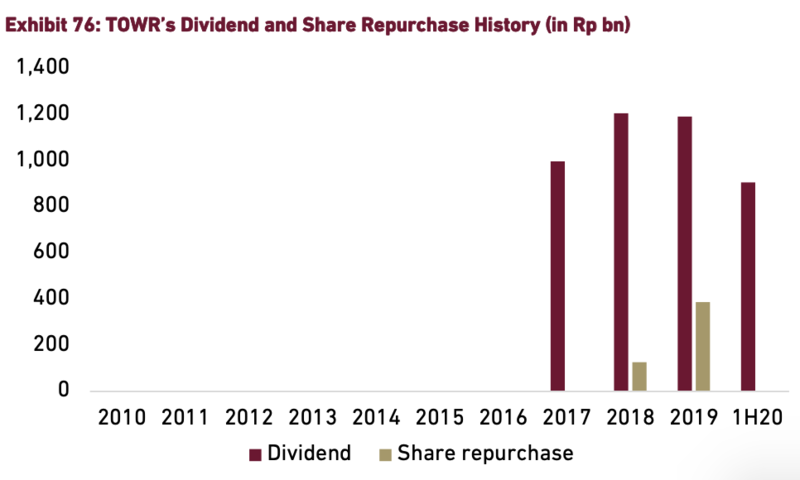

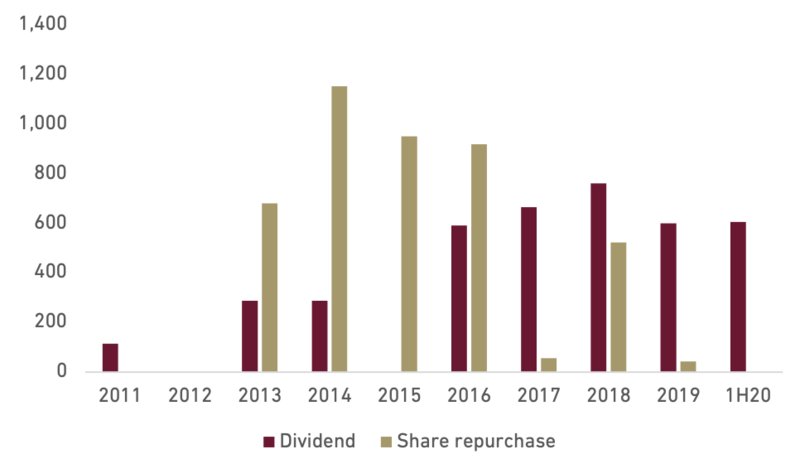

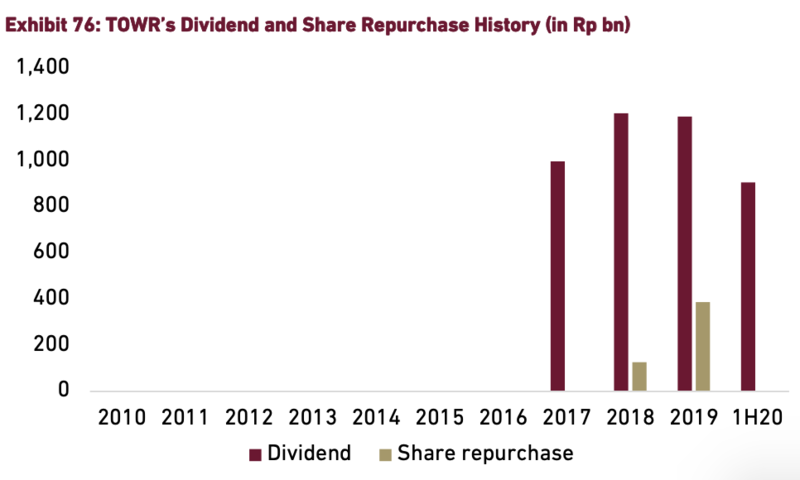

- Actively returning cash to shareholders

Both towercos are now consistently returning cash to shareholders. TBIG has started to do so since its IPO. TOWR followed suit in 2016 onwards after it revamped a new corporate strategy and coined the “buy, build, return” as the headline. From 2010 to date, TBIG has returned a total amount of Rp8.2 tn back to shareholders in the combination of cash dividend and share repurchases. This equals to c.27% of current market cap and 85% of total earnings during the period. This is a positive trait for the Company as it enables investors to hold in a long-term position in the stock. TOWR is opting for a stable dividend policy in 2018-19 with the amount is set at around Rp1.2 tn. Higher absolute dividend amount is possible in 2020-22F going forward, subject to capex requirements and share buybacks progress. We project 3.3% and 2.8% dividend yield for TBIG and TOWR, respectively.

Exhibit 75: TBIG’s Dividend and Share Repurchase History (in Rp bn)

Source : Companies, Ciptadana

Exhibit 76: TOWR’s Dividend and Share Repurchase History (in Rp bn)

Source : Companies, Ciptadana

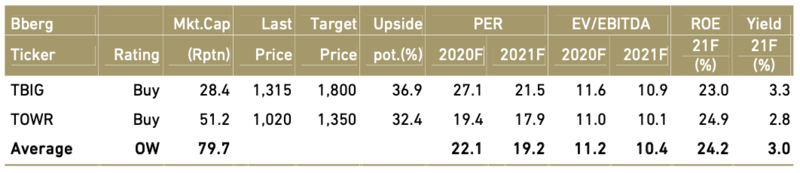

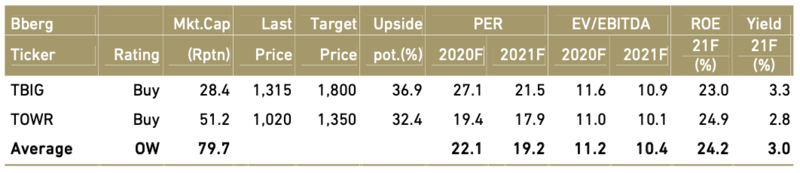

- OVERWEIGHT on towercos with TBIG as our top pick

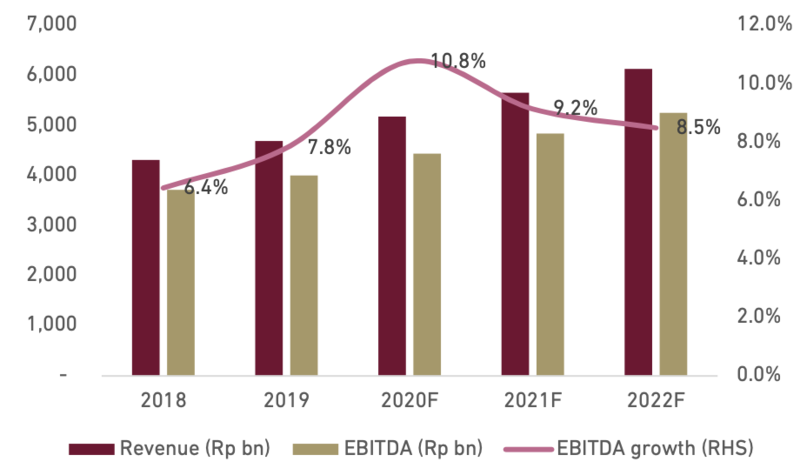

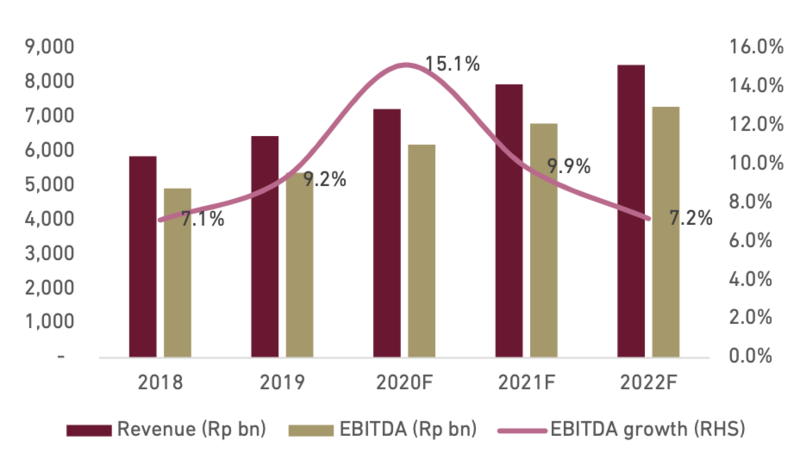

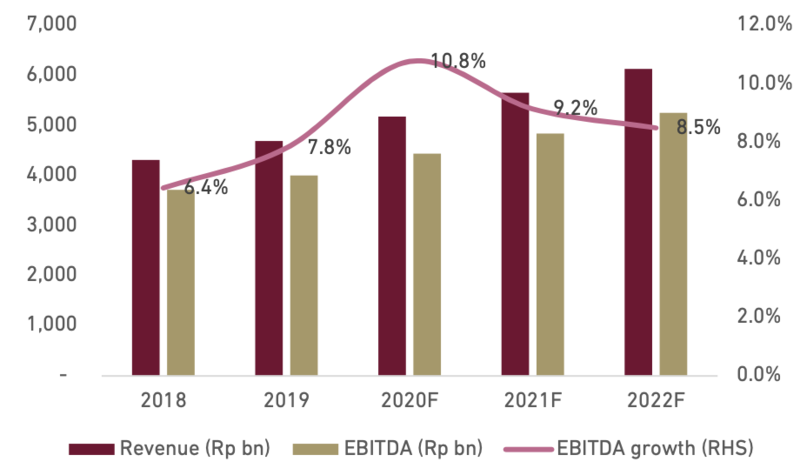

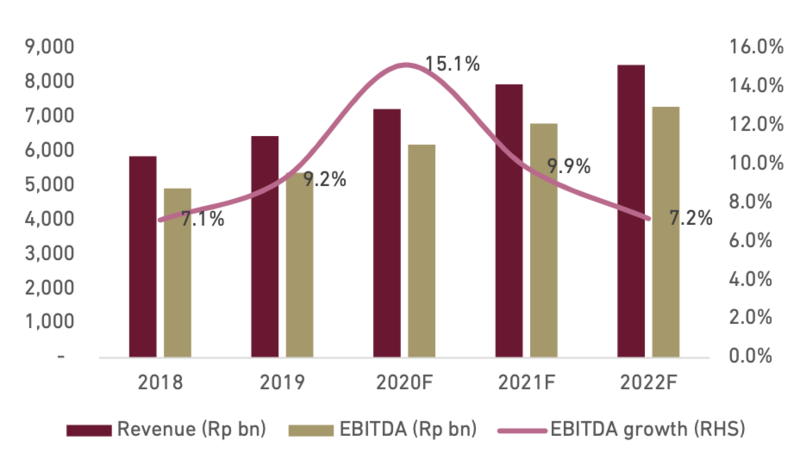

We are OVERWEIGHT on towercos owing to its robust long-term outlook whereas we believe towercos are in the most critical growth phase for the next 1-2 years. As such we are projecting 9.5/10.2% of revenue/EBITDA CAGR for the industry in 2019-22F. Additionally, we also like towercos’ defensive business model with high visible earnings, a merit that is hard to find in the midst of Covid-19 outbreak. We rate BUY for TBIG and TOWR as we believe both of them will be the beneficiary of the current trend. However, our top pick for the sector is TBIG as we believe it has slight edge in garnering organic tower growth. Given no sizeable M&A opportunity in the foreseeable future, we believe TBIG is better positioned in the industry. Also, TBIG is a more leveraged player which should benefit more in currently low interest rate environment.

Exhibit 77: Towercos stocks rating and valuation

Exhibit 78: TBIG financial projections

Source : Companies, Ciptadana

Exhibit 79: TOWR financial projections

Source : Companies, Ciptadana