Telecommunication Overweight

Sector Outlook

- On-going legacy to data services transition with complex competition dynamic

Telecommunication (telecom) sector is still in the structural transition phase from legacy services (voice and SMS) to data services. The stage of the transition, however, is different from one another. On the other hand, we expect the competitive landscape of the industry to remain intense in the near future. Telecom companies (telcos) may have their own agendas, however, none would benefit from a severe price war. Instead of price war, we see telcos are embarking more on quota war by pushing larger data package and unlimited offerings to their respective subscribers. While this would continuously push down data yield, ARPU may still trend upwards. This is a sensible strategy, in our view, as recent network statistics indicate an improving network quality despite the rising data traffic. Costs control in turn befits into another important lever to cash flow generation which is imperative for telcos to maintain steady capex spending.

- Industry data traffic growth is set for further growth

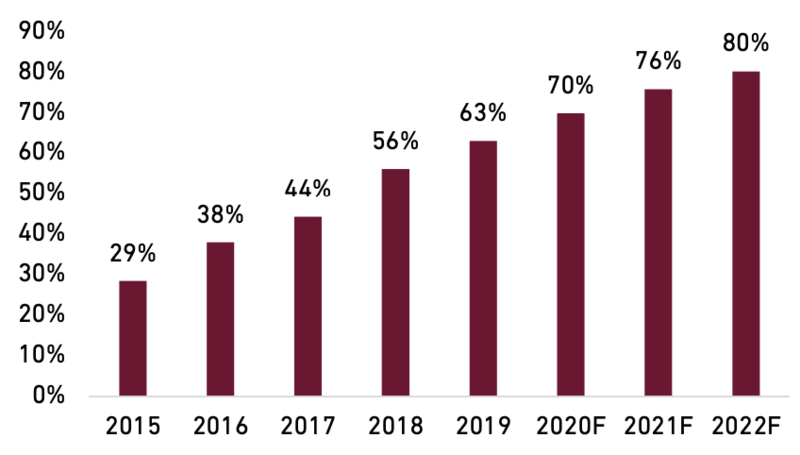

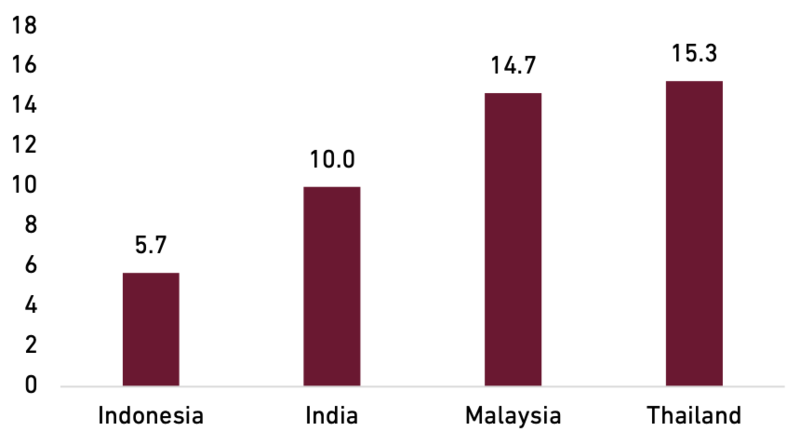

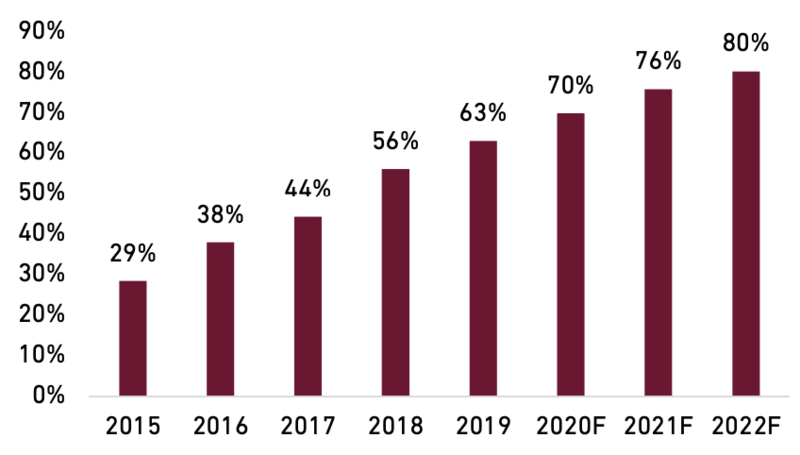

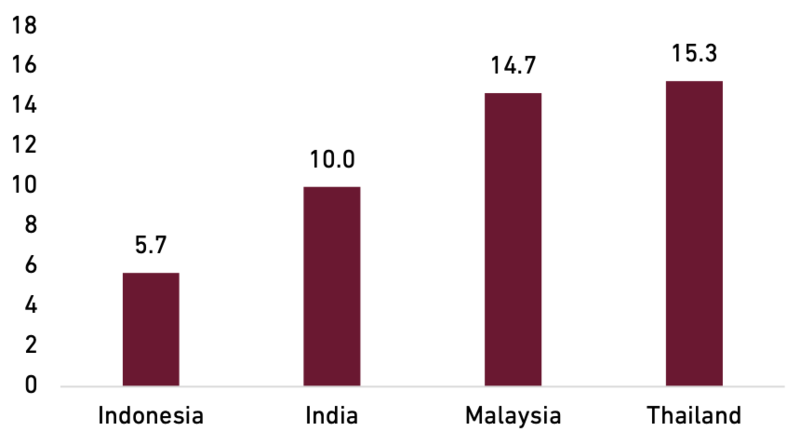

Since the beginning of 4G roll-out in 2015, data consumption has witnessed a tremendous growth. Data traffic (from the top-3 operators) grew at 17.0% compounded quarterly rate in 1Q15-2Q20 with 2Q20’s figure is at 27x of that in 1Q15. Notwithstanding the explosive growth, we believe Indonesia is still in the early phase of mobile data adoption. Indonesia’s smartphone penetration picked-up rapidly in the last few years due to the rise of cheaper handsets especially the Chinese brands. However, Indonesia’s smartphone penetration rate of 63% is still low compared to neighbouring countries (Thailand: 82%, Malaysia: 78%, Philippines: 71%). Furthermore, monthly data-consumption-per-subscriber number also suggests ample further growth potential as the average from top-3 telcos is currently at 5.7GB, far lower than that of other South East Asian countries (Malaysia at 14GB/subscriber/month, Thailand at 15GB/subscriber/month) or India (10GB). Having a young demographic profile, coupled with the acceleration of digitalization trend, we estimate data traffic could still post 40% CAGR in 2019-22F.

Exhibit 47: Smartphone Penetration in Indonesia

Source :ASEANUP, Statista, Ciptadana

Exhibit 48: Comparison of Monthly Data Consumption per subscriber (in GB)

Source : Companies, Ciptadana

- Different agendas among telcos: smaller telcos expansions…

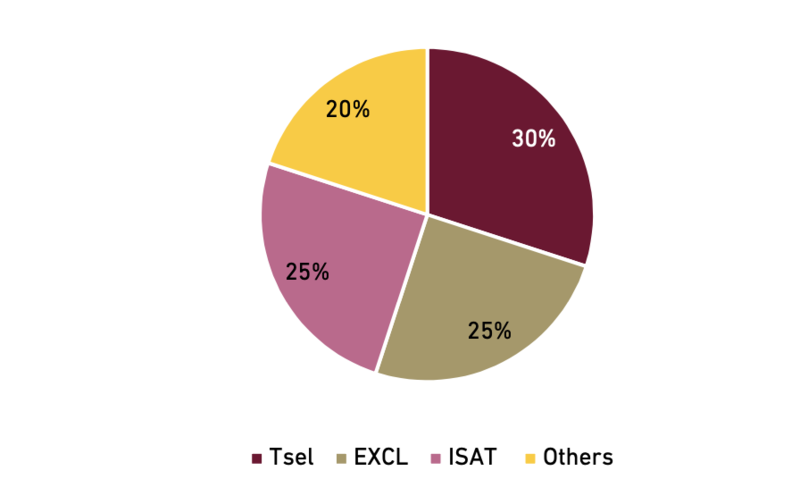

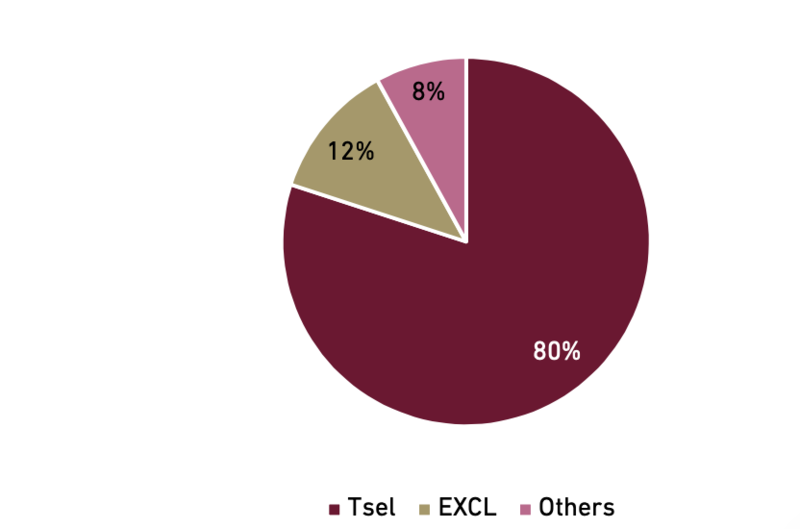

Competition landscape in telcos sector is dynamic and intricate. Differences in ex-Java presence, economic of scale, and legacy/data revenue mix are complicating the competition dynamics. For instance, apart from the incumbent Telkomsel (Tsel), smaller telcos are expanding their ex-Java coverage as a greenfield revenue opportunity. EXCL as the early mover, started its ex-Java expansion in 2H16 and has managed to reach 90% population coverage in key islands with current estimated ex-Java market share at 10-15%. ISAT and Hutchison 3 Indonesia (H3I) have also started expanding to ex-java in 2019 with ex-Java population coverage at around 80%/75%, respectively. FREN, while also has initiated ex-java expansions, is more focused to cover more sites in Java and gain more subscribers. We believe EXCL has already achieved the appropriate scale in some of its early ex-Java investments. It now needs to balance out between monetizing and filling-in more subscribers to its networks. On the other hand, ISAT and H3I will continue to expand their coverage into new areas over the next two years and customers’ acquisitions will be their focal points for a while.

- Different agendas among telcos: smaller telcos expansions…

Tsel is the network leader in Indonesia and is the incumbent operator in ex-Java with nationwide coverage of >95%. At the same time, Tsel is still in the midst of legacy transition to data/digital services as 26% of revenue is still derived from legacy services. Before smaller telcos rolled out ex-Java expansions intensively, Tsel could maintain its legacy revenue while growing data business at the same time. As digital adoption accelerates throughout the country, in some part thanks to smaller telcos expansions, Tsel currently suffers the highest revenue decline from legacy services. Furthermore, its relatively low data engagement compared to peers and some market share losses resulting in muted revenue growth of late. From this point onward, as data is the only growth lever in the industry, Tsel would need to increase its data revenue market share. To achieve higher data revenue market share, Tsel must start with increasing traffic shares. Given its low data consumption per subscriber and its superior network quality, the growth potential is still aplenty for Tsel. Increased data usage will consequently drag down data yield in at least the short term (more details in the following section).

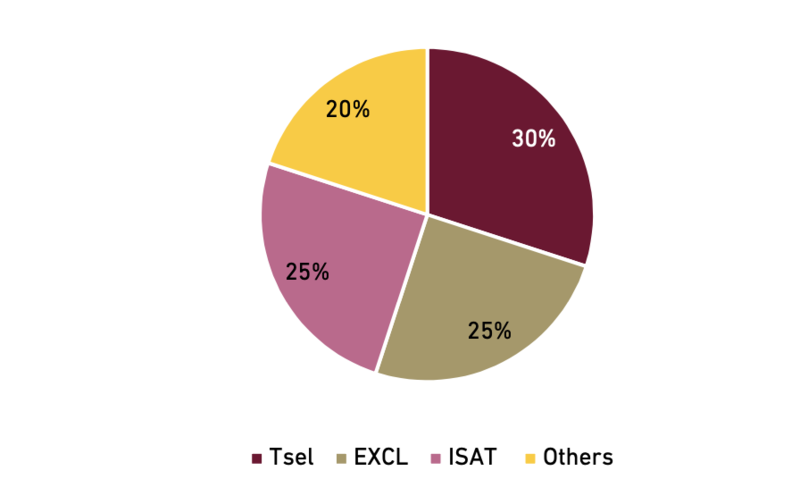

Exhibit 49: Estimated Java market share

Source : Companies, Ciptadana

Exhibit 50: Estimated ex-Java market share

Source : Companies, Ciptadana

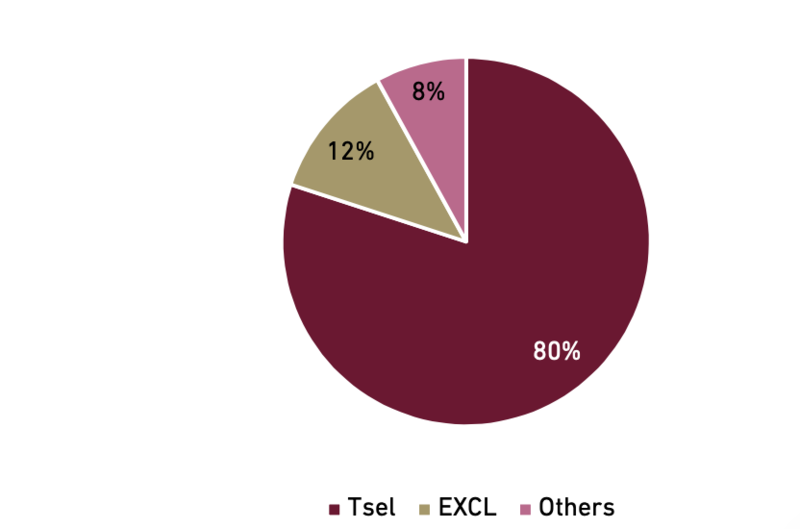

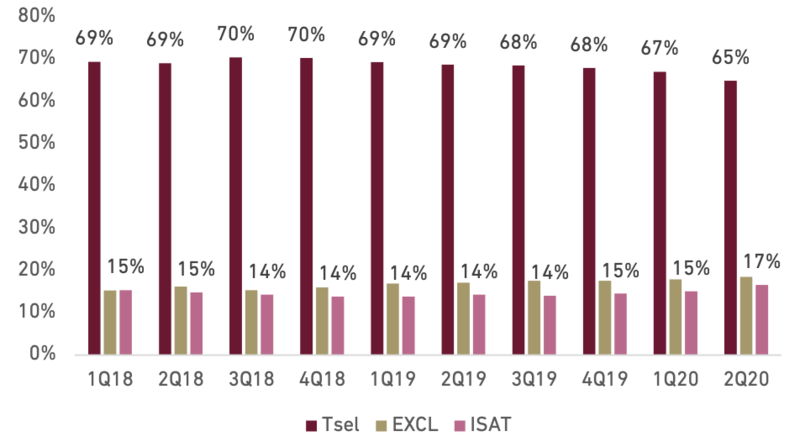

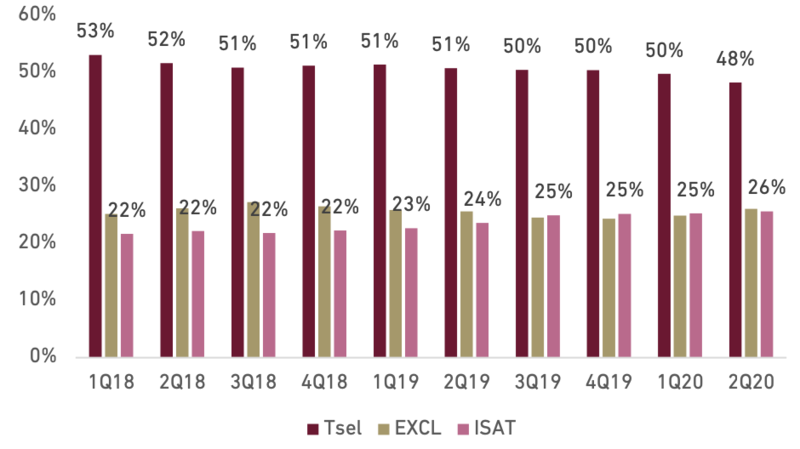

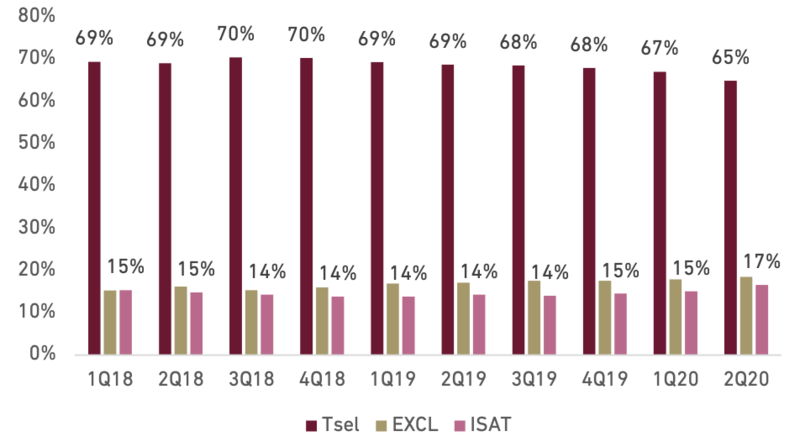

Exhibit 51: Mobile Revenue Market Share

Source : Companies, Ciptadana

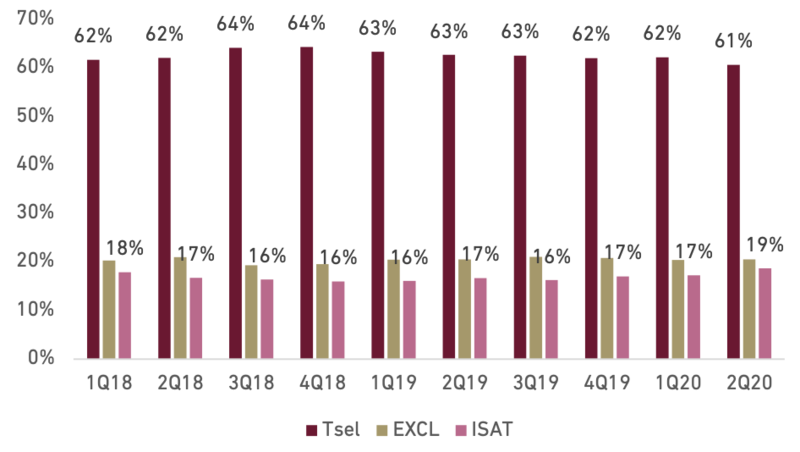

Exhibit 52: Data Revenue Market Share

Source : Companies, Ciptadana

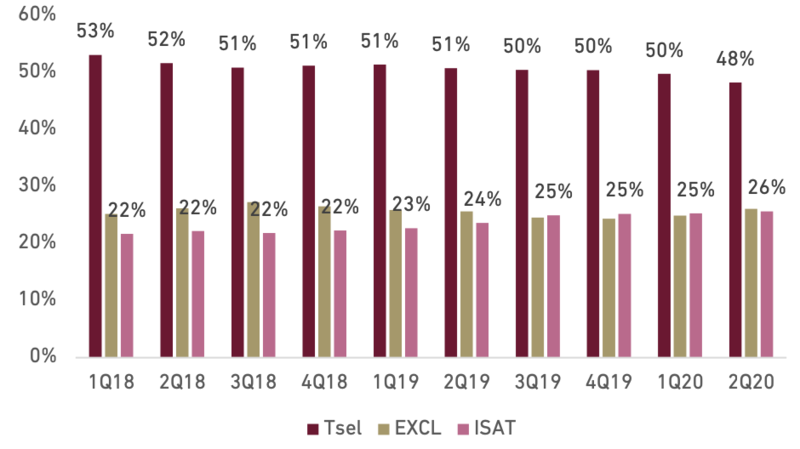

Exhibit 53: Data Traffic Market Share

Source : Companies, Ciptadana

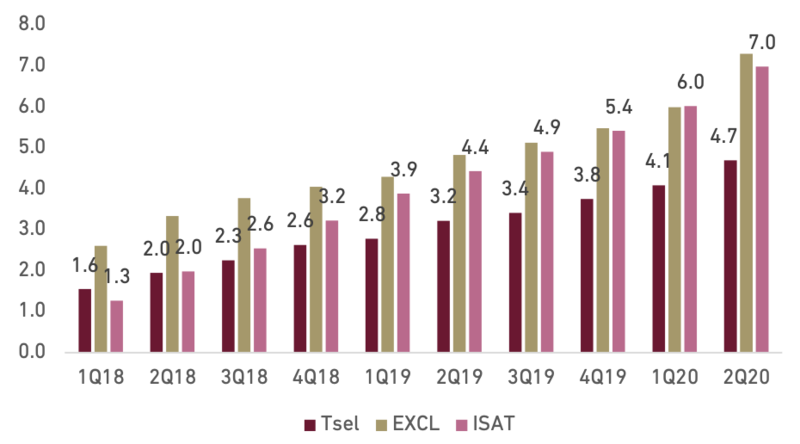

Exhibit 54: Data Consumption per Subscriber (in GB)

Source : Companies, Ciptadana

- Tsel’s strategies to grab back data revenue share…

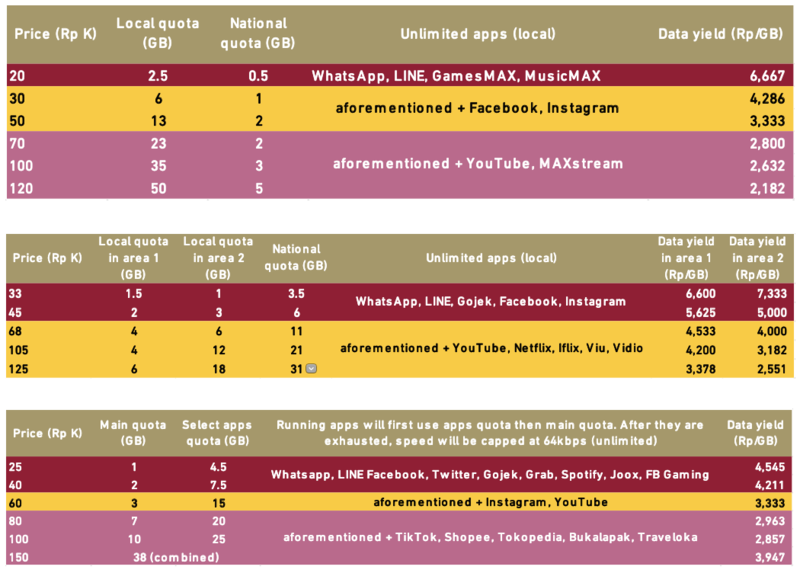

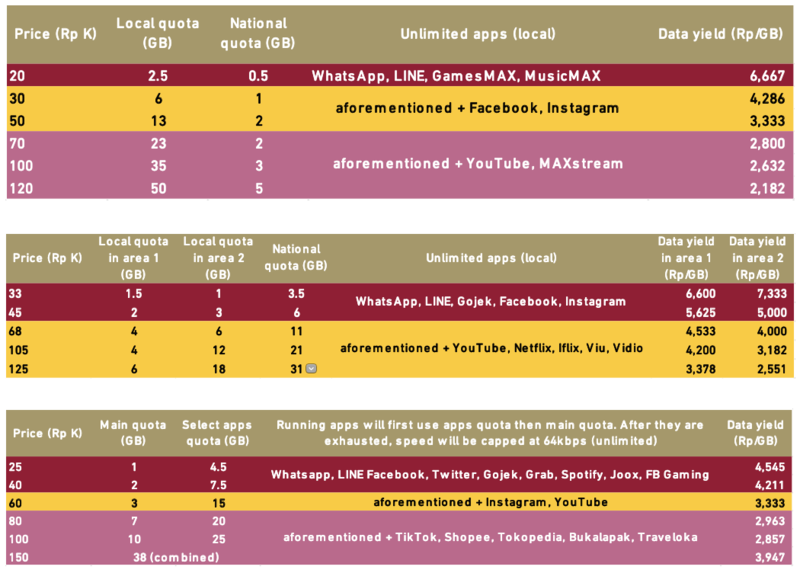

Going forward, we expect Tsel will try to increase data usage of its subscribers base. We see two-pronged approach coming from Tsel. Firstly, on data engagement front, Tsel is continuously expanding its contents offering on video, gaming, and social media. For example, it had opened access to Netflix and secured partnership with Disney+ Hotstar. Secondly, on pricing and affordability issue, Tsel has introduced “Kuota Ketengan” and unlimited feature to its offerings. Kuota Ketengan is a sachet data package to access select apps with the lowest entry price of Rp2,500/GB which we believe is competitive in the market. Tsel started its unlimited offers in late July/August this year with Unlimited Max aiming to acquire new subscribers. Tsel now has expanded unlimited offerings to more cities as an adds-on/booster of main package.

Exhibit 55: Comparison of Unlimited Offerings (Top to Bottom: Tsel, EXCL, ISAT)

Source :Companies, Ciptadana

- … but Tsel will tread carefully

As the result of Tsel’s efforts, we believe the sector will remain competitive for the next few years but should be able to avoid a price war. We believe Tsel may tweak its pricing to be competitive against its smaller peers. As the market leader with 61% of market revenue, we believe Tsel would not drive the market into a price war. On the other hand, ISAT might want to grab more or regain some market shares but would likely to avoid a severe price war as the Company is still in net loss and would like to generate a positive return on its sizeable network investments.

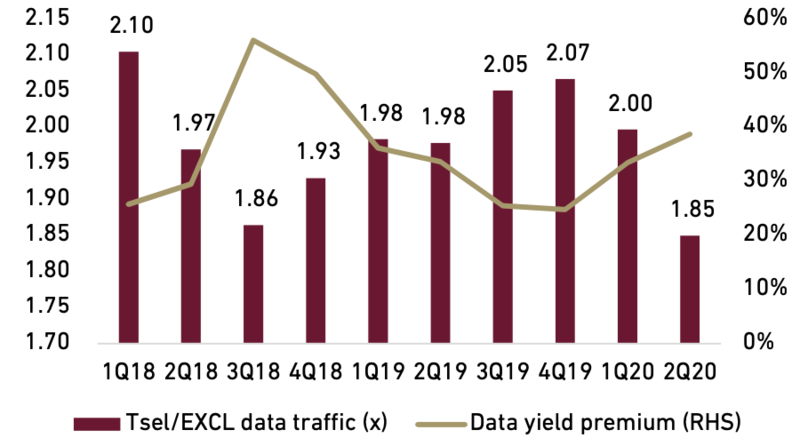

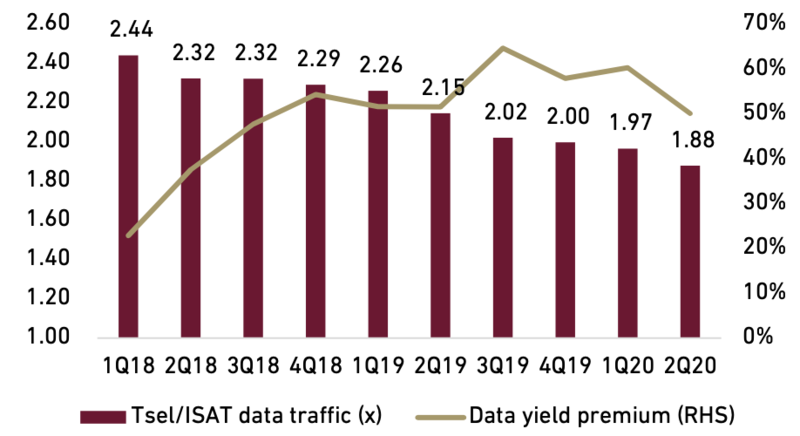

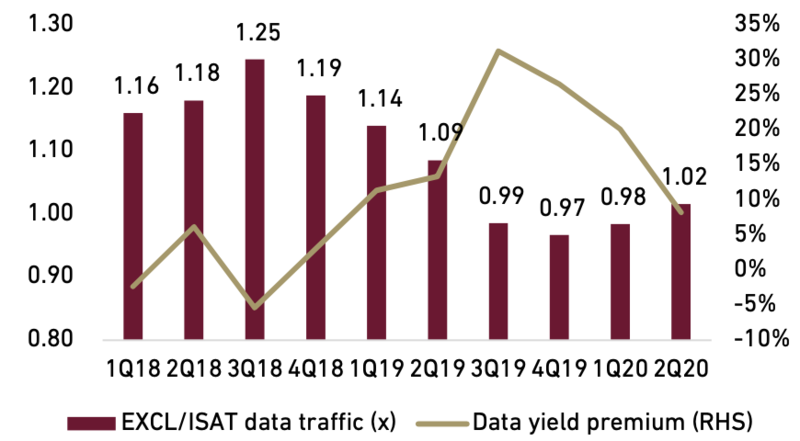

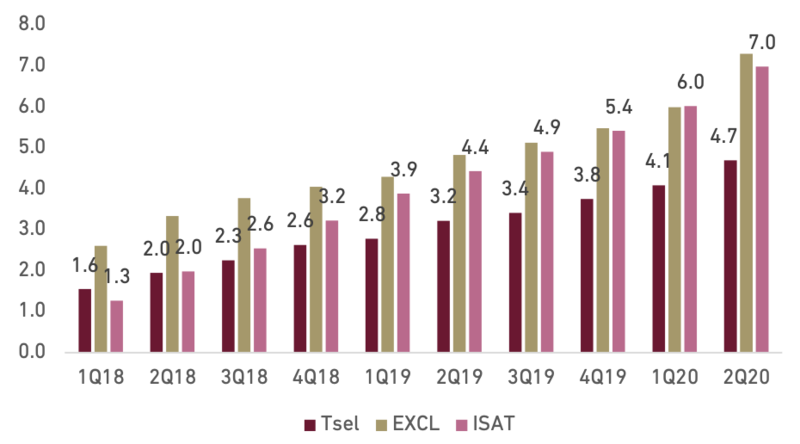

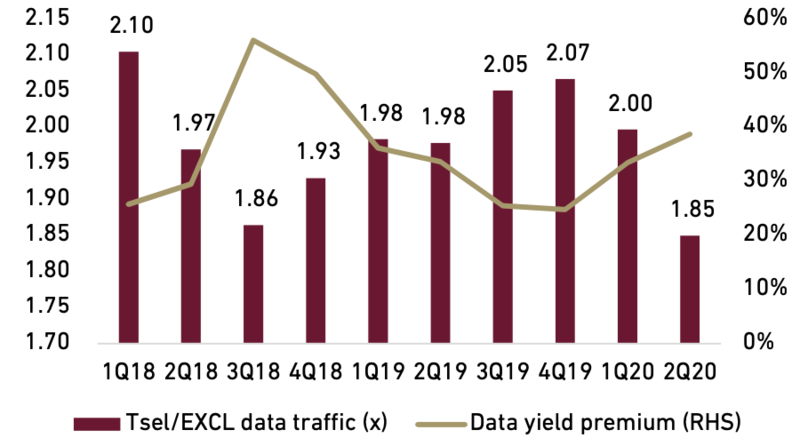

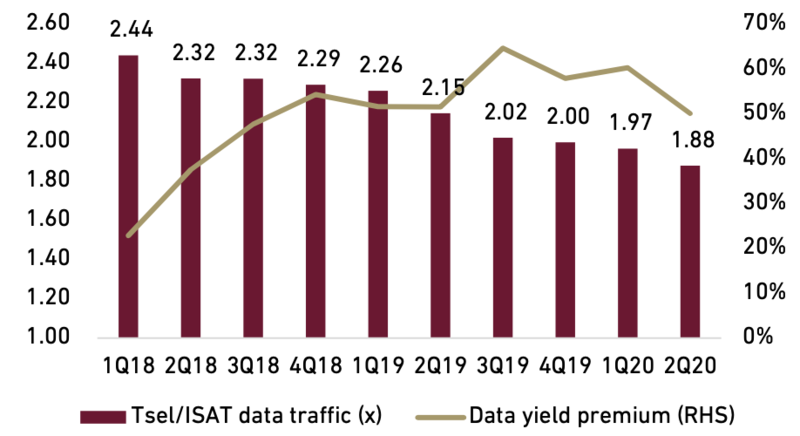

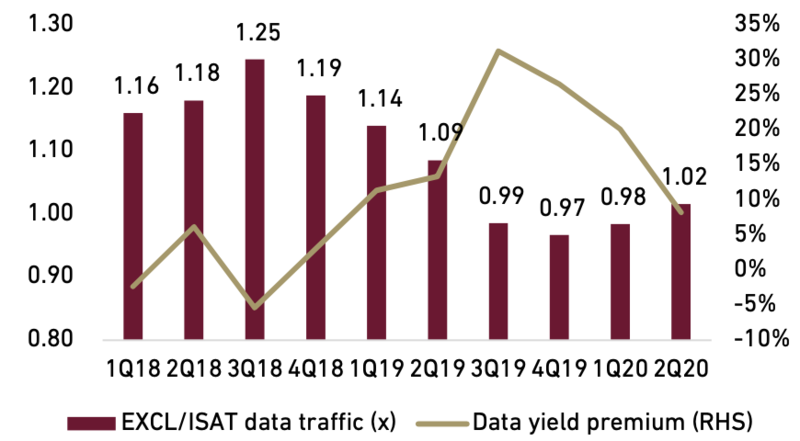

- Relative Tsel-EXCL pricing elasticity should drive data yield down

We analyse Tsel’s data traffic multiple to EXCL’s and found that it is correlated to Tsel’s data yield premium over EXCL. This implies that Tsel could increase its relative data traffic share to EXCL, if Tsel’s data yield decline steeper than EXCL. Interestingly, the correlation is less prominent in Tsel-ISAT relationship. This suggests a more direct competition between Tsel and EXCL. We also observe a decent relationship on EXCL-ISAT analysis. These findings also align with Tsel strategy in maintaining 30-40% premium pricing over EXCL. Therefore, with aforementioned strategies in garnering more data traffic, we believe data yield will continue to trend down at least in the near future. Barring from any significant tariff cuts, this could still translate to a higher ARPU as is the current trend in the industry. This might be the trend in the industry for some time; declining data yield but better ARPU trends.

Exhibit 56: Tsel-EXCL data traffic multiple vs data yield premium

Source :Companies, Ciptadana

Exhibit 57: Tsel-ISAT data traffic multiple vs data yield premium

Source :Companies, Ciptadana

Exhibit 58: EXCL-ISAT data traffic multiple vs. data yield premium

Source :Companies, Ciptadana

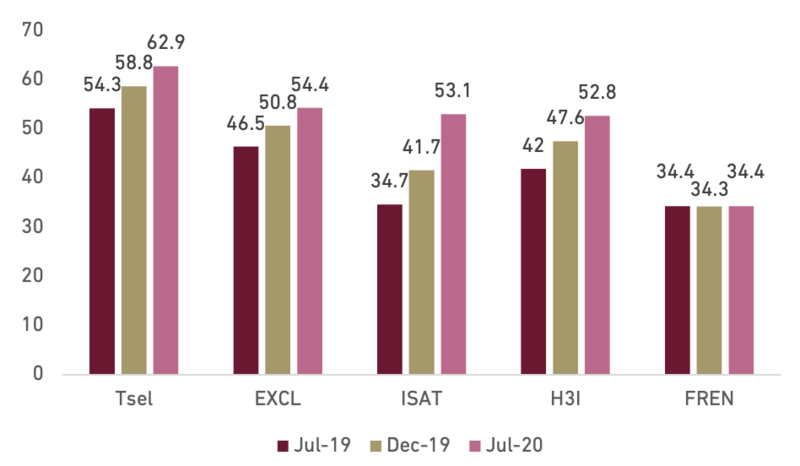

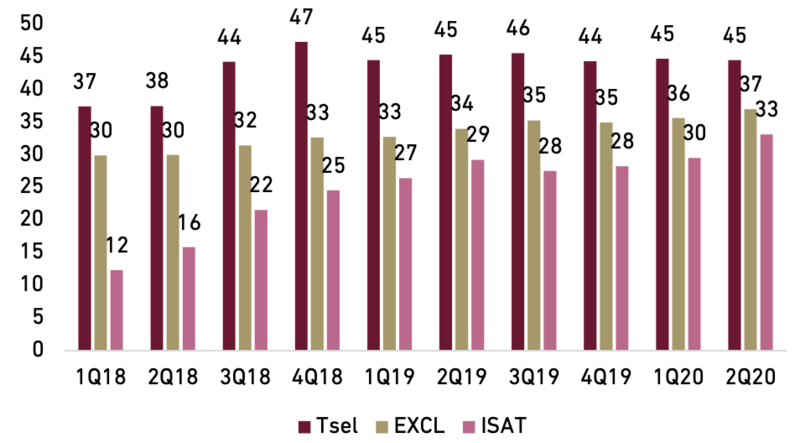

Exhibit 59: Telco ARPU Trends (in Rp K)

Source :Companies, Ciptadana

- Network quality is as important as ever

Rapid data traffic growth coupled with plenty of generous/unlimited quota offerings in the market, telcos must ensure their network capacity. With video streaming services become increasingly popular, a stable 4G connection with low latency is required to cater for a good video experience. In that regards, we see telcos continuing to invest in improving their 4G networks. This includes cell densification and fiberization, spectrum refarming, and RAN equipment upgrade. Apart from network upgrades, telcos will also set aside capex for network expansion (as explained in previous section) with EXCL and ISAT have mentioned that they will allocate 50% of capex for ex-Java.

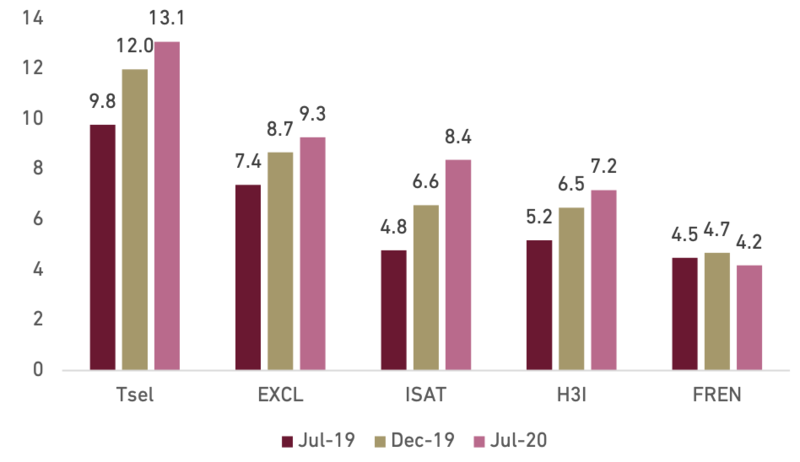

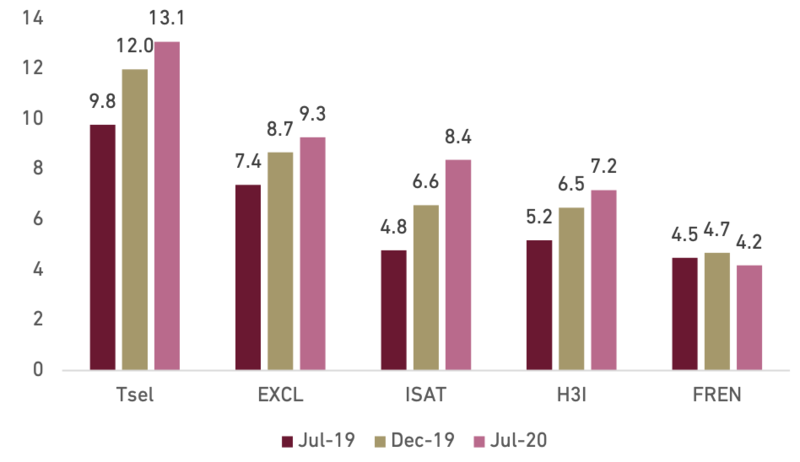

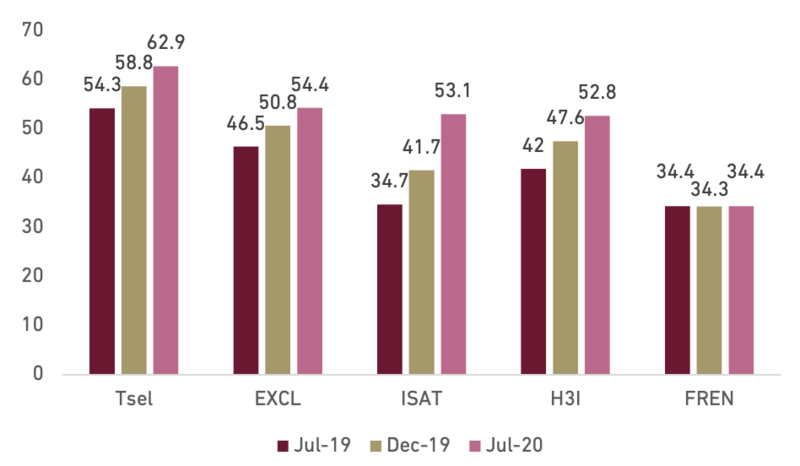

- Telcos network stats are improving, save for FREN

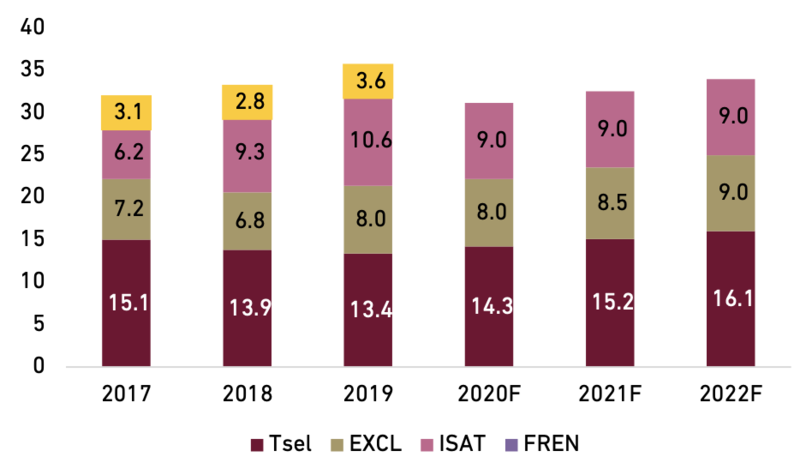

Based on the latest OpenSignal report, we observe that telcos have been investing adequately to maintain/improve their network performance. It is also noteworthy that FREN’s 4G download speed lag peers significantly and has not been improving since Jul-19, perhaps due to the high usage on its unlimited data plan and MiFi products. In overall, we deem telcos’s networks are ready to face traffic hikes from the unlimited offerings. That said, telcos must continue with their capex spending going forward to maintain their networks. However, aside from the spectrum auction (see following section for details), we do not see major upward capex pressure for telcos. We believe under-investing is not an option for telcos as continuous deterioration may result in revenue loss as reflected in ISAT’s case before its sizeable capex cycle in 2018-2020. Therefore, smaller telcos with stretched balance sheet may be limited in their capex spending. FREN with 6.2x net debt-to-EBITDA as of 1H20, is limited to Rp2-4tn capex per annum in 2017-19, which we believe is only adequate for adding capacity. On the other hand, H3I’s balance sheet is in a much better position after equity injection in 2019. It is currently debt free and has greater capability to invest. H3I is allocating USD300-400mn (Rp4.5-6.0 tn) capex in 2020, a stable amount compared to 2019 number, after years of under-investment in 2015-18. The amount, however, is still lower than EXCL and ISAT, and should resulting in wider network deficit in the future.

Exhibit 60: Download Speed (in Mbps)

Source : OpenSignal, Ciptadana

Exhibit 61: Video Experience (score from 0 to 100)

Source : OpenSignal, Ciptadana

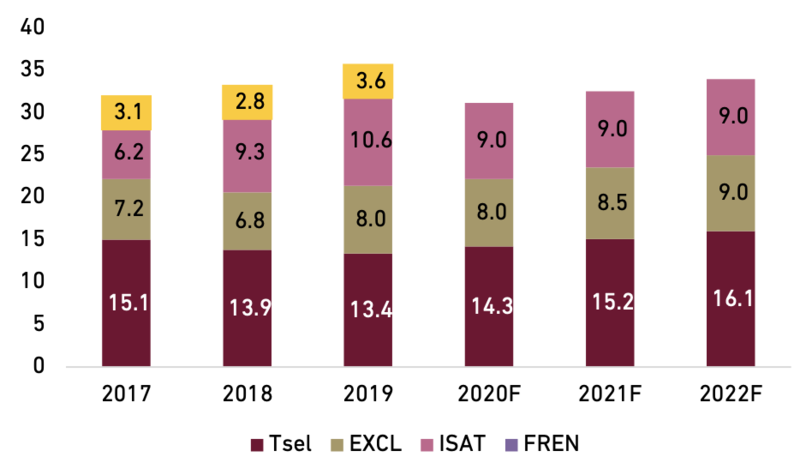

Exhibit 62: Reported Capex (in Rp tn)

Source : OpenSignal, Ciptadana

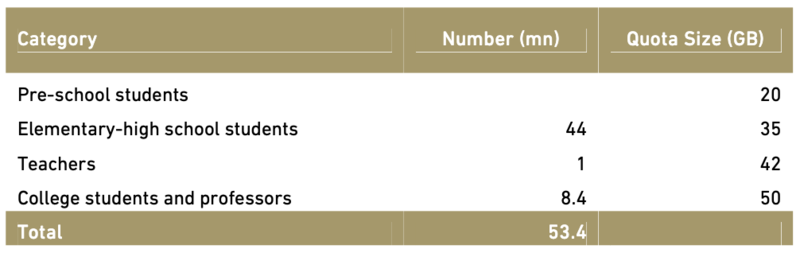

- Free education quota program (FEQP) is neutral to revenue trajectory

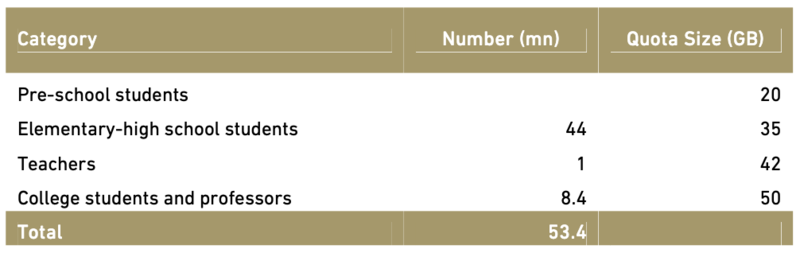

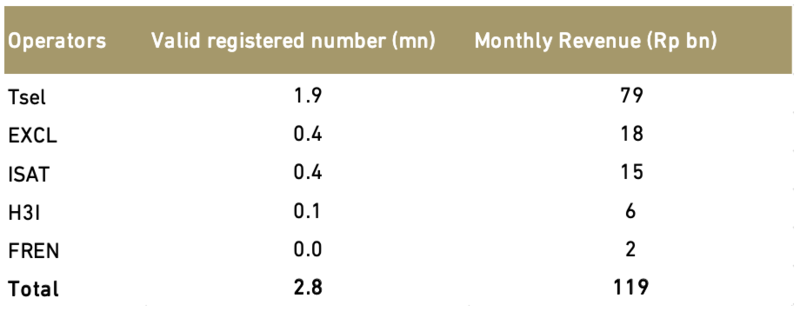

To support the study from home (SFH) program, The Ministry of Education and Culture (MEC) has allocated Rp7.2 tn for data quota subsidy for students, teachers, and lecturers for 4 months from Sep-20 until Dec-20. Students and teachers need to register to their schools/colleges by 11th of September. Afterwards, there is a verification and approval process from the school before the data is sent to MEC. MEC will cross-check the validity of the registered number with telcos and if nothing is wrong, the number will be eligible for the program. Students who fail to register during the first registration window are able to register in the next window and could get the quota in the subsequent month.

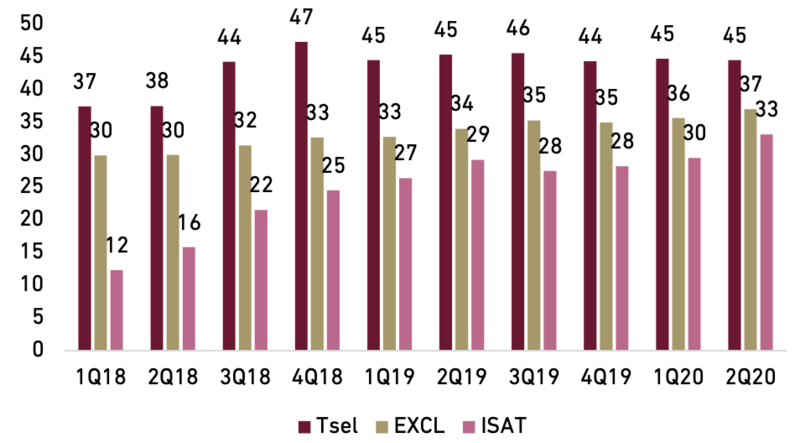

FEQP comprises of 20-50GB data quota, depending on the recipient. The MEC will pay telcos Rp20-50K/month, implying a data yield of Rp1K/GB for every sub registered under FEQP. Of the quota package, 5GB is eligible for general usage, while the remaining 15-45GB is designated for education-related apps/websites. With this quota allocation, we believe FEQP will not adversely impact telcos’ earnings substantially. Perhaps, some potential revenue opportunity from SFH monetization may be gone. That being said, since the beginning of the outbreak, telcos have not monetized the WFH and SFH traffics effectively as they provided CSR quota for work and education related purposes by as much as 10-30GB for 1-3 months. Furthermore, according to telcos, students are unlikely to consume all of their quota, and citing that 10-15GB per month as the current average usage of the education package. We do not see material ARPU cannibalisation from the general quota allowance to subscribers’ existing data plan either as the payment from MEC should be able to compensate. Telcos under our coverage reported 33-45K ARPU in 2Q20, and as most of the FEQP recipients are school students, we believe their existing data ARPU is lower than the reported ARPU. Therefore, we are neutral on the FEQP and do not see this could derail the revenue growth trajectory. Telcos’ currently strong network condition is prepared for this program, we believe, and we do not see any material hikes on capex or opex.

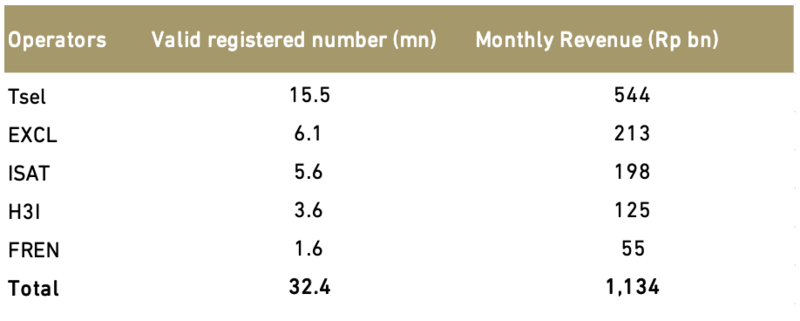

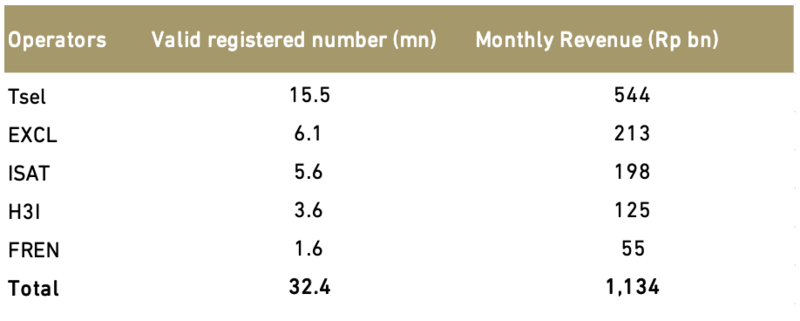

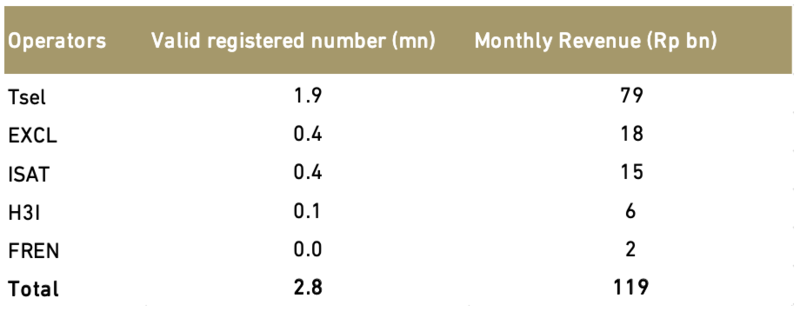

On the longer term, we believe FEQP is positive in accelerating data adoption in the country. As the program runs nationwide and includes pre-school and elementary students, we believe this could accelerate smartphone penetration and increase data usage in the society. According to MEC website, as of the 29th of September, 32.4mn students and 2.8mn teachers have successfully registered. 48%/66% of the verified registered students and teachers are registered on Tsel network, followed by 19%/15% on EXCL and 17%/12% on ISAT.

Exhibit 63: Number of Students and Teaching Staffs

Source: BPS, Ciptadana

Exhibit 64: Registered Students by Operator and Expected Monthly Revenue

Source: MEC, Ciptadana

Exhibit 65: Registered Teachers by Operator and Expected Monthly Revenue

Source: MEC, Ciptadana

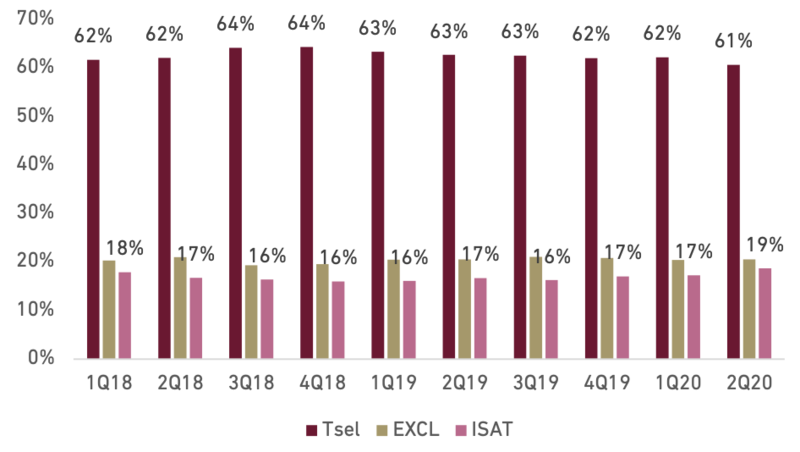

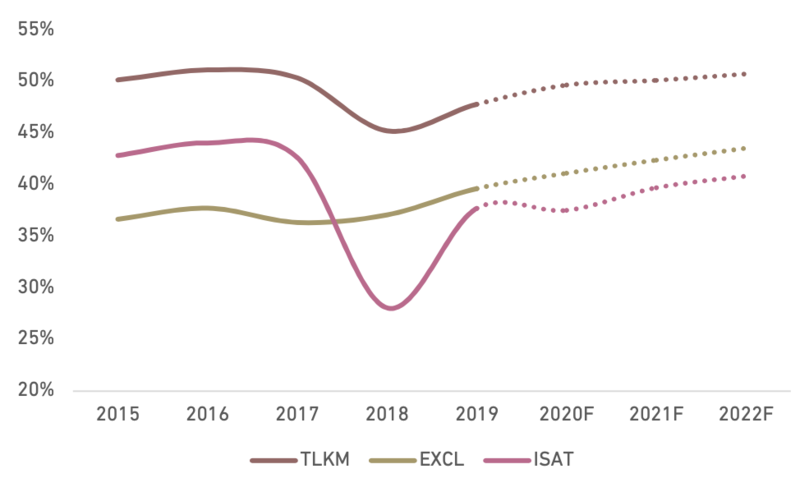

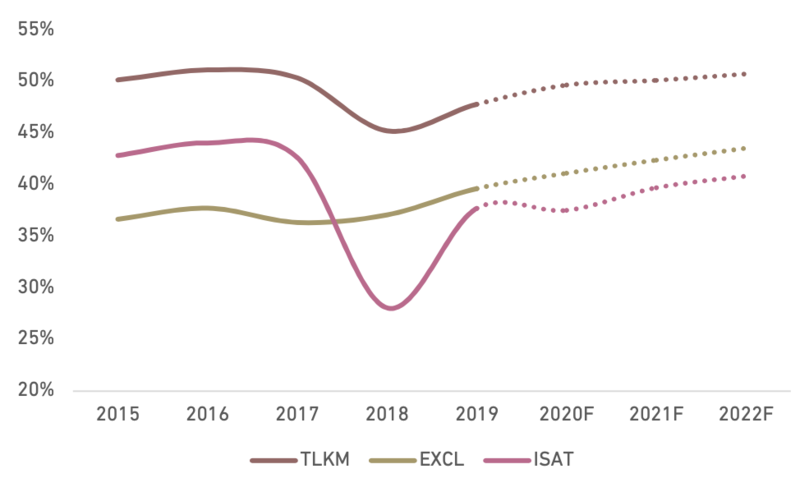

- Costs are generally well-contained

In addition to pushing top-line growth, telcos are embarking on cost efficiency program. Notwithstanding network cost increases due to the network expansions, costs saving opportunities could arise largely from: 1) tower leases renewals, 2) saving on site’s energy and power costs due to modernisation and closer monitoring, 3) lower marketing expenses as telcos are reducing on the ground activities and focusing more on digital marketing, 4) saving on third-party commission fees as telcos are pushing the adoption of in-house apps for reloads and buying data packages, and 5) leaner headcounts and more efficient G&As after rightsizing and business streamlining.

Exhibit 66: EBITDA margin of telcos (in %)

Source: Company, Ciptadana

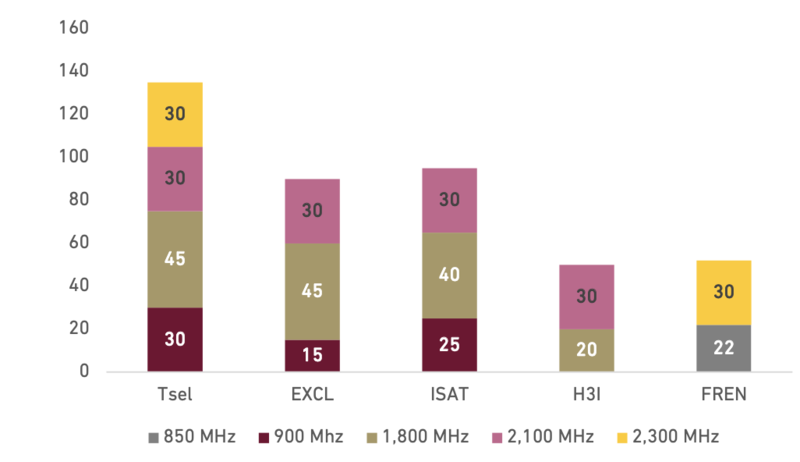

- The 2.3GHz spectrum auction and 5G rollout from spectrum perspective

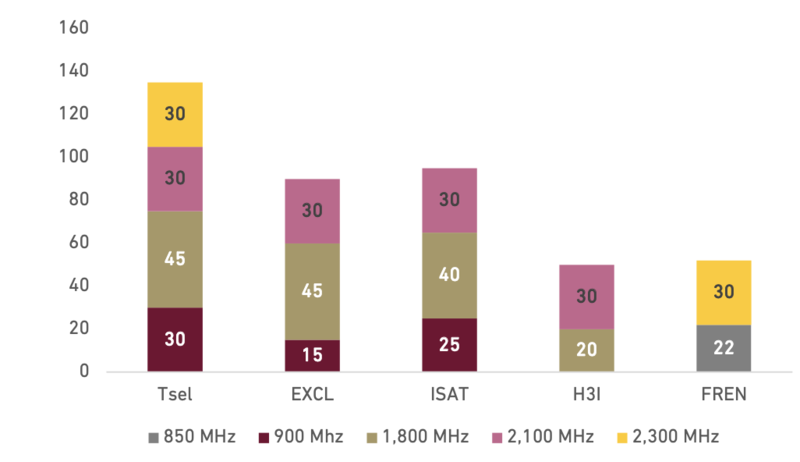

The rollout of 5G networks in Indonesia might take years to materialize. There are a lot of things to prepare, including the network design and architecture, technological aspect, infrastructure upgrade, use case development, and regulatory issue. From spectrum perspective, we believe it requires a few more years before 5G spectrum could be available. Rolling-out 5G would require a broad range of spectrum, spanning from the low-, mid-, and high- band spectrum to achieve the balance of capacity and coverage. However, those spectrums are not readily available at the moment. The ideal low band spectrum (700 MHz) is currently utilized for analogue TV. This could only be freed-up after the process of analogue switch-off (ASO) has been completed. On the proposed omnibus law, ASO is targeted to complete in two years after the passing of the bill which would mean in 2022, though we still see potential delay. Meanwhile the high band of 3.5GHz is currently used for satellite services in Indonesia, including Telkom, and BRI Satellite. The contract expiry for those satellite vary but they run a long term contract until 2031-2034. We believe it would require a lot of efforts and negotiation time to clean up and optimally utilize the 3.5GHz for 5G rollout. While the mid band spectrum, currently the 2.6GHz is already awarded to IPTV to run its DTH TV service under Indovision brand. The spectrum rights will expire in 2024.

Another possible mid band spectrum is the 2.3GHz. The MICT is currently in the process of auctioning 30MHz quantum of the 2.3GHz band spectrum. Currently, Tsel and FREN are holding 30MHz of 2.3GHz spectrum each. Therefore, we think they will have the biggest incentive to outbid others for the spectrum. This is to form a contiguous 60MHz of bandwidth that is also ideal for 5G rollout and would enable the spectrum winner to have an edge in the market. Considering the financial capability of the two, we expect Tsel would win the auction. We expect the spectrum cost would be similar to the fee paid by Tsel in Oct 2017 auction which required Rp2-3 tn payment, including the acquisition and other upfront fees.

Exhibit 67: Spectrum Holdimg (in Mhz)

Source: Company, Ciptadana

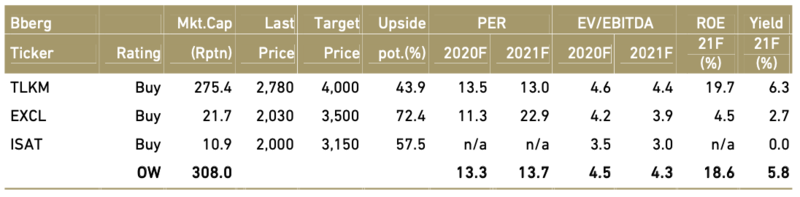

- OVEWEIGHT rating on the sector with TLKM as our top pick

Amid the still intense competition outlook, we estimate the sector to deliver mid-single digit growth with some margin expansions in 2019-22F. We are OVERWEIGHT on telcos as the sector should be able to provide a more stable earnings profile with good visibility, compared to other sectors, as have been demonstrated in 1H20. Our top pick is TLKM as it would remain the most profitable telcos with defensive profile thanks to its scale and unparalleled network. Despite its mobile business (Tsel) may be lagging peers, we see potential upside from the fixed broadband and enterprise business in 2021F. Current valuation is also attractive at 4.4x 2021F EV/EBITDA (lower than -1SD) and 6.3% dividend yield in 2021F.

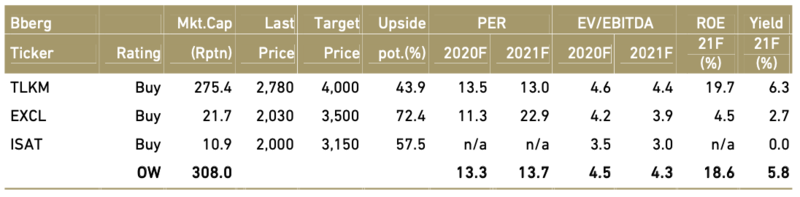

Exhibit 68: Telecom stocks rating and valuation