Banking

Overweight

Sector Outlook

- 2018 would be an upswing in credit cycle

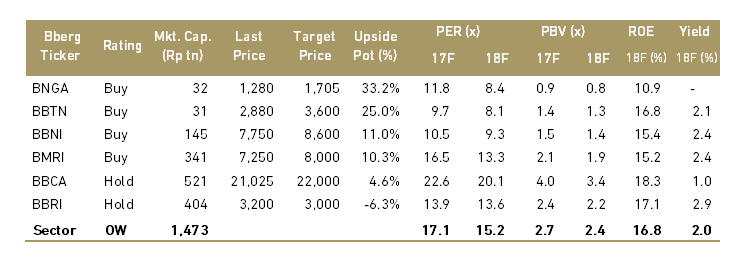

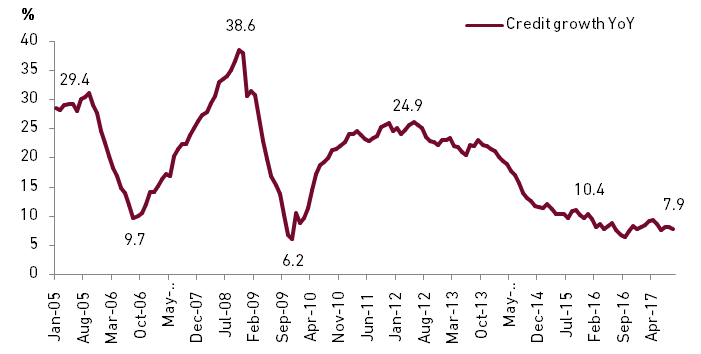

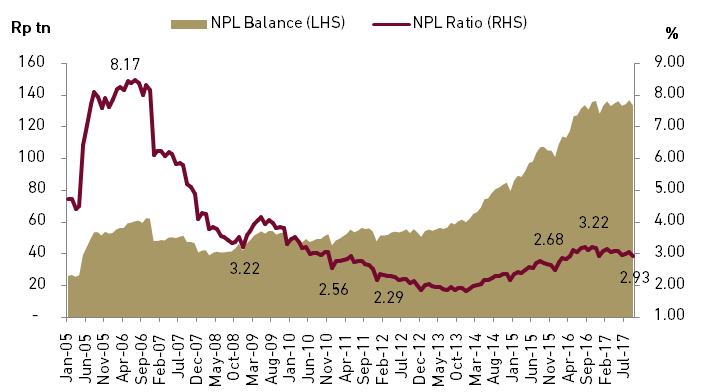

Banks went through weak credit cycle from mid-2015 to 2017 on weak economy and rising non-performing loan (NPL). Many of the policy tone was very expansive to push the lackluster credit growth (i.e 200 bps rate cuts in 2016-2017, LTV relaxation in 2016, asset quality relaxation in 2015-2017); but elevated NPL and weak loandemand still hampered credit growth in 2016-2017.We believe that credit growth is already bottoming,most of banks have seen the peak of NPL and loan demand should pick up on the back of lower rates and better economy in 2018F. At the moment, industry NPL stands at 2.93% as of Sep-2017, much improved compared to the peak of 3.22% in Oct-2016. Hence we expect 11-12% credit growth for 2018F, slightly going up compared to our expectation of 8-9% YoY in 2017F.

Exhibit 24: Weak credit cycle should come to an end

Source: OJK and Ciptadana Sekuritas Asia

- Room for more decline in credit cost

Credit cost has eased from 2.5% to 2.1% in 9M17 for banks under our coverage. Although credit cost decreased, banks manage to increase their NPL coverage ratio level by an average of 950 bps YoY to 139%. With this higher level of coverage, coupled with lower new NPL formation going forward, we believe there should be room for more decline in credit cost to 1.7% of average loanin 2018F.

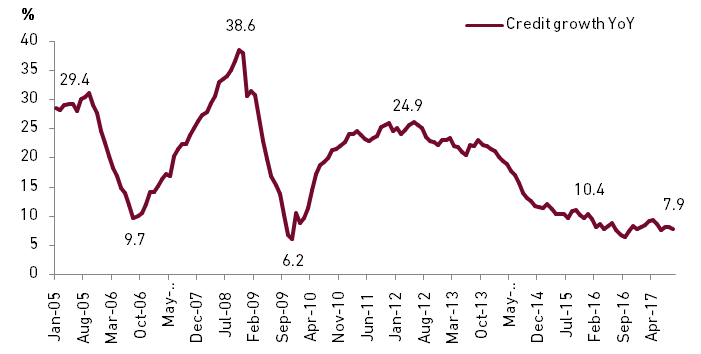

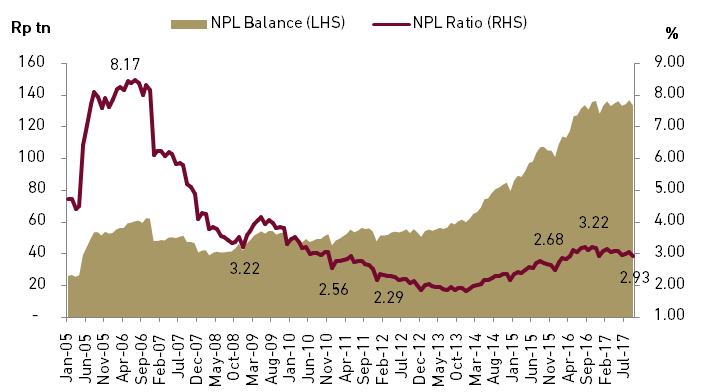

- Muted impact of expired OJK’s relaxation on asset quality

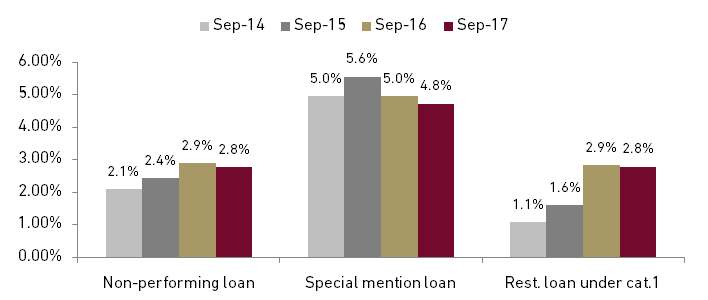

Some investors put concern on the impact of expired relaxation on asset quality. We believe it has muted impact as the big banks has already provided provision and downgrade loan based on 3 pillars conservatively before the relaxation expired. The encouraging data is that loan at risks (the sum of NPL, special mention loan, and restructured loan under category-1) has stabilize (exhibit 3) with restructurization loan under category-1 is on decreasing trend.

Exhibit 25: Non-performing loan has stabilized

Source: OJK and Ciptadana Sekuritas Asia

Exhibit 26: Loan at riskfor banks under coverage

Source: OJK and Ciptadana Sekuritas Asia

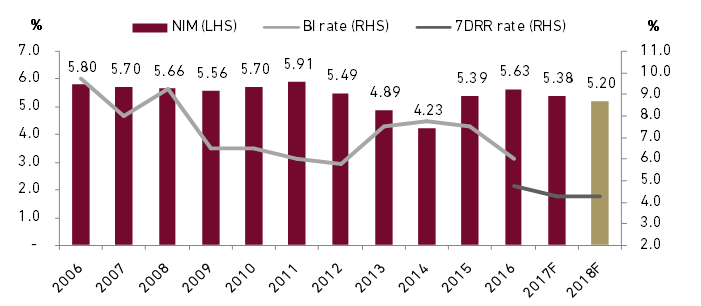

- Lack of NIM upside in 2018

Further lending rates decline in 2018F is likely due to the lagged effect of 50 bps rates cut in 2017. In addition, lack of strong recovery in credit growth means that loan pricing will not be high as banks try to maintain market share, putting even more pressure on lending rates.

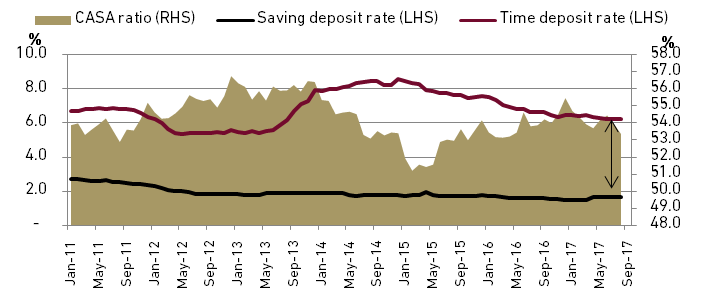

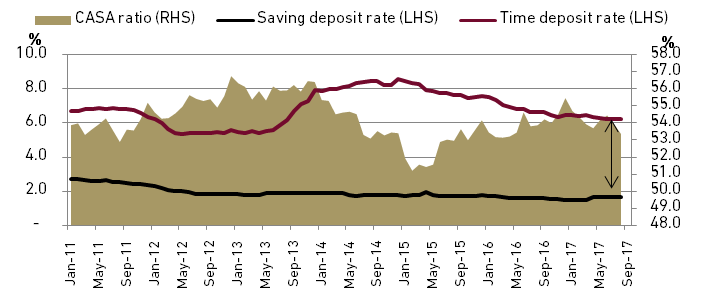

The relief is there are plenty of liquidity in the banks at the moment as deposit growth has outpaced the loan growth. We also believe that deposit competition will be less intense in 2018F as interest rate goes on a lower rate. The spread of time deposit and saving deposit is narrowing and should help CASA growth to outpace time deposit (exhibit 4). This will result in lower cost of fund, although the decrease will be less than 2016 and 2017 since it purely from change in funding mix.

Exhibit 27: Banking CASA ratio trend

Source: OJK and Ciptadana Sekuritas Asia

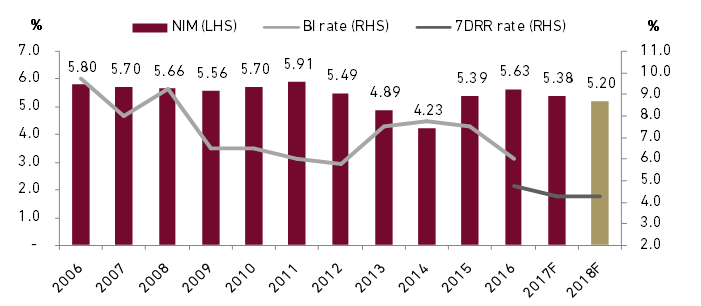

All in all, we expect banks NIM to fell to 5.2% in 2018F. At the moment, Indonesian bank’s NIM has just started to decline from 5.6% (BUKU IV banks 6.5%, non-BUKU IV4.9%) in 2016 to 5.4% (BUKU IV banks 6.0%, non-BUKU IV 4.6%) in 8M17.

Exhibit 28: Banking NIM trend

Source: OJK and Ciptadana Sekuritas Asia

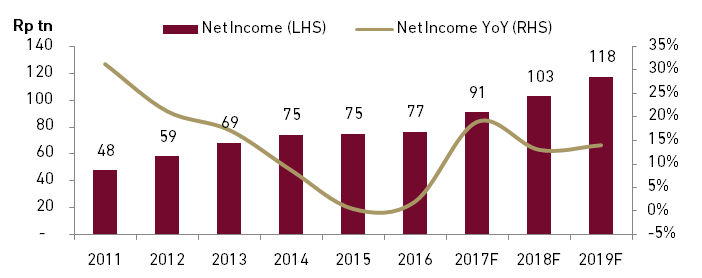

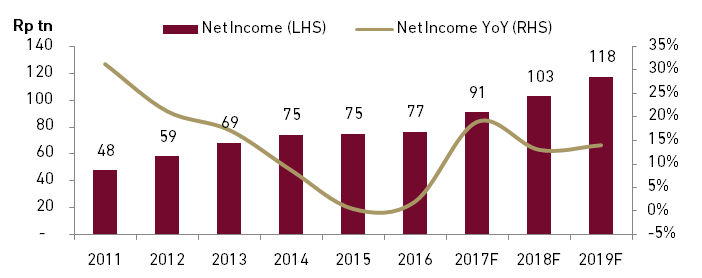

- Expecting mid-teens earnings growth

Incorporating double-digit loan growth and slightly declining NIM, we expect pre-provision profit to grow at low teens in 2018F. Other earnings upsidethat could help pre-provision profit to grow even higher are prominent, such as:cost efficiencies on office automation and reduction of high-cost branches, stronger recoveries income from marginally better economic growth, and gain from lower bond yield under low rates environment. Nevertheless the most significant boost would come from lower NPL which makes bottom line to grow on mid-teens level next year.

Exhibit 29: Net profit outlook for banks under coverage

Source: Companies and Ciptadana Sekuritas Asia

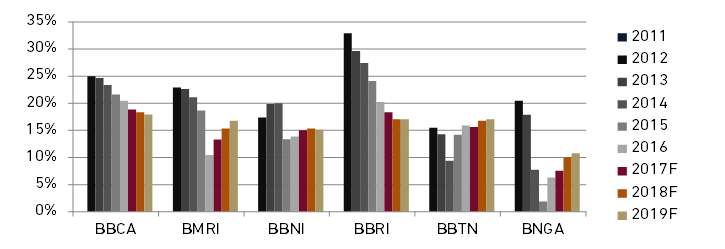

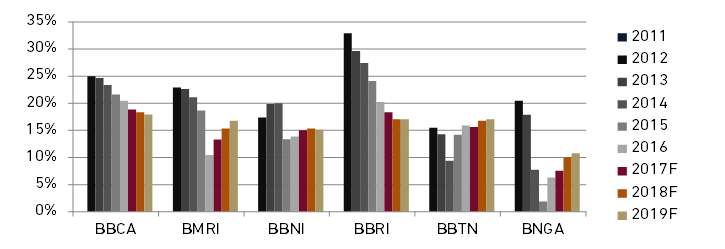

Exhibit 30: ROE outlook for banks under coverage

Source: Companies and Ciptadana Sekuritas Asia

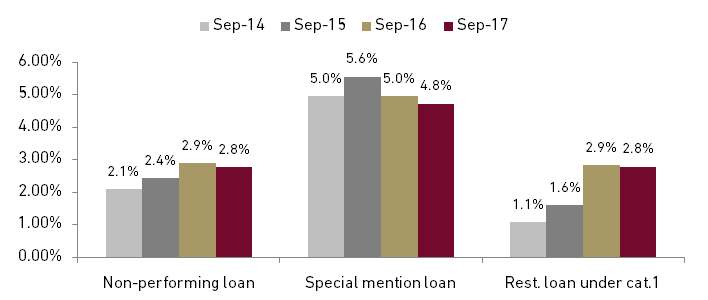

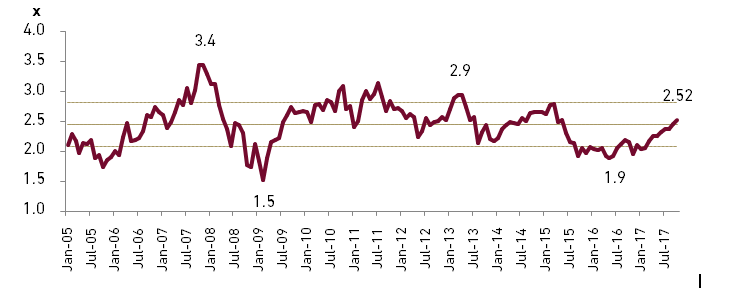

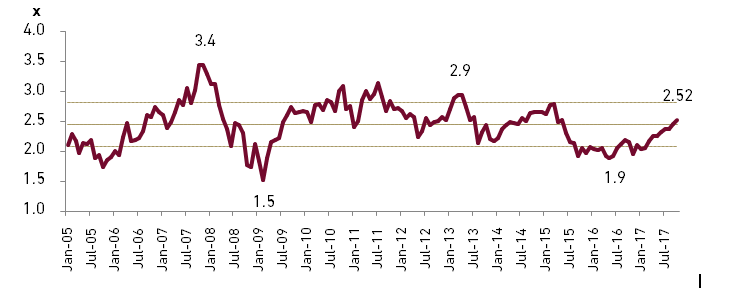

- Valuation not yet excessive

Both JAKFIN and big four banks has outperform JCI significantly by 14/19% Ytd Oct-2017, respectively, this is reasonable as they came from the lowest end of historical PBV range of 1.9x at the start of 2017. At the moment, big four banks forward PBV trades at 2.5x or slightly above the average of 2.4x. For 2018F we continue to overweight banking sector considering the earnings recovery. In the big four we like BBNI and BMRI on its better earnings upside and more attractive valuation. In the smaller banks our top pick are BNGA and BBTN. We like BNGA on its turnaround story and BBTN for its better profitability from government housing program.

Exhibit 31 a: Big four banks forward PBV

Source: Bloomberg and Ciptadana Sekuritas Asia

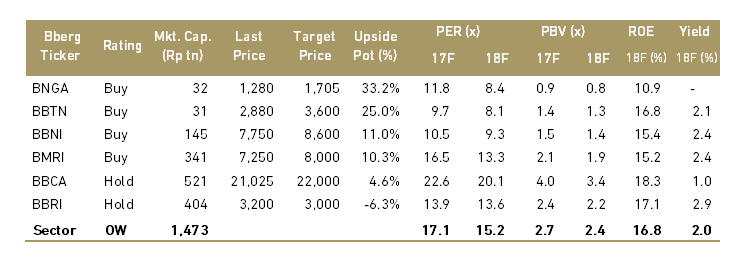

Exhibit 31 b: Banking sector valuation