Infra budget still increase despite lower government revenue

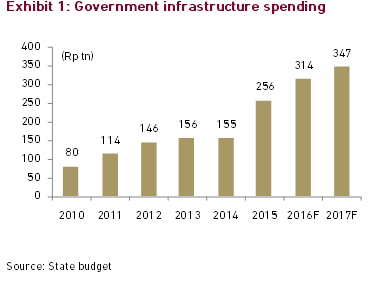

Incorporating the sluggish global economic recovery and low commodity prices, the government set lower state revenues of Rp 1,738 tn in 2017 or 2.7% lower than the target in the revised 2016 budget. However, total spending for infrastructure is budgeted at Rp337 tn still grow by 11% YoY. With infrastructure development placed high on the nation’s economic agenda, all the ministries concerned with infrastructure projects have seen their budget increase. The budget for the Ministry of Public Works and the Ministry of Transport and are each lifted by 9% and 14% , respectively. Some of the infrastructure projects targeted in the 2017 state budget include the construction of 815 km of roads, 9,399 km of bridges and 14 new airports. We believe 2016 would be another significant year for the construction sector since that most infrastructure projects are expected to forge ahead since we need infrastructure development to go on and spur future growth.

New contracts picking up strongly

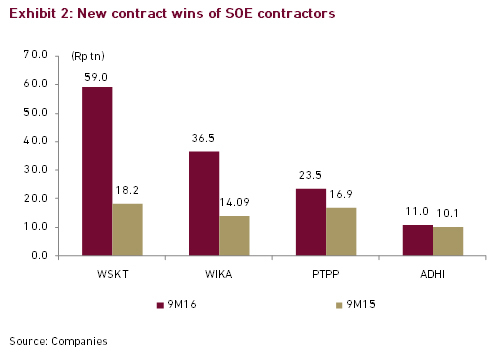

The four SOE contractors under our coverage (WSKT, WIKA, PTPP and ADHI) booked average increase of 119% YoY in new contracts in 9M16 to Rp130 tn compared to Rp59.3 tn in 9M15. WSKT took the lead and delivering the strongest new contract wins growth of 224% YoY to Rp59 tn. This is followed by WIKA which booked new contract growth of 159% to Rp36.5 tn. Meanwhile, the Ministry of Public Work has spent 55.8% of its budgets at end of first-week of Oct-16, which was better than the same period in last year of 42.9% We believe government project to continue rising , in line with historical government total expenditure which is historically back-end loaded, picking up towards the year-end.

Capital injection to boost expansions

Following parliament’s approval, four publicly listed state-owned enterprises (SOE) have announced rights issues to raise funds for expansion, which contain the state capital injections allocated in the revised 2016 state budget. The companies including construction firms PT Pembangunan Perumahan (PT PP) and PT Wijaya Karya (WIKA) , are slated to receive a combined Rp9 tn in state capital injections (PMN). This may simply offer confidence to the view that they will be taking on more business on stronger balance sheets, enabling both WIKA and PTPP to leverage its higher equity at end of this year. The expected proceeds from rights issuance will be Rp6.2 tn for WIKA and Rp4.4 tn for PTPP.

Valuation drops by 35% off the peak

Following their lagged performance against the whole market in 9M16 (with the exception of WSKT), the contractors’ forward PER decreased by 26% YTD to 16.7x, close to the historical average forward PER of17x. We believe this among others were caused by lower-than-expected new contracts and earnings results at ADHI and potential rights issue price of WIKA and PTPP at discount to market prices. We believe de-rated valuation presents a good entry opportunity in anticipation of acceleration in the execution of infrastructure projects in 4Q16 in-line with government spending seasonality and leading into 2017.

Expecting 39% net income growth in 2017

We expect the companies under our coverage to book net income growth of 35% CAGR in 2016-18F period , following higher new contract wins coupled with robust backlog order in 2016-18F. We forecast new contracts in terms of value will increase by 38% in 2016F to Rp114 tn and by 36% to Rp143 tn in 2018F. This will be supported by 1) rising government infrastructure spending, 2) early tender held by ministry of Public Work, and 3) contractors stronger balance sheets post capital injection in 2015 and 2016.

Our top picks

We continue to like contractors with 1) high exposure to government infrastructure projects, 2) higher earnings visibility and 3) attractive valuations. We select PTPP (PTPP) and Wijaya Karya (WIKA) our top picks in the sectors since the counters have high earnings visibility on its largest order book. All of our top picks performance has lagged the whole market on budget cut issue and planned rights issue at PTPP and WIKA . Overall, we have Buy rating for PTPP, WIKA, ADHI, WSKT, WTON, TOTL and Hold rating for NRCA. We maintain our Overweight stance on construction sector.