Economic Outlook

Covid-19: enigma to global economy

Since its first occurrence in late 2019, Covid-19 has wrecked the world. The number of lives taken now exceeds 1 mn and the number of infections is already above 33 mn globally, of which 60% are in developing countries. The condition sustains the uncertainty that 2019 left to 2020. Thus, there are three major issues triggering world’s uncertainty that we see will remain in 2021: the pandemic, de-globalization and US – China dispute. However, the current ups and downs of economic recovery including the progress of vaccine rekindle hope towards the prospect of global economy. Though global economic growth is estimated to decline by 4.9% YoY in 2020, it is expected to soar by 5.4% YoY in 2021.

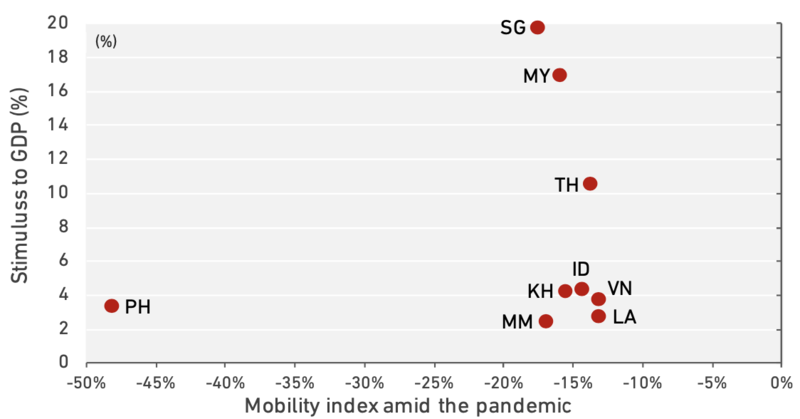

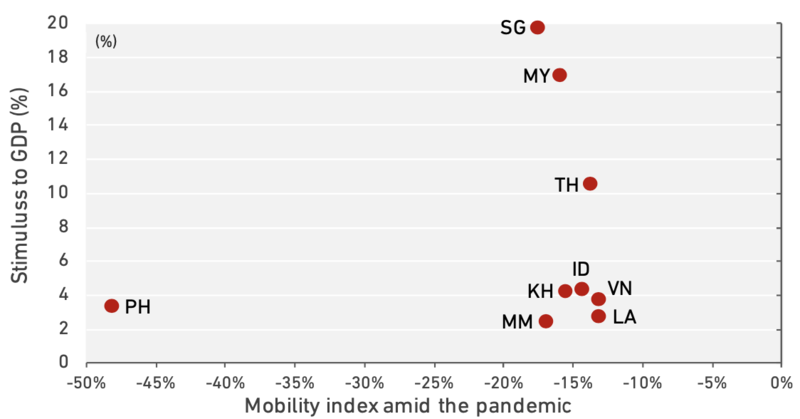

- Pandemic containment in SEA

Covid-19 containment measures like lockdowns and international travel bans were imposed by all ASEAN countries. Despite of our large-scale social restriction (PSBB) in mid Mar-20, Indonesia becomes country with most 20 confirmedCovid-19 cases in ASEAN. We see the combination of strict 18 lockdowns and those highly exposed to international travel will face harder 16 comeback to their pre-Covid levels of output until 2021. Though the stimulus is 14 relatively low compared the ASEAN5, we’ve been more optimistic about Indonesia’s trajectory given better mobility and macroeconomic indicators.

- Stronger post-crisis emergence

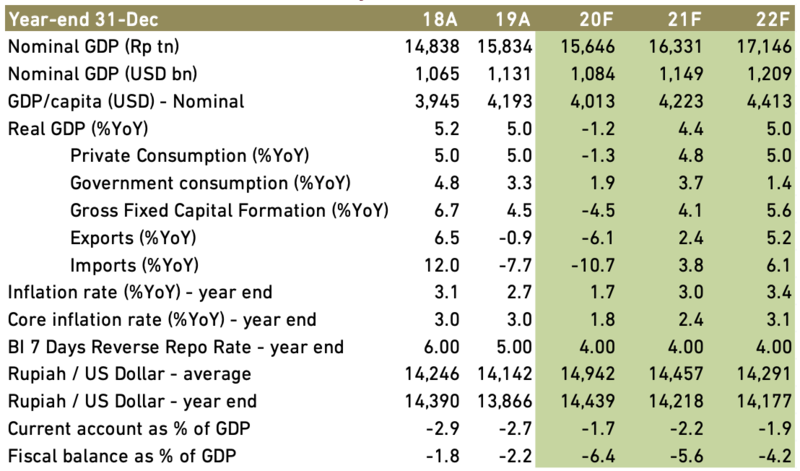

Indonesia is preparing for a strong post-crisis emergence. The government may be denial on its first response to Covid-19 but it has acknowledged broad actions to tackle the downside risks afterwards. Compared to the peers, the external sectors are not the key drag of Indonesia under the pandemic, but it is more due to the collapse of domestic demand. As the domestic demand share of GDP in 2020 and 2021 is around 54%, we see the demand side stimulus and the better condition in 2021 will reverse the expected Indonesia economic growth from -1.2% YoY in 2020 to 4.4% YoY in 2021.

Exhibit 1: Global Economic Growth Forecast

Source: IMF

Exhibit 2: Responses in tackling Covid-19 in SEA

Source: Google Mobility Report, Bloomberg, Ciptadana estimates

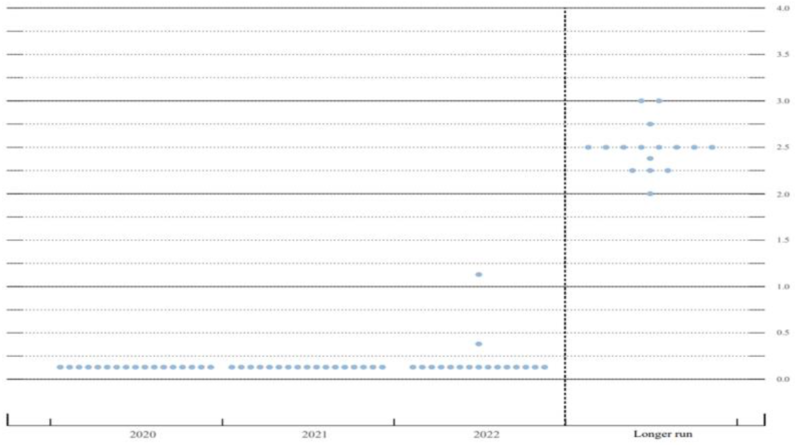

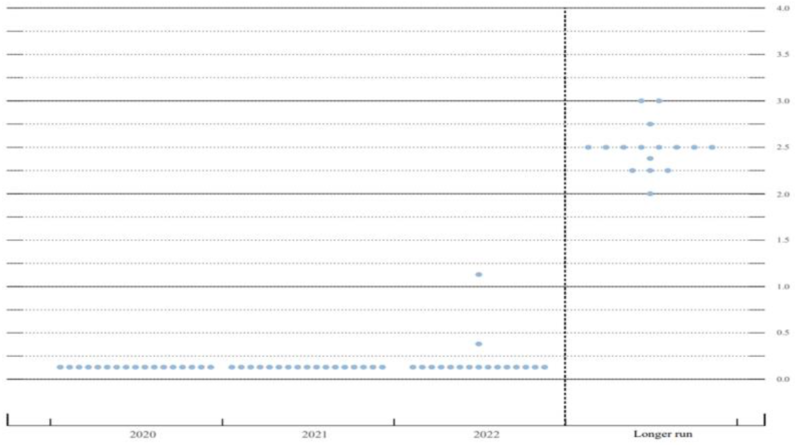

Emergency break for interest rate

The Federal Reserve unexpectedly cut Federal Funds Rate (FFR) to combat the economic slowdown due to the pandemic. It was the first emergency rate cut since the Global Financial Crisis (GFC) in 2008, as well as the first of this size since then. There were 2 times of FFR cut in Mar-20 each from 1.75%-1.5% to current level at 0.25%-0%. The Fed expects to leave FFR near zero for years through at least 2023 and will tolerate higher inflation in order to revive the labor market and economy. Thus, it triggers worldwide interest rates go lower.

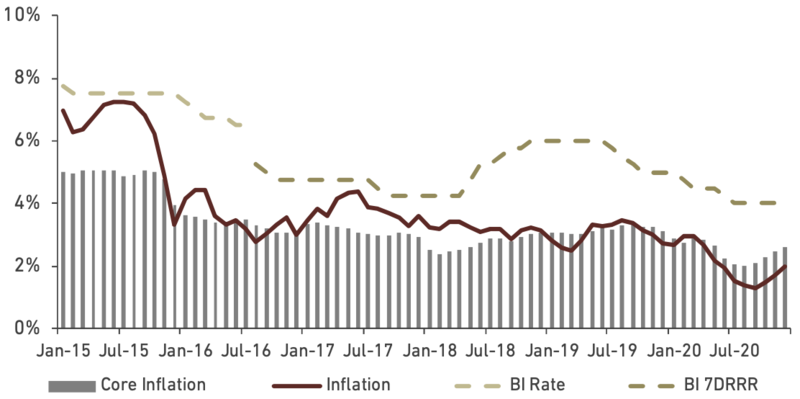

Similar, Bank Indonesia (BI) has cut BI-7DRRR by 100bps so far to 4%, which is the lowest in two years. However, in general, monetary policy loses its effectiveness as expansive fiscal policy is much more needed amid the crisis that hit the demand side. Thus, keeping the rate unchanged until the economy restarts is wise to store monetary ammunition when it is needed. Ergo, we expect BI will hold the rate at 4% until 2021 without ruling out the possibility of it getting lower in 1H21 as BI may do the rate cut to fuel up the growth in 2H21.

- Wider room for BI-7DRRR cut

Regardless we expect the rate remains at 4% until 2021, we spot wide room for BI to have mild rate cut. Indonesia real interest rate is around 3.7% or relatively high compared to our peers given the inflation that stays low until YE 2020. Trade surplus (is expected at USD111 mn in YE 2020) remain though the size will get narrower in line with the recovery of domestic manufacturers that require imported goods. The higher expected forex reserves in 2021 also provide room for the rate cut. We also see some banks are reluctant to cut interest rates due to risk premium and the transmission lag of the rate cut.

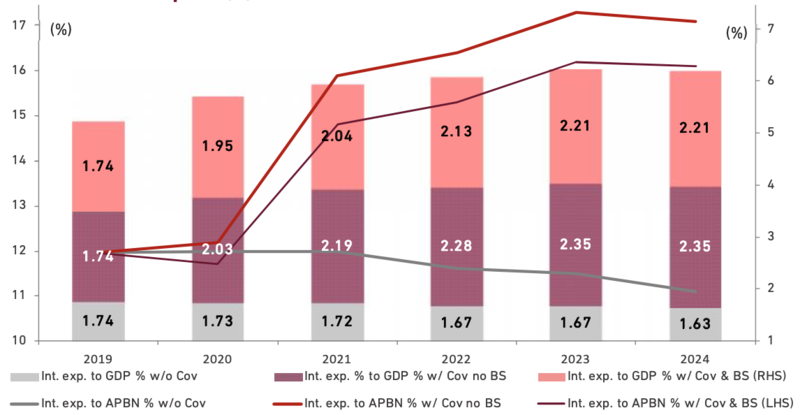

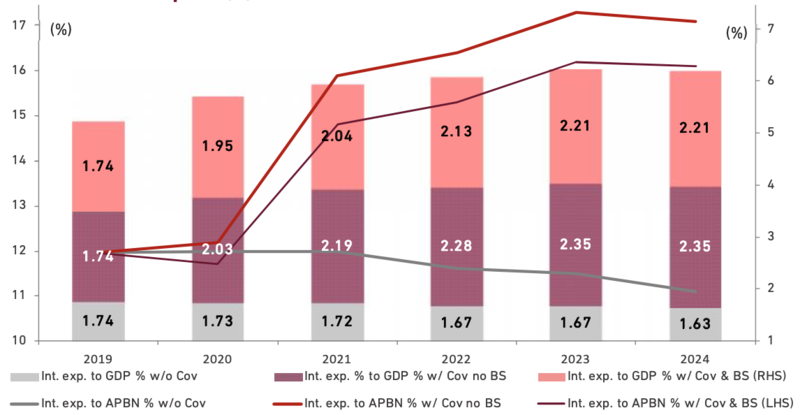

- Burden sharing to remain in 2021

According to Government Regulation (PP) 23/2020 on National Economic Recovery (PEN), the government and BI have agreed to implement burden sharing (BS) scheme on debt worth Rp574.6 tn (USD39.7 bn) for PEN program. The government will bear 4.3%-7.4% less interest expense in State Budget (APBN) until 2021. However, deterioration in debt affordability will emerge afterwards. All in all, we see BI is still on track and do the right for economy.

Exhibit 3: FOMC participants view on future monetary policy

Source:The Fed

Exhibit 4: Interest expense (%) to GDP & APBN under BS scheme forecast

Source: MoF

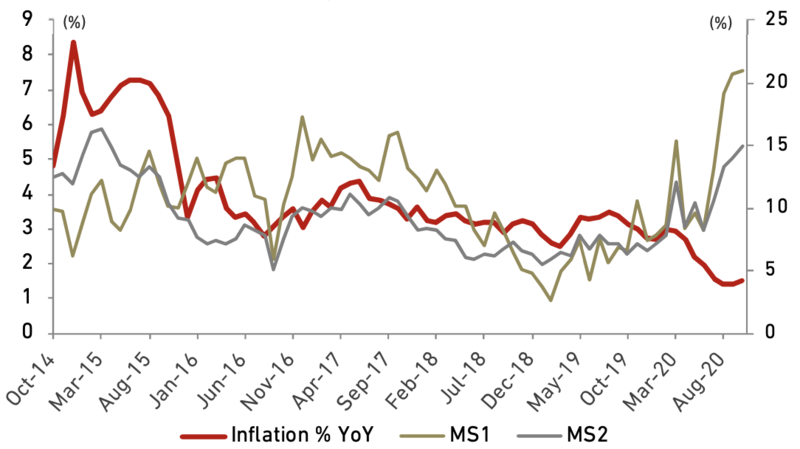

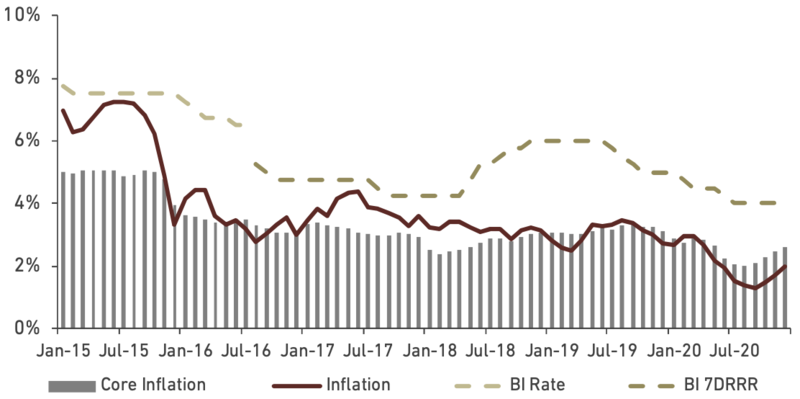

Temporary deflation, manageable inflation ahead

The inflation edged down to the lowest in 20 years due to the low demand amid the Covid-19 pandemic where it plunged to 1.4% YoY in Sep-20, followed by three-month consecutive monthly deflations. Households tend to save more to avoid uncertainty in the near future due to the pandemic where food prices and transportation tariffs tumble the most. We expect the low inflation stays longer despite some festivities in 4Q20, the previous muted Ramadan effect may indicate the other muted impact of festivities on inflation subsides. We expect inflation to stay low at 1.7% YoY in 2020 as the improvement of the economic activity and the realization of fiscal stimulus may ease the deflation ahead.

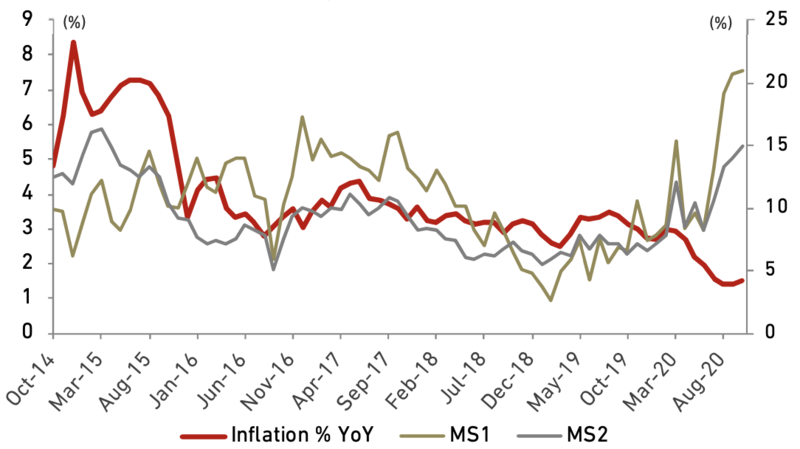

Under the unusual inflation, we see the chicken culling program and the end of harvest season for some commodities may escalate price of food basket as both commodities contribute dominantly all this time. Starting Jan-20, Indonesia Consumer Price Index (CPI) calculation changed its methodology to adapt with new consumption pattern. It included ride-hailing tariff and makes voucher/internet related price to be the 5th biggest weight in CPI calculation. As everything goes online, internet related price may contribute to inflation. Besides, we see transportation tariffs will soar once more as PSBB loses its effectiveness to halt people mobility over time. Liquidity injection, previously moved in the same pattern, will likely to impact the inflation with lag and increase the inflation eventually. Thus, we remain confidence the price will pick up, even if limited, to 3% YoY in 2021 or within BI’s target at 3±1% YoY.

- Right time for debt monetization

There are some risk occur related to BS scheme which usually materialize within two months lags to inflation. It may trigger inflation to soar and weaken the exchange rate. In addition, BI will hold some risks associated with the more substantial percentage of national debt and issue on its independence. However, we see the policy is implemented at the right time, with low inflation regime alongside with the weak demand that will not get back to the pre-Covid levels in 2021. Yet, we believe this will not be translated into further rate cut. BI has emphasized that it will support the economy via the quantitative channel while maintaining the aggregate price.

Exhibit 5: Inflation and policy rate estimates

Source: BI, BPS, Ciptadana estimates

Exhibit 6: Inflation and money supply growth YoY estimates

Source: BPS, Ciptadana estimates

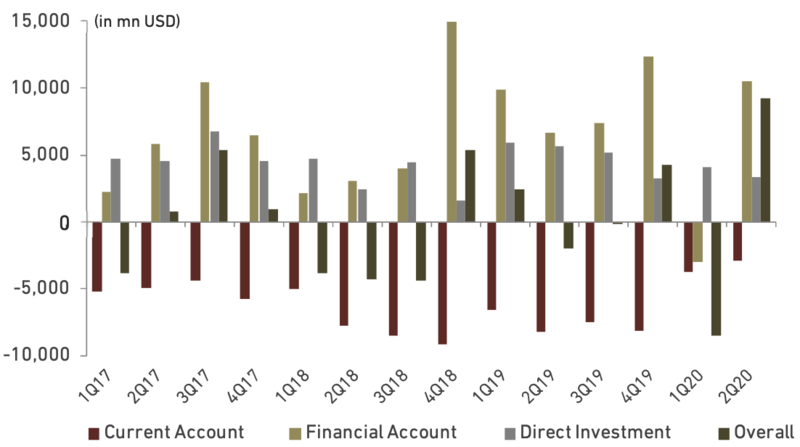

Maintained external resilience

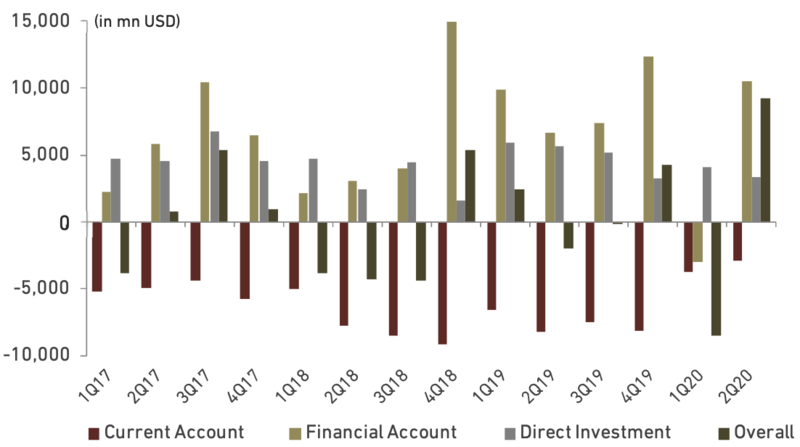

Since late 2011, Indonesia recorded current account deficit (CAD) and it has remained in deficit ever since. In 2Q20, CAD was recorded at USD2.9 bn (1.2% of GDP), lower than the deficit in the previous quarter of USD3.7 bn (1.4% of GDP). The decline in CAD stemmed from a surplus in the goods trade balance due to lower imports as domestic demand weakened. Besides, CAD narrowed due to declining payment of yields to foreign investors after domestic economic growth contracted in 2Q20, as reflected by the decline in performance of companies and investment. However, we see the CAD will go deeper from our estimation at -1.7% of GDP in 2020 to -2.2% of GDP in 2021. CAD prevails as domestic industries are heavily dependent on imports and payments to foreign investors will rise as the economy revives.

- Large surplus on BoP, manageable debt

Surplus on balance of payment (BoP) in 2Q20 was the largest BoP surplus under President Joko Widodo’s cabinet at USD9.2 bn. Of course, it was mainly made up of inflows of a surge of portfolio investment inflows. It was primarily attributable to the issuance of global bonds by the government and corporate. In 1H20, Indonesia external debt was recorded at Rp5,264 tn (USD354.2 bn) or 32.9% of GDP – under assumption the GDP at Rp15,972 tn (USD 1,074 bn). We see the debt ratio will hover around 40±1% of GDP until YE 2020 as Ministry of Finance (MoF) is planning to raise Rp900.4 tn (USD61.1 bn) from the government bonds issuance in 2H20.

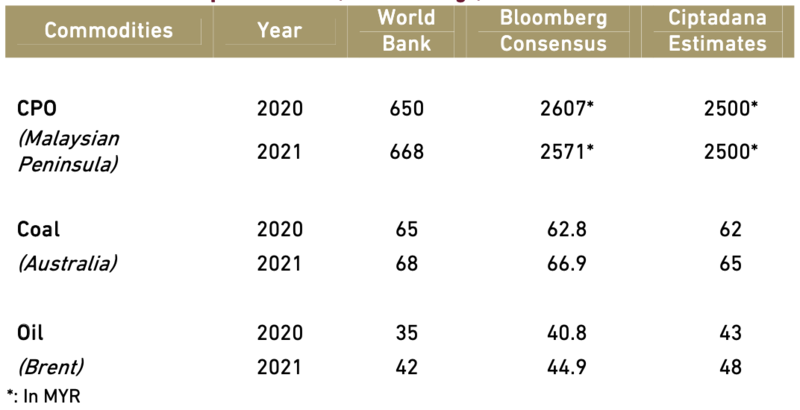

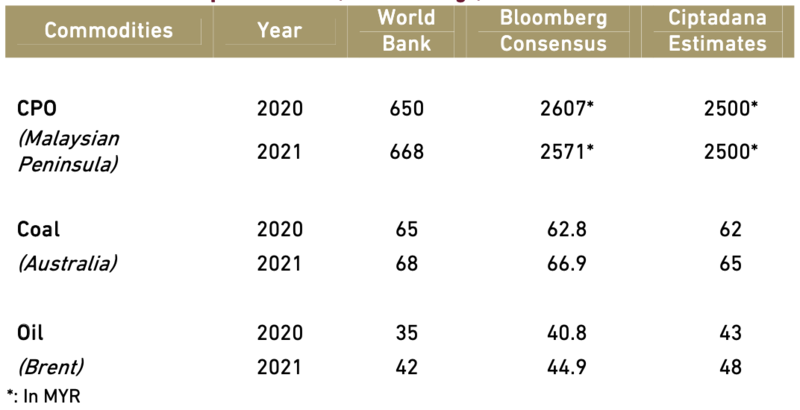

- Remarkable trade reversal

In Jul-20, Indonesia recorded the second highest surplus at USD3.26 bn from the highest surplus at USD3.57 bn since Aug-11. Lockdowns and the weakening demand for imported goods generate serious trade surplus at USD10.9 bn YtD. We see the surplus remains but smaller to USD0.11 bn in YE 2020. Not for long, as the manufacturers grow stronger in 2021, trade deficit will occur as we expect the import will grow at 3.8% YoY or bigger than the growth of export at 2.4% YoY in YE 2021. Unfortunately, the commodity price downtrend in 2020 deteriorates Indonesia trade performance as commodity is around 60% of our exports. Based on our estimation, we see the performance will get better as the commodity prices hike will be seen in 2021.

Exhibit 7: Balance of payment

Source: BI

Exhibit 8: Commodities price forecast (annual average)

Source: WB, Bloomberg, Ciptadana estimates

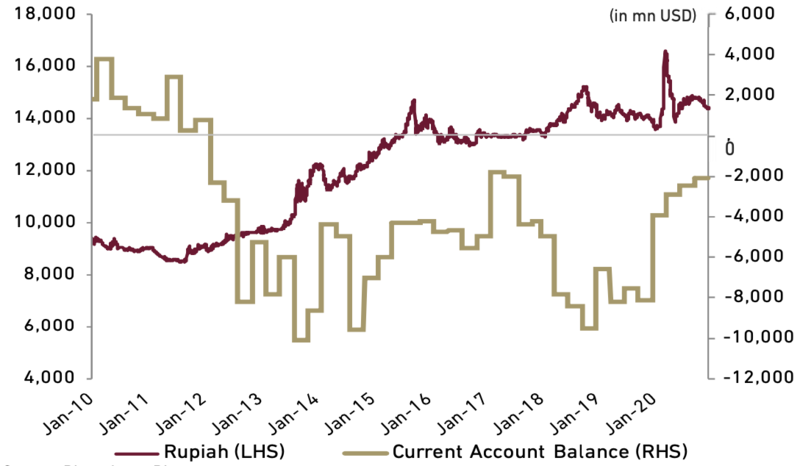

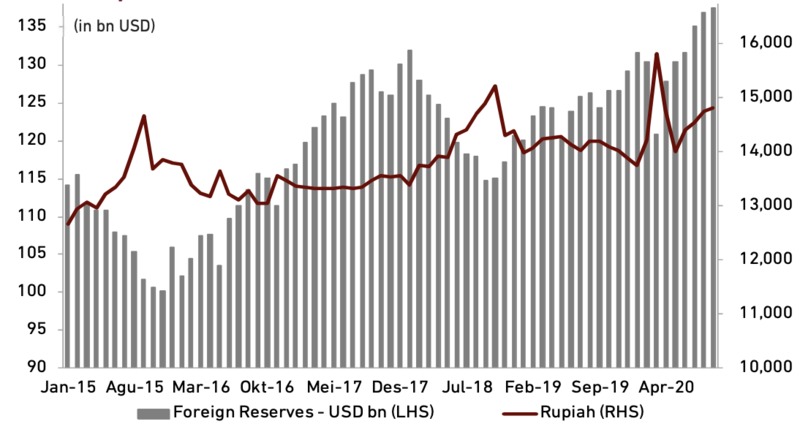

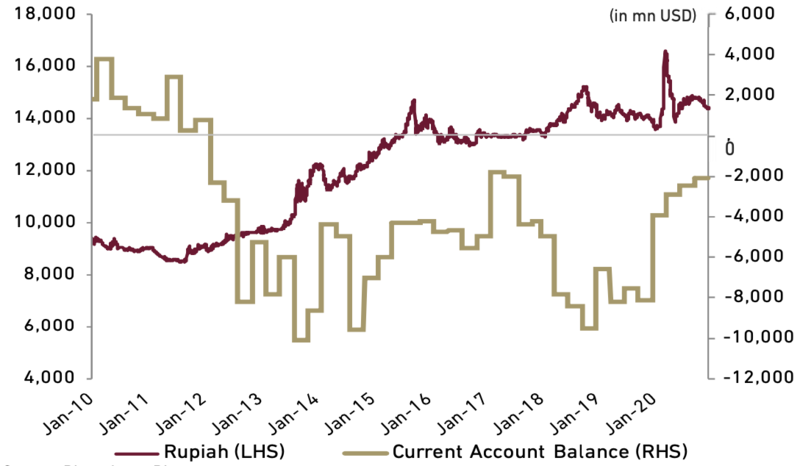

Mild strike on rupiah

Dramatically, rupiah depreciated in Mar-20 amid capital outflows from emerging markets. However, it has since clawed back some of these losses. It was recorded at Rp14,840/USD in the end Sep-20 where it has appreciated by 11.4% from its highest level at Rp16,575/USD in Mar-20. We expect in YE 2020, rupiah will reach Rp14,439/USD in 2020 and appreciate more to Rp14,218/USD in 2021 as the current gauge of market fear is temporary following the more conducive economic condition. Nevertheless, the currency volatility will follow the development of Covid-19 cases in Indonesia.

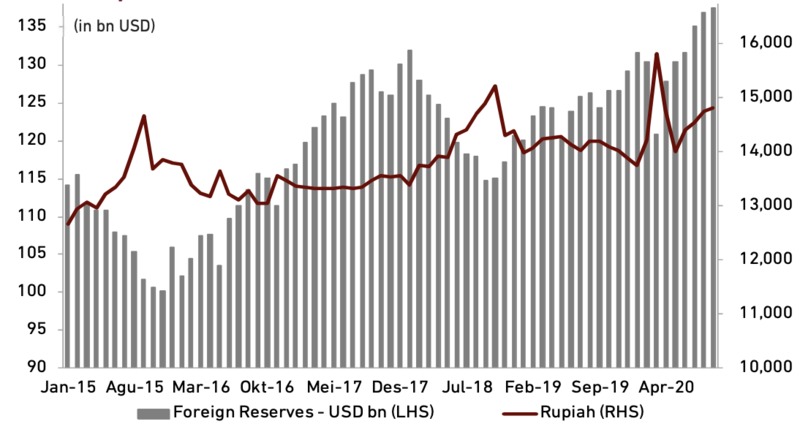

The rate cut disincentives people to save rupiah on the bank or in other word money supply will increase; makes it loses its value. Thus, we expect BI-7DRRR will stay longer at 4% in order to stabilize the currency. The smaller CAD will keep rupiah from dive down deeper as we expect it will be at -1.7% and -2.2% of GDP in 2020 and 2021 consecutively or smaller than CAD in previous years. Besides, the massive bonds issuance builds up foreign exchange (forex) reserve more. It was a record high, surpassing the previous highest record reserves all of time in Jul-20. In Aug-20 it was at USD137 bn, sufficient to support 9 months of imports and payments of the government’s short-term debts.

- Sentiment plays bigger role on rupiah

Currency imbalances should be expected during periods of high resident (corporate) foreign currency demand, such as in the forthcoming interim dividend repatriation season, which usually happens in Nov-20. We expect FDI inflows will anchor the current account in 2021 although portfolio inflows to local currency bond market stay low until the YE 2020 as foreign investor appetite for government bonds has apparently been held back by concerns over issues especially the rising Covid-19 cases in Indonesia. We remain confident that the vaccine progress in 4Q20 will bring positive sentiment alongside with the Omnibus Law. The obvious preference of the government for the “mini” lockdowns over the stricter lockdowns somehow desist market to fall deeper in short run as well.

Exhibit 9: Rupiah and current account balance estimates

Source: Bloomberg, BI

Exhibit 10: Rupiah and forex reserves

Source: Bloomberg, BI

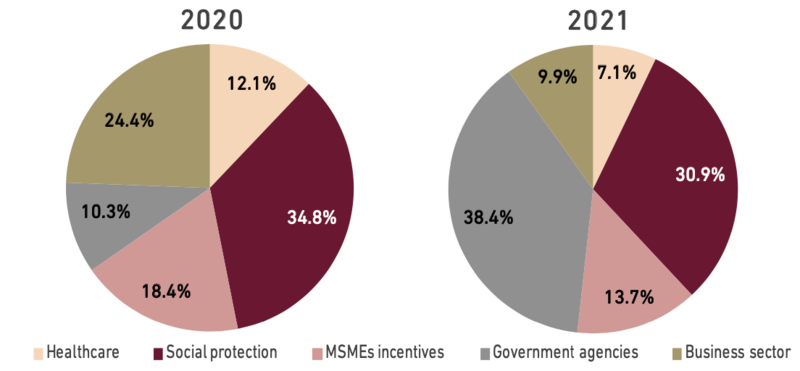

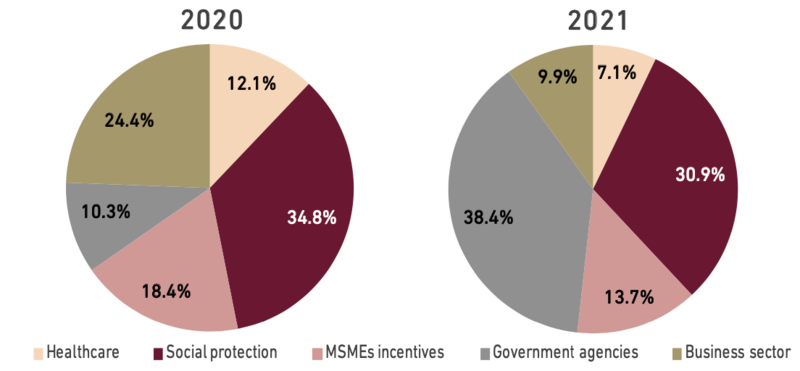

Battling Covid-19 through fiscal policy

Under the crisis that hit the demand side the most, expansive fiscal policy is a must. In order to do so, the government set a budget deficit at 6.3% of GDP amid plunging tax revenue and a widening state budget deficit. As much as Rp695.2 tn (USD49.6 bn) is allocated for National Economic Recovery (PEN) program 2020 and Rp356.5 tn (USD24.1 bn) for 2021 to cushion the impact of the pandemic. It comprises stimulus for: 1) social protection (2020: Rp242,01 tn & 2021: Rp110.2 tn), 2) MSMEs incentives (2020: Rp128,05 tn & 2021: Rp48.8 tn), 3) healthcare (2020: Rp84,02 tn & 2021: Rp25.4 tn), 4) government agencies (2020: Rp71,54 tn & 2021: Rp136.7 tn) and 5) fiscal incentives for business sector (2020: Rp116.05 tn & 2021: Rp35.3 tn). Realization of the stimulus is daunting as it has only reached 43.8% in 3Q20. Bureaucracy and classic problematic citizen data base are the main obstacles to accelerate the stimulus realization. We are optimistic that the realization can achieve 100% in YE 2020 as the government has the flexibility to allocate the stimulus to the posts that need the most especially the social protection.

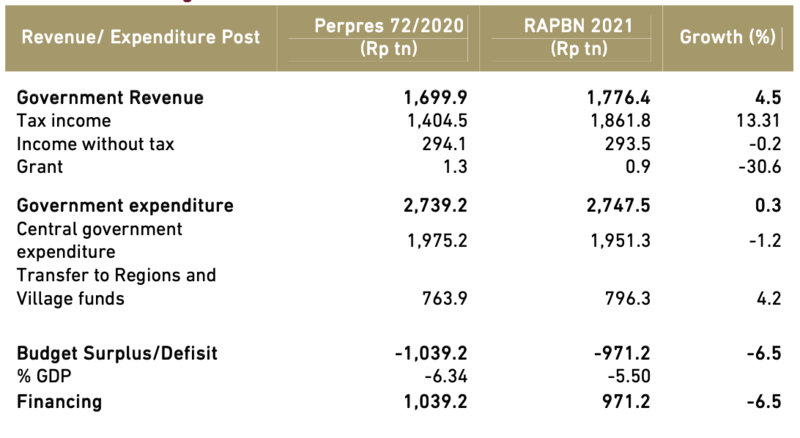

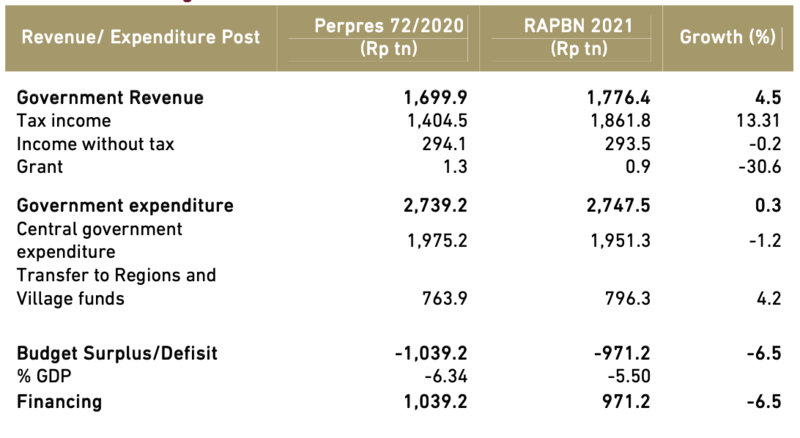

- Continued spending in prioritized sectors

Ministry of Finance (MoF) allocated Rp2,748 tn (USD185.2 bn) in state expenditure to fuel the virus-battered economy next year. The government will continue with spending in priority sectors such as infrastructure (Rp413.8 tn, 47.3% YoY), tourism (Rp15.7 tn, 214% YoY), and new priority: food resiliency (Rp 104.2 tn). Dismally, we see there are more important budgets, pandemic-related, that should be prioritized more, unlike infrastructure and others. The unprecedented fiscal support to mitigate the pandemic will put a huge burden in APBN as MoF has allocated Rp373.2 tn on debt interest payment next year.

- Digging up potential revenue

MoF expects to collect Rp1,776 tn (USD119.6 tn) of state revenue in 2021. MoF will accelerate tax reform, widen tax base and put more goods into excise. Rising pressure on public finances as well as increased demands for fairer burden-sharing urges MoF to innovate in collecting potential revenue from new source such as digital companies that will be charged with 10% of Value Added Tax (VAT), generating Rp10 tn (USD707.5 mn) of potential income. Taxing the digital economy is not an easy matter but the effort to start the taxation on this field is necessary especially amid the tax revenue contraction.

Exhibit 11: Share of stimulus to total PEN allocation in 2020 and 2021

Source: MoF

Exhibit 12: State budget for 2020 and 2021

Source: MoF

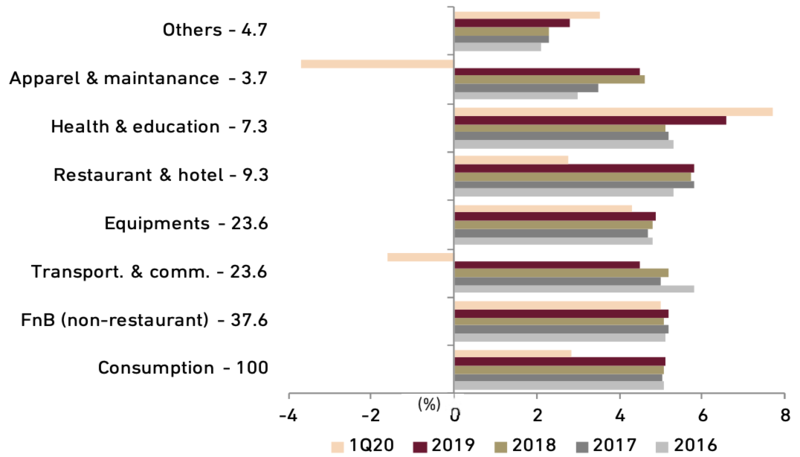

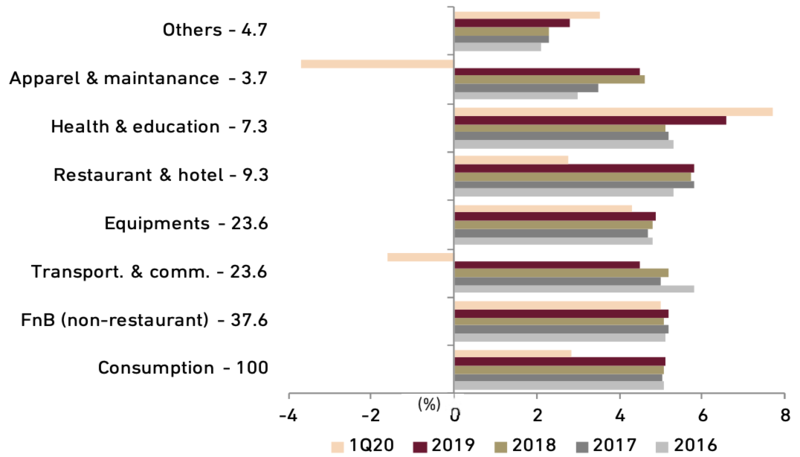

Boost the consumption, rekindle the economy

Consumption is precarious amid the pandemic as people tend to save more under the high uncertain period. Household consumption is the main driver of growth as it contributes 54.3% to GDP. Household consumption is predicted to contract by 1.34% YoY 2020 especially related to mobility and outside activity. Current stimulus packages are relatively effective but the challenge is the impossibility for the beneficiaries to be forever helped. We see the government is planning to design the gradual assistance in stages from mere consumptive assistance to productive assistance. Alongside, as the economy recovers, it is predicted to soar at 4.82% YoY in 2021.

- Mixed impact from fiscal policy

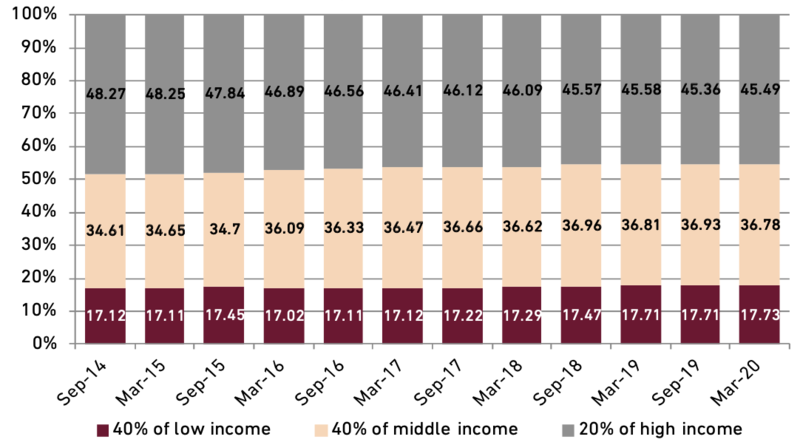

Some demand side stimulus consist of Rp43.6 tn for Sembako Card, Rp37.7 tn for salary subsidy program (Rp2.4 mn/recipient), Rp37.4 tn for Family Hope Program (Rp1.3 mn - Rp2.8 mn/beneficiary), Rp32.4 tn for cash transfer (Rp1.2 mn/family), Rp20 tn for Pre-Employment Card (Rp3.55 mn/recipient), Rp6.9 tn for electricity discount, etc. However, there are several government policies which negatively affect purchasing power, such as 900 VA electricity subsidies elimination (approximately 27 mn of impacted subscribers), slashing solar subsidies from Rp2,000 to Rp1,000/litre, lowering 3-kg LPG subsidies, unresolved Social Security Administration Agency (BPJS Kesehatan) tariff hike, increasing cigarette excise, etc. The upcoming regional elections in 9 provinces and 261 cities/regencies should help the consumption though it will be very limited. Its impact on consumption will be greater if it is suspended until 2021 when Covid-19 cases are already contained better.

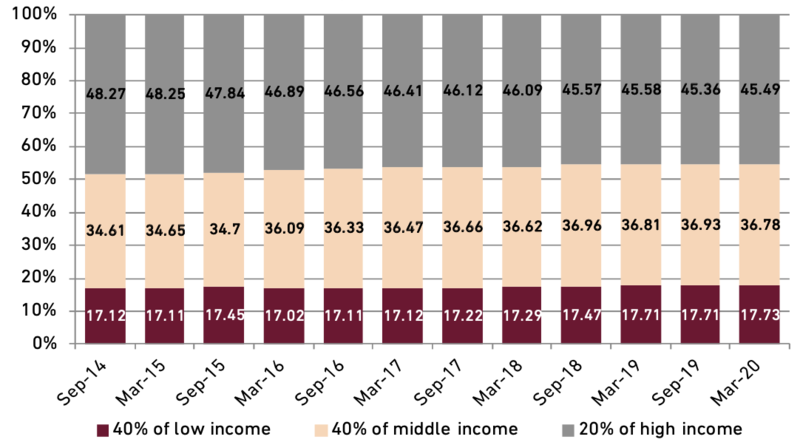

The pandemic showed its significant hit on Indonesian household in the end of 1Q20. It has affected the consumption pattern especially for the low and middle income groups as the increasing trend of their share to total household spending shrank in Mar-20. It is predicted that the open unemployment rate will rise from 5.2% to 7.3-9.0% in 2020 or it can add up to 5.23 mn of new unemployed, increasing the number of middle and low income groups in 2021. Thus, the shifted focus from the poor-vulnerable groups to the middle income groups through the stimulus package is plausible.

Exhibit 13: Household consumption growth with its weight

Source: CEIC

Exhibit 14: Share of household spending

Source: BPS

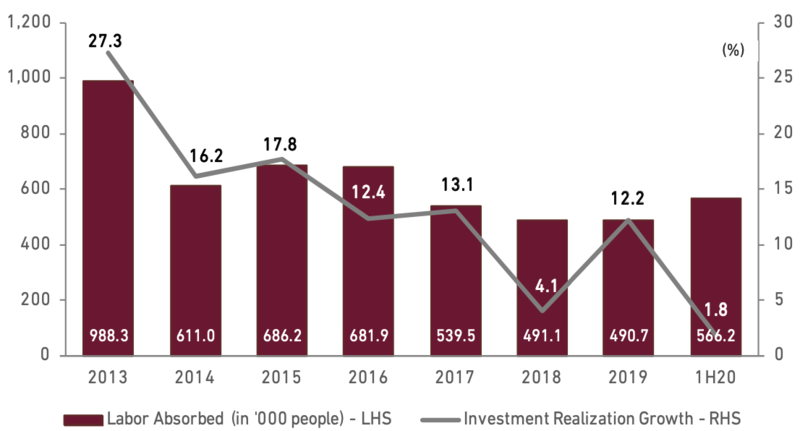

Quadrupling effort to attract investment

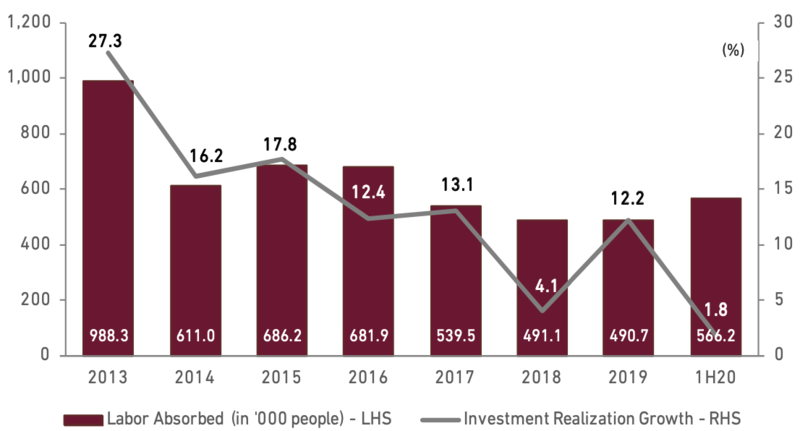

Pandemic detrimental effect on investment is inevitable. Surprisingly, investment realization in Indonesia in 1H20 still showed a positive trend where it increased by 1.8% YoY to Rp402.6 tn (USD27.5 bn). For domestic direct investment (DDI), it reached Rp207 tn (51.4%) and foreign direct investment (FDI) reached Rp195.6 tn (48.6%). There were 57,815 investment projects that absorbed 566,194 workers. It reached 49.3% of the 2020 investment target of Rp871.2 tn. The impressive results may not sustain in 2H20 as the pandemic impact seems to take a lag. However, the government has maneuvered to accelerate and attract investment through some efforts such as Investment Coordinating Board (BKPM) consolidation and Omnibus Law.

Now Indonesia Investment Coordinating Board (BKPM) has greater authority such as in attracting and determining the eligibility of companies for the tax allowance. Moreover, BKPM established a special task force to facilitate investors looking to relocate from China. A wave of foreign companies has confirmed to relocate their production facilities to the Indonesia, mostly from China, which is predicted to bring USD850 mn in investments and employ up to Indonesian 30,000 workers. From 119 potential China relocations, there are 17 corporations under process of relocation to Indonesia and it is almost done. We expect more investment relocation to come as Indonesia can capitalize more on a shift in manufacturing away from China after Covid-19 pandemic.

The government strives to remove dozens of overlapping regulations which serve as obstacles to business through Omnibus Law with three main focus: (1) tax law, (2) labor reform and (3) MSME empowerment. The government aims to improve Indonesia’s Ease of Doing Business (EoDB) rating from 73 to 60 in 2020 then to 40 in 2023. We believe Omnibus Law alone is not sufficient enough to improve EoDB rank significantly as the top three problems are corruption, bureaucracy and access to finance. However, we see Omnibus Law, accommodative monetary-fiscal policy and the low policy rate will attract investment where we expect the gross fixed capital formation (GFCF) can reverse its contraction at 4.5% YoY in 2020 to rebound at 4.1% YoY in 2021.

Exhibit 15: Investment realization growth and labor absorbed

Source: BKPM

Exhibit 16: Investment growth and BI-7DRRR

Source: BI, MoF, BPS, Ciptadana Estimates

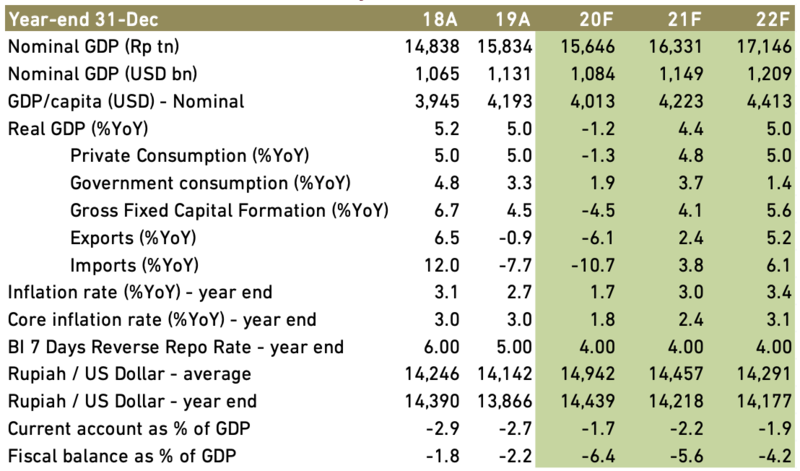

What to expect

The pressure is real but it has been diminishing along the time. The pandemic might bring a kind of shock the world hasnever experienced before amid the current complexity. However, there are always silver lining in every hardships and we are making some noteworthy progress onwards. Thus, just like the previous global crisis, this too shall pass.

Given the hardships, we expect Indonesia will experience recession where economic contraction happens in two consecutive quarters, even in 4Q20 we expect the economy will contract. As the result, Indonesia will contract at 1.2% YoY in 2020. Under the assumption that the pandemic start to diminish or the vaccine is effective enough to suppress the fear of Covid-19 in 2021, we expect the GDP will grow at 4.4% YoY.

In 2020, massive government spending is a must. Although it injects lot of money to the economy, low inflation prevails as the demand side weakens. Divergence in recovery among sectors reflects the K-shaped recovery in short run. Policy mix between fiscal and monetary policy will bring the recovery in next year from the low based 2020. However, the condition in 2021 will still below the pre-Covid level with rosy outcome ahead. Hopefully, every efforts taken in 2020 in attracting investment will reap the apparent results in 2022 and afterwards. In 2023, the government will push the budget deficit to below 3% according to Law No.2/2020. As the inflation rises, BI-7DRRR starts to go up. Furthermore, 2024 election year comes alongside with its positive impact for economic growth from higher domestic consumption as the main driver.

Exhibit 17: Indonesia’s Macroeconomic Projection

Source: BI, MoF, BPS, Ciptadana estimates